This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. For an explanation of our Advertising Disclosure, visit this page.

There’s a good chance you’ve come across the Chase Sapphire Reserve® and the Chase Sapphire Preferred® Card. Even if you’ve never heard of either, know that these cards are popular in the travel community because of their flexibility and perks.

60,000 Bonus Points (Worth $750 In Award Travel) Learn more: Chase Sapphire Preferred® Card

60,000 Bonus Points (Worth $900 In Award Travel) Learn more: Chase Sapphire Reserve®

The Sapphire Reserve is one of the best premium cards, while the Sapphire Preferred is one of the best cards for beginners and more seasoned travelers.

Overall, both the Reserve and Sapphire cards are worth considering if you’re a frequent traveler or if you just want to earn some great rewards on your everyday purchases. It comes down to how much you can pay in annual fees and what benefits matter most to you.

So, what’s the verdict in the Chase Sapphire Preferred vs Chase Sapphire Reserve showdown? It’s time to put these two heavyweights to the test and see which one is the perfect fit for you.

Chase Sapphire Preferred vs Chase Sapphire Reserve – Sign-Up Bonus

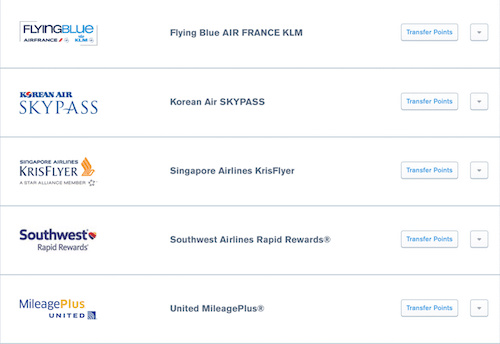

Let’s start with the signup bonuses. Both bonuses can set you up for traveling and can help offset costs when on the road. Both are also able to transfer on a 1:1 basis with Chase travel partners. These include Southwest, Marriott, United, and more. So, earning 60k Sapphire points is like earning 60k United Miles, etc.

New Chase Sapphire Preferred® Card cardholders can earn 60,000 bonus points after spending $4,000 on purchases in the first 3 months from account opening. That’s $750 when redeemed through Chase Ultimate Rewards®. Member FDIC

The Preferred comes with a 25% point redemption bonus when redeemed through Chase Travel℠. This is why the bonus is worth $750 toward travel.

New Chase Sapphire Reserve® cardholders can earn 60,000 bonus points after spending $4,000 on purchases in the first 3 months from account opening. That’s $900 toward travel when redeemed through Chase Travel℠.

The Reserve comes with a 50% point redemption bonus when redeemed through Chase Travel℠. This is why the bonus is worth $900 toward travel.

Transferring Chase Points

One of the other reasons that travelers choose either the Chase Sapphire Reserve or the Chase Sapphire Preferred Card is because of the travel benefits. As mentioned above, both cards earn Chase Ultimate Rewards that can be transferred on a 1:1 basis to many airline loyalty programs, including Virgin Atlantic, United MileagePlus, Southwest Airlines, British Airways, and hotel programs from Hyatt, Marriott, and IHG.

It should go without saying that neither credit card charges a foreign transaction fee and earns rewards on purchases made in the U.S. and abroad.

Chase Sapphire Travel Benefits

One of the best travel benefits of the Sapphire Preferred and Chase Sapphire Reserve is the primary CDW waiver coverage for most rental vehicles. When you book a car rental with the Sapphire Preferred, you can decline the insurance policies offered by the car rental agency. In the event of an accident, Chase will reimburse any associated costs.

In addition to rental car insurance, cardholders can also enjoy 24/7 roadside assistance, a $5 or $10 monthly fee that might be part of your auto insurance policy. Hopefully, you will never need to use this service, but it’s an easy way to save a few bucks each month by dropping duplicate coverage from your car insurance company.

Another travel perk is baggage delay insurance. If you have a checked bag that gets delayed by at least 6 hours at your final destination, you can be reimbursed for essential purchases such as clothing and toiletries (up to $100 per day).

Other benefits also include trip cancellation/trip interruption insurance that can be used to reimburse up to $10,000 in non-refundable travel purchases. One final perk is trip delay insurance which will reimburse each ticket holder up to $500 in expenses when a flight is delayed at least 6 hours or an overnight stay is required.

