This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. For an explanation of our Advertising Disclosure, visit this page.

If you’ve been shopping around for a travel card or want to travel more in 2024, you’re likely coming across the Chase Sapphire Preferred® Card. It’s a great card for several reasons, including its metal makeup, the number of valuable Chase transfer partners, no foreign transaction fees, and its low ($95) annual fee. I’ve had it in my wallet for many years. There are also travel insurance perks that can be a tremendous help.

So, I’m just going to say it—The Chase Sapphire Preferred® Card is still worth it if you want a top credit card that you can use when traveling and in your daily life. Plus, there are several Sapphire benefits to take advantage of. The signup bonus is also a welcome perk.

So, why else is the Chase Sapphire Preferred worth it?

The Chase Sapphire Preferred Bonus Offer – 60,000 Points!

Let’s start with the signup bonus.

New Chase Sapphire Preferred® Card cardholders can earn 60,000 bonus points after spending $4,000 on purchases in the first 3 months from account opening. That’s $750 when redeemed through Chase Ultimate Rewards®. Member FDIC

This is a great signup bonus and is just another perk to supplement the Chase Sapphire Preferred benefits.

Q: Is the Sapphire Preferred Worth It? Are the Sapphire Preferred Benefits Worth the $95 Annual Fee?

A: Yes. Simply put, the benefits of the Chase Sapphire Preferred are worth the $95 annual fee. Compared to many cards in similar rewards categories, this annual fee can quickly pay itself off if you can make use of the benefits.

Here’s why the $95 annual fee is worth it:

Ultimate Rewards Points Transfer Partners

The Chase Sapphire Preferred earns precious and flexible Chase Ultimate Rewards® points. Ultimate Rewards points can be used for travel through the Ultimate Rewards portal (points for travel are worth 25% more with the Sapphire Preferred) or for merchandise or gift cards. But the real value of Ultimate Rewards points is being able to transfer them out to top travel partners.

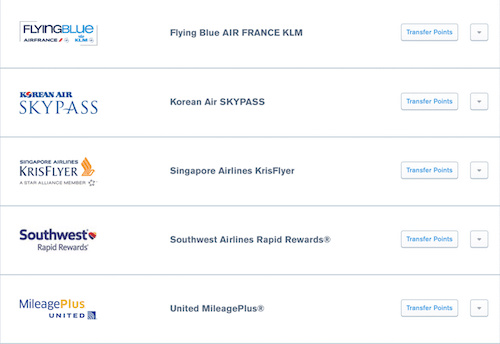

The Chase travel partners are:

- Aer Lingus AerClub

- Air Canada Aeroplan

- Air France/KLM Flying Blue

- British Airways Executive Club

- Emirates Skywards

- Iberia Plus

- JetBlue TrueBlue

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying Club

- IHG

- Marriott Bonvoy

- World of Hyatt

Only the Chase Sapphire or Ink business cards give you the ability to transfer points out to travel partners.

The no annual fee Chase Freedom Flex℠ and Ink Business Cash® Credit Card also earn Ultimate Rewards points, but they can’t be transferred out to the travel partners. That said, if you hold the Sapphire Preferred, you can combine your points earned from the Freedom cards or Ink Business Cash.

Once you combine your points, you can transfer them out to travel partners.

The information for the Chase Freedom Flex℠ has been collected independently by Johnny Jet. The card details on this page have not been reviewed or provided by the card issuer.

Spreading Out The Spending Love

For example, I keep my no annual fee Chase Freedom Flex for its 5x quarterly categories, and then I combine those points on Chase’s Ultimate Rewards website with my Chase Sapphire Preferred Card points.

Then I can transfer them out to travel partners.

Boom.

As a reminder, the Chase Freedom Flex earns:

- 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate (then 1% back)

- 5% cash back on travel purchased through Chase Ultimate Rewards®

- 3% cash back on dining at restaurants, including takeout and eligible delivery services

- 3% cash back on drugstore purchases

- 1% on all other purchases

If you’ve read the blog for a minute, you know that I like to transfer my Ultimate Rewards (UR) points out to Hyatt, Singapore Airlines, British Airways, and Southwest. There’s a little something for everybody.

