This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. For an explanation of our Advertising Disclosure, visit this page.

For many people, traveling is something that takes some time to plan and budget for. So when friends and family ask how to travel without breaking the bank, we recommend using a travel credit card that earns rewards and works for them. Earning rewards points can be such a valuable practice, especially Chase Ultimate Rewards® points. This Chase Ultimate Rewards points review can help you understand where you’ll get the most value and what options you have. See here how much 50,000 Chase points are worth, and how to get 100,000 Chase points here.

I’ve been lucky enough to travel the world with my wife, and all of our travels have been accomplished with the help of rewards miles and points. Not only have we traveled to some amazing destinations, but most of the time we’ve also been able to fly in business or first class.

Why Chase Ultimate Rewards Are Worth It

These are experiences that I would have never been able to afford out of pocket, which is why I’ve become a rewards travel evangelist. I always say that anyone can travel as I do; I’m not special, just a little obsessed. With good credit, the use of some of the best rewards credit cards, and some organizational skills, traveling with rewards points/miles can become a lifestyle.

The points that I’ve redeemed the most for my travels are Chase Ultimate Rewards (UR) points, and that’s because of their value and flexibility through partner transfers. Let me break down the many reasons Ultimate Rewards and Chase cards are my go-to points to earn and a great option for anyone looking to travel with rewards points.

Quick Tip: The best personal credit card to earn Ultimate Rewards points is the Chase Sapphire Preferred® Card. It comes with a 25% redemption bonus when booking through the Chase travel portal, earns up to 5x points, has 1:1 point transfer partners, a reasonable $95 annual fee, and no foreign transaction fee. Read more in our Chase Sapphire Preferred Card review.

Table of Contents

Use this table to jump to specific sections in this Chase Ultimate Rewards points review:

- How Can I Redeem Chase Ultimate Rewards Points?

- Redemptions through the Ultimate Rewards Chase Travel Portal

- Redemptions through Ultimate Rewards Travel Partners

- Other Redemption Options

- How to Earn Chase Ultimate Rewards Points

- Category Bonuses on your Chase Card

- Chase Credit Card Application Terms

- Ultimate Rewards Mall or Shopping Portals

- What Will Not Earn Ultimate Rewards Points?

- How Much is a Chase Ultimate Rewards Point Worth?

- Transferring Chase Points

- Redeeming For Chase Travel Rewards

- Maximizing Chase Points for Non-Travel Rewards

- Combining Ultimate Rewards Points

- Summary

How can I redeem Chase Ultimate Rewards points?

With Chase Ultimate Rewards, you have the flexibility to redeem your points for so many different kinds of travel, and options are a good thing! Here are a couple of examples of how to unlock the value in Chase Ultimate Rewards:

Redemptions through the Ultimate Rewards Chase travel portal

First of all, you can book flights, hotels, cruises, and car rentals by logging into your Ultimate Rewards account.

You also have the option of combining your UR points with cash if needed. Since these redemptions are treated as cash purchases, they will count towards airline or hotel elite status if that’s something you’re trying to achieve.

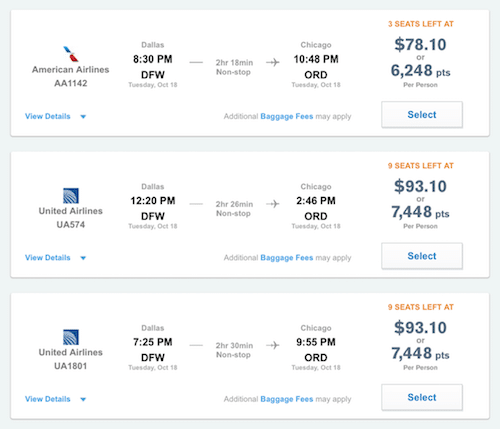

Booking travel through the online portal, as opposed to transferring your points out to one of the many Ultimate Rewards transfer partners (more on those below), allows you to redeem your Chase points with airlines, hotels, etc., outside of their transfer partners and receive a bonus on your points.

Redemptions through Ultimate Rewards travel partners

Let’s talk about redemptions in the Chase Ultimate Rewards points review. I’ve redeemed my UR points through their online portal before, but I transfer them out to a travel partner more often than not. This is where the real crazy value can be found.

If you hold a Sapphire product or the Ink Business Preferred® Credit Card, you can transfer your Ultimate Rewards points out instantly at a 1:1 ratio to the following.