Chase Sapphire Reserve Specific Travel Benefits

The Chase Sapphire Reserve® justifies its $550 annual fee with its travel perks. It carries many of the same benefits offered by the Sapphire Preferred, including the rental car CDW coverage and trip insurance. But, the best perk is an annual $300 annual travel credit. This can be used to be reimbursed for airfare or hotel expenses. Most “premium” travel credit cards normally allow the credit to be redeemed for incidental airline fees such as checked baggage and in-flight food or movie purchases.

Therefore, this gives cardholders more flexibility. And no, the Sapphire Reserve isn’t just for rich people.

Other travel perks include being reimbursed the $100 Global Entry or $85 TSA PreCheck fee (both passes are good for five years) that will help you breeze through security lines at American airports. And, fliers also have complimentary access to over 900 Priority Pass Select airport lounges across the globe, plus Chase Sapphire lounges.

Additional travel benefits also include complimentary rental car upgrades from Avis, National, and Silvercar, along with complimentary room upgrades for hotel reservations made within the Luxury Hotel & Resort collection.

The $300 travel credit and the Global Entry/TSA Precheck application help offset the annual fee and make the Reserve more affordable than it initially appears on the surface.

Earning Points Chase Sapphire Preferred vs Reserve

So far, the Chase Sapphire Reserve has outshined its predecessor when it comes to travel benefits. The competition is stiffer, but the Reserve still edges out the Preferred (as it should).

Chase Sapphire Preferred Card

The Chase Sapphire Preferred earns unlimited:

- 5x points on travel purchased through Chase Ultimate Rewards® (excluding hotel purchases that qualify for the $50 Anniversary Hotel Credit)

- 3x points on dining (including eligible delivery services, takeout, and dining out)

- 3x points on online grocery purchases (excluding Target®, Walmart®, and wholesale clubs)

- Plus, 3x points on select popular streaming services

- 2x points on all other travel purchases

- 1x point per $1 spent on all non-bonus purchases

There is a $50 annual Ultimate Rewards Hotel Credit. It comes in the form of a statement credit that will automatically be applied to your account when your card is used for hotel accommodation purchases made through the Ultimate Rewards program, up to an annual maximum accumulation of $50.

Plus, on each account anniversary, you’ll earn bonus points equal to 10% of your total purchases made the previous year. So, if you spend $25,000 on purchases, you’ll get 2,500 bonus points.

Points redeemed for travel rewards using the Chase Ultimate Rewards portal receive a 25% redemption bonus. The Sapphire Preferred is worth it!

Chase Sapphire Reserve

Reserve cardholders earn bonus points on the same standard categories but with a little more “oomph.”

Chase Sapphire Reserve® purchases earn up to 10x Chase Ultimate Rewards®. Cardholders can earn unlimited:

- 10x total points on hotels and car rental purchases through Chase Travel℠ (after the first $300 is spent on travel purchases annually)

- 10x total points on Chase Dining purchases through Chase Travel℠

- 5x total points on flights when you purchase travel through Chase Travel℠ (after the first $300 is spent on travel purchases annually)

- 3x points on other travel worldwide (after the first $300 is spent on travel purchases annually)

- 3x points on other dining at restaurants, including eligible delivery services, takeout, and dining out

- 1x points for all remaining purchases

You will not receive rewards points on your first $300 in annual travel purchases as the annual travel statement credit reimburses these purchases.

Points redeemed for travel rewards using the Chase Ultimate Rewards portal receive a 50% redemption bonus.

Chase Sapphire Preferred and Reserve Annual Fees

Chase definitely raised the bar for premium travel credit cards by introducing the Chase Sapphire Reserve®. While sign-up bonuses and travel rewards are great reasons to try for a particular card, it also pays to look at the annual fees. Depending on your circumstances, the fees might not justify the rewards.

Chase Sapphire Preferred

- Annual Fee: $95

- Additional Card Fee: $0

- Foreign Transaction Fee: 0%

Chase Sapphire Reserve

- Annual Fee: $550

- Additional Cardholder Fee: $75 annually per card

- Foreign Transaction Fee: 0%

The Winner Chase Sapphire Preferred vs Reserve

Overall, the Chase Sapphire Reserve is the superior choice in almost every aspect and isn’t harder to get than the Preferred. However, it carries a much higher annual fee. The additional travel benefits offered by the Reserve (such as the $300 travel credit, Global Entry application fee reimbursement, airport lounge access, and 50% redemption bonus) make it hard for the Sapphire Preferred to compete.