For example, I was just looking at flying to Cabo from Austin non-stop on Southwest, and I found a great deal for only 6,500 points & $27 one-way. That’s a bargain. All I would have to do is transfer over some UR points, and then I’m on my way to Cabo. That easy.

Chase Sapphire Preferred Rewards Categories

The Chase Sapphire Preferred® Card makes an excellent daily travel credit card option because it earns valuable Ultimate Rewards points and has a couple of category reward-earning options that make sense for a few everyday purchases. That’s sweet.

Cardholders earn unlimited:

- 5x points on travel purchased through Chase Ultimate Rewards® (excluding hotel purchases that qualify for the $50 Anniversary Hotel Credit)

- 3x points on dining (including eligible delivery services, takeout, and dining out)

- 3x points on online grocery purchases (excluding Target®, Walmart®, and wholesale clubs)

- Also, 3x points on select streaming services (which can save money)

- 2x points on all other travel purchases

- 1x point per $1 spent on all non-bonus purchases

With a few exceptions, the travel and dining purchases listed above can be used worldwide.

Let me break down some of these extra benefits to help get a clearer sense of what this card can be used for.

Hotel Credit

There is a $50 annual Ultimate Rewards Hotel Credit. It comes in the form of a statement credit that will automatically be applied to your account when your card is used for hotel accommodation purchases made through the Ultimate Rewards program, up to a maximum annual accumulation of $50.

Points Bonus

Plus, on each account anniversary, you’ll earn bonus points equal to 10% of your total purchases made the previous year. So, if you spend $25,000 on purchases, you’ll get 2,500 bonus points.

Chase Sapphire Preferred Travel & Purchase Benefits

The Sapphire Preferred is packed full of travel perks, which can be valuable if you….travel.

For starters, there are no foreign transaction fees, and it has chip & signature technology. This makes using the Chase Sapphire Preferred internationally super easy (and one of the best credit cards for international travel).

The Sapphire Preferred also has trip cancellation and trip interruption service, up to $10,000 per trip. Nice.

It also has “primary” collision damage coverage on car rentals. I always decline the car rental company’s coverage and rely on my credit card’s coverage.

I hate to bring it up, but the Chase Sapphire Preferred also offers travel accident insurance. From their website: “When you pay for your air, bus, train or cruise transportation with your card, you are eligible to receive accidental death or dismemberment coverage of up to $500,000.”

There’s also a lost luggage reimbursement of up to $3,000 per passenger. I hope never to have to go down that road.

Have a delay? Well, at least you can get up to $500 in eligible expenses reimbursed. And if your bags are delayed over 6 hours, you can get $100 a day, up to 5 days, for essentials like toiletries and clothing.

The Chase Sapphire Preferred Card benefits also protect your purchases. You will get “purchase protection” on new purchases for 120 days against damage or theft, up to $500 per claim and $50,000 per account.

What is the Chase Sapphire Preferred Bonus?

The Chase Sapphire Preferred bonus is one of the most valuable and sought-after credit card offers. Another reason these Sapphire bonus offers are so exciting is you have plenty of ways to redeem your bonus for award travel.

New Chase Sapphire Preferred® Card cardholders can earn 60,000 bonus points after spending $4,000 on purchases in the first 3 months from account opening. That’s $750 when redeemed through Chase Ultimate Rewards®. Member FDIC

New Chase Sapphire Reserve® cardholders can earn 60,000 bonus points after spending $4,000 on purchases in the first 3 months from account opening. That’s $900 toward travel when redeemed through Chase Travel℠.

Do You Qualify for the Chase Sapphire Preferred Bonus?

Before you try for either of these Chase credit cards, you should verify you qualify for the bonus. First-time Sapphire cardmembers shouldn’t have a problem earning the bonus.

If you are a current or returning Sapphire card member, it is more difficult to qualify for a second Chase Sapphire bonus. In the past, you could get a second bonus 24 months after earning your first Sapphire bonus.

Now you must wait at least 48 months since earning your most recent Sapphire bonus and must also have closed your original Sapphire account during this period. Is earning the bonus worth a potential 4-year wait and closing an existing credit account worth it for you?

If not, you might consider upgrading to the Chase Sapphire Reserve instead.

Credit Score Needed for the Chase Sapphire Bonus

You will have the best approval odds if you have a 740 credit score, which is the start of excellent credit. Already owning a credit card to show a positive payment history also boosts your odds.

Even if you have near-perfect credit and have never owned a Sapphire product, you should only apply if you have less than five new credit card accounts in the most recent 24 months.

Chase has an internal policy called the 5/24 rule that automatically declines online applications for most Chase-issued travel credit cards if you have opened or been listed as an authorized user on five or more new credit cards in the last 24 months.

Here’s a more detailed guide to the Chase Sapphire application rules.

Redeeming Chase Sapphire Preferred Bonus Points

You can redeem your bonus points for travel or cash rewards. What’s fantastic about Ultimate Rewards points is they are worth at least 1 cent each when redeemed through Chase for cash, gift card, and Amazon.com shopping credit.

But with the Sapphire cards, you get a travel redemption bonus if booking travel directly through Chase. A second option is the 1:1 point transfers to airline and hotel loyalty programs.

Note that the Ink Business Preferred® Credit Card also has these two redemption boosts.

Below is a quick overview of how to redeem your Chase Sapphire bonus for award travel to get the most value from each point.

Travel Redemption Bonus

The easiest way to redeem your points is for a travel redemption bonus through the Chase Ultimate Rewards travel portal.

Chase immediately applies the bonus, so you get an instant discount. Here is a quick example of the cash value of redeeming 20,000 points through the credit card travel portal:

- Capital One Venture Rewards Credit Card (1 point=1 cent): $200

- Chase Sapphire Preferred (1 point= 1.25 cents): $250

- Chase Sapphire Reserve (1 point=1.5 cents): $300

Expedia powers the Chase travel portal. The travel redemption bonus applies to any travel offer found on Expedia, including flights, hotels, rental cars, cruises, and guided tours.

The Chase Sapphire Preferred perks offset the annual fee, and it ($95 a year) has a 25% travel redemption bonus that makes each point worth 1.25 cents each. You must redeem 60,000 points to book $750 in award travel.

The Chase Sapphire Reserve ($550 a year) has a 50% travel redemption bonus with Chase Travel℠. Each point is worth 1.5 cents, you only need 80,000 points to book $1,200 in award travel. Side note: while the annual fee is high, the perks, including a $300 annual travel credit, help offset this premium card.

This difference in the travel redemption bonus is why both cards have different point amounts but have the same cash value.

However, this bonus is only for travel. Redeeming your points for cash rewards, gift cards, and Amazon.com credit means your points are only worth 1 cent each.

1:1 Point Transfers

There are currently several Chase travel partners where you can transfer your points on a 1:1 basis in 1,000-point increments. You will have the most success by transferring points to the airline partners, and air miles are almost always worth more than hotel points. Having flexible travel dates and being able to fly.

Southwest Airlines to Hawaii

You can find one-way flights from Oakland to Hawaii with a redemption value of 1.44 cents each. The cash value of this ticket is $219, or you can redeem 15,204 points.

Southwest doesn’t offer flights in the Chase travel portal, so you will need to transfer Ultimate Rewards points to your Rapid Rewards account to use Chase points to book an award flight.

Related: Chase Sapphire Preferred vs Southwest Credit Cards

Singapore Airlines to Frankfurt

Saving your points for first-class and business-class seats is another way to get the most value from each point. Singapore Airlines is a popular option for booking flights Singapore Airlines. You can also book partner flights on United Airlines for fewer points than transferring your points directly to United.