Chase did a great job of making sure the Reserve was worth the annual fee. It is one of the best travel rewards cards available.

This doesn’t mean that the Chase Sapphire Preferred Card should be thrown out. It is still the best travel rewards card with an annual fee of $95. The casual flier who only flies two or three times per year might be better off with this card. But, for an additional $155 (annual fee price difference once you use the $300 travel credit and were to pay the $95 Preferred annual fee), you can get the Reserve. The Reserve has more travel benefits and earns more purchase rewards.

Sign-up bonuses aside, if lounge access, Global Entry/TSA Precheck, or the increased reward rates are not important, it can make more sense to go with the Chase Sapphire Preferred® Card.

Should You Go for the Chase Sapphire Reserve over the Sapphire Preferred?

Two of the most popular travel credit cards are the Chase Sapphire Reserve and Preferred. Both of these credit cards offer the same sign-up bonus, earn the same points, and have the same transfer partners, but there are a few major differences when comparing the Chase Sapphire Reserve vs Preferred.

So is the Sapphire Preferred or Reserve better for you?

Sapphire Sign-Up Bonus Comparison

New Chase Sapphire Preferred® Card cardholders can earn 60,000 bonus points after spending $4,000 on purchases in the first 3 months from account opening. That’s $750 when redeemed through Chase Ultimate Rewards®. Member FDIC

New Chase Sapphire Reserve® cardholders can earn 60,000 bonus points after spending $4,000 on purchases in the first 3 months from account opening.

However, the Chase Sapphire Reserve bonus is worth more when redeeming points through Chase Travel℠ because of the 50% travel redemption bonus.

Eligibility for Sapphire Cards

As a side note, the current Chase policy only lets Sapphire card members earn one sign-up bonus at a time. If you currently hold a Sapphire Preferred or Reserve, you must wait 24 months from the time you received the sign-up bonus before trying for the other Sapphire product. Here’s more on the income they need for the Sapphire credit and their usual credit limits.

Also, you can always upgrade your Preferred to the Reserve or downgrade the Reserve to the Preferred, but you wouldn’t receive a sign-up bonus in either situation. And if you’re unfamiliar with unfamiliar with Chase’s 5/24 rule, you may want to read up on it.

Don’t try for any credit cards if your credit score isn’t in good condition (excellent for the Reserve) and if you can’t manage your credit properly. Here are our posts on what credit scores you’ll need for the Sapphire Reserve and Sapphire Preferred.

How do I upgrade from Chase Sapphire Preferred to Reserve?

If you are looking to upgrade your Chase Sapphire Preferred to a Chase Sapphire Reserve, all you need to do is call the number on the back of your card. There are also a couple of things you should take into consideration before contacting Chase.

For instance, if you have only had your Sapphire Preferred for less than a year, you will not be able to upgrade your card. You will also need to have at least $10,000 in available credit on your card. Your account should also be in good standing.

Note that even if you meet the above criteria, this does not guarantee that you will be approved.

Sapphire Reserve and Preferred Annual Fees

The Chase Sapphire Preferred has an annual fee of $95. The Chase Sapphire Reserve has an annual fee of $550. There’s quite a bit of difference in these annual fees, so it makes looking into the benefits of each travel card even more important.

And, of course, neither card has a foreign transaction fee.

The Chase Sapphire Reserve’s Premium Benefits

What really sets the Sapphire Reserve apart from the Sapphire Preferred is the Chase Sapphire Reserve benefits.

$300 Annual Travel Credit

The Chase Sapphire Reserve® has a $300 annual travel credit as reimbursement for travel purchases charged to your card each account anniversary year. This credit is extremely flexible because it will be applied to any travel-related purchase.

This applies to things like plane tickets to guided tours, not just checked bags and in-flight purchases (such as is the case with the Amex Platinum). Compare the Chase Sapphire Reserve vs American Express Platinum, two premium travel credit cards that may be beneficial if you travel often.

The annual fee also effectively reduces to $250 when you factor in the Sapphire Reserve travel credit.

Airport Lounge Access

You will enjoy complimentary airport lounge access with Priority Pass Select, which gives you access to more than 1,000 airport lounges worldwide with unlimited visits. The same paid unlimited access you might already be paying for costs $399.