Flying Singapore Airlines from New York to Frankfurt in a luxurious First Class Suites class can only cost 86,000 points. This flight can cost $6,628, making each point worth 7.7 cents each.

Aer Lingus to Dublin

Aer Lingus is one of the few international carriers that doesn’t charge fuel surcharges on long-haul flights. They are one of the cheapest ways to fly from the eastern United States to Ireland. One-way flights in the off-peak season cost 13,000 Avios from Zone 5 airports, including Boston, New York, Washington, and Toronto. This can make each point worth 4.9 cents each when you avoid the $645 cash value price.

World of Hyatt Hotel Nights

Redeeming points for hotel nights means you don’t pay cash, but it can be challenging to get more than a 1-cent value from each point. Most hotel points are worth between 0.5 and 0.7 cents. One exception is World of Hyatt, whose top-end hotels only require 40,000 points nightly.

One of the most exotic destinations is the Park Hyatt Maldives, for 30,000 points. Without points, you could pay $595 per night instead, which makes each point worth 1.9 cents which is impressive for award hotel nights.

Are the Chase Sapphire Preferred Benefits Worth the Annual Fee?

The Chase Sapphire Preferred benefits are one reason why the Chase Sapphire Preferred is one of the best credit cards for travel miles, even though it’s not a co-branded airline card. The Chase Sapphire Preferred costs $95 a year. You might be tempted to bypass it because of the annual fee, but these benefits can change your mind.

Possibly the best travel benefit of the Chase Sapphire Preferred is the option to transfer your rewards points on a 1:1 basis to one of the leading airline and hotel loyalty programs. You probably belong to several of these loyalty programs and are able to instantly transfer your points in 1,000 points increments to book award flights and nights easily.

The Sapphire Preferred is one of the few travel rewards cards with an annual fee below $100 that lets you transfer your rewards points on a 1:1 basis.

While you can find good reward redemption options with any of the travel partners, your best redemption options will be the airline rewards, as your points can easily be worth at least 2 cents each on many flights because you have more options and competition with flights. And you can really stretch out your value by redeeming points for premium cabin flights.

25% Travel Redemption Bonus

Some Chase Sapphire Preferred card owners prefer to redeem their points directly through Chase for award travel instead of transferring them to a 1:1 travel partner. This can be a better route when you need to book a flight or hotel night with a non-1:1 transfer partner like Delta or Hilton.

Each reward point is worth 1.25 cents each when redeemed for reward travel. Many other travel rewards cards only have a maximum redemption value of 1 cent or less for award travel, like the Capital One Venture Rewards Credit Card vs Chase Sapphire Preferred, which also has a $95 annual fee.

The 25% redemption bonus can help offset the $95 annual fee. There are also no blackout dates or restrictions, so you have full access to any open seat on the plane, hotel room, or travel excursion.

Primary Auto Rental Car Collision Damage Waiver

If you rent cars on a regular basis, having primary collision damage waiver protection can be well worth the annual fee if you’re involved in a wreck or theft damage. Chase Sapphire rental car coverage can cover up to the actual cash value of the rental car. You will then submit a claim to your regular automobile insurance policy to cover any remaining expenses.

Almost all other rewards credit cards only offer secondary coverage, which means your automobile insurance is responsible for paying all expenses first, and the credit card will cover any applicable expenses after the insurance claim is paid out.

Travel Protection Benefits

If you travel on a regular basis, you’ve most likely had your travel plans canceled or delayed at least once. If the carrier doesn’t reimburse your expenses, you have to rely on the travel insurance you hopefully purchased. While the Sapphire Preferred travel protection benefits don’t cover every cancellation reason like “Cancel for Any Reason,” they do cover many other reasons like sickness and severe weather.