The complimentary membership alone pays at least half of the annual fee before you even account for the $300 annual travel credit and other travel benefits.

Global Entry Application Fee Reimbursement

As long as you own the Chase Sapphire Reserve®, Chase will reimburse you the application fee for Global Entry ($100) or TSA Precheck ($85) through a fee credit. You can now skip the long airport security lines for free.

Complimentary Rental Car Upgrades and Discounts

Both versions of the Sapphire offer primary rental car collision damage waiver insurance, but you can enjoy some additional perks with the rental car perks from Avis, National, and Silvercar. By paying for your rental through these three rental car agencies with your Sapphire Reserve, you can save some money and maybe get a free upgrade as well.

Learn more in our Chase Sapphire rental car insurance benefits guide.

1:1 Chase Travel Partners

The Sapphire Reserve and Sapphire Preferred have the exact same 1:1 travel partners. The Reserve’s 50% redemption bonus through Chase’s portal is awesome, but you can still find better redemption options by transferring your points out to a travel partner and booking directly from the airline or hotel.

With some of the best Ultimate Rewards redemption options, each point can easily be worth 2.0 cents each or more.

When You Should Try for the Chase Sapphire Reserve

Here’s when it makes sense to try for the Chase Sapphire Reserve®:

- You travel several times per year

- You redeem your Ultimate Rewards points through Chase’s travel portal

- Can use the $300 travel credit, lounge access, and Global Entry benefits each year

- Looking for a premium travel rewards card

- Up to $100 application fee credit for Global Entry or TSA Pre✓®

You will have access to the same Chase travel partners as with the Sapphire Preferred. Because of the 3x earning bonus, you will have more points to transfer.

When to Try for the Chase Sapphire Preferred

You should try for the Chase Sapphire Preferred® Card instead of the Sapphire Reserve when:

- You won’t use the travel benefits enough (aren’t a constant traveler)

- Only want a travel credit card with flexible travel redemption options

- You’re not a big spender on travel & dining purchases

- You want a lower annual fee

If you don’t use the Sapphire Reserve travel benefits, it’s extremely difficult to offset the annual fee after you redeem the $300 annual travel credit. Frequent flyers will get the most value from Sapphire Reserve benefits because of the Priority Pass Select and Global Entry benefits.

If you find yourself driving more than flying or not having time to visit a Priority Pass lounge, try for the Sapphire Preferred instead. When that’s the case, the Sapphire Preferred’s $95 annual fee is very reasonable.

Whether you redeem your points directly through Chase or transfer them to your frequent flyer program or hotel loyalty account, you might be able to pay the annual fee redeeming your rewards points on your first award trip each year.

Summary of the Chase Sapphire Preferred vs Reserve

In summary, with either Chase Sapphire card, you will have the same access to the 1:1 travel partners. This lets you achieve award travel quicker than any other travel rewards card. Frequent flyers who can use the Reserve flight benefits will greatly benefit from the Sapphire Reserve. Otherwise, the Sapphire Preferred is a great option for all travelers of any background.

With the Chase Sapphire Preferred® Card, you know what you get:

- 1:1 point transfers to your favorite airlines and hotels

- 25% point redemption bonus for award travel booked through Chase

If you prefer a travel rewards card that has a lower annual fee but is still valuable, the Sapphire Preferred is hands down the better option.

The value of the Chase Sapphire Reserve® is in the annual travel benefits that help justify the $550 annual fee. The 10x points on travel (once eligible) and dining plus a 50% redemption bonus through Chase’s portal is nice, too. If you won’t maximize the Reserve’s benefits, it doesn’t make sense to try for the Reserve over the Preferred.

60,000 Bonus Points (Worth $750 In Award Travel) Learn more: Chase Sapphire Preferred® Card

60,000 Bonus Points (Worth $900 In Award Travel) Learn more: Chase Sapphire Reserve®

Related Articles:

The 50,000 sign up bonus is worth $750 when used for travel, which comes out as the same as the preferred 60,000 sign up bonus. So they are technically equal in sign up rewards..

Thank you for all this info. I agree the Reserve seems like a better option, but with one exception. I’m wanting to get one of these cards with 3 authorize users, that becomes $775 annual fee for me. All 4 of us already have global entry, so wouldn’t be using the perk for a few years (until it’s time to renew). So for me, Preferred becomes the better option with a $95 AF for all 4 cards.