- Up to $10,000 of prepaid, non-refundable travel expenses can be reimbursed

- Baggage delay insurance of up to $100 per day when bags are delayed at least six hours

- Trip delay reimbursement for essential expenses of $500 per person when travel is delayed at least 12 hours

- Up to $3,000 per passenger if the carrier loses or damages your luggage

- Travel accident insurance up to $500,000 per person

The three most valuable Sapphire Preferred benefits will be the 1:1 point transfers, 25% point redemption bonus, and the primary rental car damage waiver coverage, but this travel insurance can help save you a few bucks if you currently purchase add-on travel insurance.

Chase Sapphire Experiences

Experiences can be just as valuable as award flights and trip insurance. Chase Sapphire members can get exclusive access to high-profile events like attending the Emmys and walking the red carpet. New opportunities are available all the time, you might even get some travel ideas.

When the Chase Sapphire Preferred Benefits Aren’t Worth It

You won’t be able to maximize the Sapphire Preferred travel benefits when:

- You only travel one or two times a year

- Don’t fly or stay with the Chase 1:1 travel partners

- Prefer airline or hotel-specific rewards and benefits

If you’re loyal to a specific airline or hotel, you can be better off with a co-brand travel credit card so you can get free checked bags, priority boarding, or even a free hotel night certificate. You might want to visit our best hotel credit card post if you are looking for a hotel option, though the $50 annual hotel benefit is not to be dismissed.

Our best miles credit card post may also be helpful if you want to compare cards that get you mileage.

When the Benefits are Are Worth the $95

The $95 annual fee is worth it when:

- Use the 1:1 point transfers

- 25% travel redemption bonus when booking travel with non-Chase travel partners

- Want built-in trip protection better than the standard Visa Signature travel benefits

The Chase Sapphire Preferred is one of the best options for travelers who solely want a rewards card with flexible point redemption and transfer options. Not being hemmed in and only being able to redeem your points with one airline or hotel is well worth it to frequent travelers who solely look for the best travel deals.

Are Chase Sapphire Preferred Benefits Worth the Annual Fee?

The Chase Sapphire Preferred Card is wildly popular with travel enthusiasts because of its signup bonus. You’ll get the most value from the flexible redemption options. Plus, the trip protection benefits can also justify your annual fee if a wrench gets thrown in your travel plans.

There are many miles credit cards to choose from as most airlines and hotels offer their own rewards cards. You might also prefer a flexible travel rewards card that lets you earn and redeem rewards points with multiple loyalty programs.

These travel credit cards require a 740 credit score to have the best approval odds.

Wrap Up on the Chase Sapphire Preferred Bonus and Benefits

With its bonus, you may be wondering if the Chase Sapphire Preferred® Card is worth it. The Chase Sapphire Preferred is widely considered one of the best travel credit cards available, but I often get emails from readers asking if the Sapphire Preferred is worth it, considering the $95 annual fee. And, given the new bonus and category bonuses, this card just moved to the top of the “you-need-to-know-about-this-card” list.

The Chase Sapphire Preferred® Card is one of the best flexible travel rewards cards because of its redemption options. Your points are worth 1 cent each for cash and gift card rewards. Your points are worth 1.25 cents each when you redeem them for award travel. You can also transfer them on a 1:1 basis to airline and hotel partners, including Southwest, United, JetBlue, and Hyatt.

In my opinion, the Chase Sapphire Preferred is worth it. It’s a big key to traveling the world in style for pennies. But, at the end of the day, only you can decide if the $95 annual fee is worth it. It really depends on your spending patterns and travel needs.

Related Posts:

When do you have to pay the annual fee of $95

initially or after a year?

Since Chase raised the Sapphire Preferred bonus to 60,000 points the annual fee hasn’t been waived. The increase in bonus more than makes up for the annual fee, imho.

It will be 4 years since I received my bonus in February 2020. However I did not cancel my card until two years after I opened it. Will I have to wait a total of six years before I can get the bonus again?

You should be good to apply once it’s been 48 months from the time you received your last bonus (not when you closed your account).

We have a chase sapphire preferred. My husband is the primary and I am an authorized user. Can I apply for the Chase sapphire preferred on my own as a primary and get the bonus points?

Yes, you can apply for own Chase Sapphire Preferred.