The airline Chase Ultimate Rewards transfer partners are:

- Aer Lingus

- Air Canada

- British Airways

- Flying Blue Air France KLM

- Emirates

- Iberia Plus

- JetBlue TrueBlue

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying Club

Hotel transfer partners include:

- IHG Rewards Club

- Marriott Bonvoy

- World of Hyatt

Once you transfer your points to one of the transfer partners listed above (you’ll have to create an account with that transfer partner, but that’s free and easy), you can book award flights or hotels on that transfer partner’s site. Pricing will be tied to their specific award chart, and for airline transfer partners, you will also be able to book flights on their partners. Oh, the options!

Here are a couple of examples.

Domestic examples

Domestic airfare can easily be booked by transferring your points out to Southwest Rapid Rewards, United MileagePlus, British Airways Avios, and even Singapore Krisflyer. Southwest has a revenue-based award chart (which means the award price of the flight is tied to the cash price of the flight), but they often have fare sales where you can get screaming deals.

Plus, they fly all over the country, so they are a solid option. For example, you could book a one-way flight from Austin to Nashville on Southwest for under 7,000 points. Don’t forget that Southwest fliers also get two checked bags for free, an awesome and unique perk these days!

British Airways Avios has a distance-based award chart so that short-distance flights can offer a good value. Starting at 13,000 Avios, you can fly one-way, and for only 30,000 Avios, you can fly roundtrip in economy to Hawaii. Aloha. You can also book American Airlines flights with Avios since they are partners, and you can do this on the British Airways website.

IHG, Marriott, and Hyatt are all good options for domestic hotel awards. Personally, I prefer Hyatt because I have status with them, but Marriott has some good deals.

International examples

Let’s look at international options in the Chase Ultimate Rewards points review. I’m always looking to burn my Ultimate Rewards points on international travel, especially premium cabin travel since it is more expensive than domestic travel. I want to get the most value out of my points. An easy way to travel across the globe with UR points is to transfer them to United Airlines.

United flies almost everywhere. Since they are in the Star Alliance, you can fly any airline in the Star Alliance, like Lufthansa, Austrian, and Thai airlines. For example, you can fly roundtrip to Europe in economy for only 60,000 United miles.

Not bad, especially when people generally pay well over $1,500 for a roundtrip flight to Europe. A one-way business class award on United metal to Europe is 60,000 miles. Or you can fly one of their partners, like Lufthansa, for 70,000 miles.

Related: How Much Are 60k Miles Worth? (A Lot!)

Singapore Krisflyer is also a transfer partner of the Chase Ultimate Rewards program, making me happy. Singapore Airlines is well known for its world-class products and service. Some good Singapore routings are:

(1) One-way business class from Houston to Bali (DPS) for only 44,000 Singapore Krisflyer miles

(2) One-way first-class awards in Suites Class from JFK to FRA are only 97,000 Singapore Krisflyer miles

These are both fantastic redemptions! IHG, Marriott, and Hyatt all have fantastic options for international travel. As I mentioned before, most of my hotel stays are with Hyatt since I have status with them, but I highly recommend them even if you don’t have status. A great Hyatt award example is the Andaz in Costa Rica.

Other Redemption Options

- Redeeming for experiences, gift cards, merchandise & cash

- If travel isn’t your thing, then what are you doing reading this blog? Just kidding. A travel redemption for your points might not always make sense, or you might just want cash back. Nothing wrong with that. You can redeem 50,000 Chase Ultimate Rewards points for $500 in statement credits. Not bad.

- You can also redeem your UR points for gift cards to many top retailers, like Lowes, Amazon, iTunes, Starbucks, and many more. Every 500 points = $5 in gift cards. Gift cards make great birthday gifts.

You can even redeem your Chase Ultimate Rewards points towards exclusive dinners, concerts, or sporting events. Basically, there’s something for everyone.

Credit cards with an annual fee can have more redemption options. For example, only the Chase Sapphire and Chase Ink Business Preferred products offer point transfers as the no-annual-fee offerings only let you book award travel through the Chase Ultimate Rewards booking site.

How to Earn Chase Ultimate Rewards points

Chase Ultimate Rewards points are easy to earn because of the many travel rewards credit card options you have, each offering unique spending perks. You can earn Ultimate Rewards by spending on your best Chase credit card or shopping through the Ultimate Rewards shopping portal.

These are the Chase credit cards that earn Ultimate Rewards points on their own:

Chase Sapphire Preferred Card

The Chase Sapphire Preferred card is one of the best (if not the best) personal travel rewards cards out there. It’s the first travel card I recommend to family, friends, and readers for many reasons.

New Chase Sapphire Preferred® Card cardholders can earn 60,000 bonus points after spending $4,000 on purchases in the first 3 months from account opening. That’s $750 when redeemed through Chase Ultimate Rewards®. Member FDIC

This bonus gives you a great opportunity to earn many UR points right from the start.

Also, enjoy Chase Sapphire benefits such as a $50 annual Ultimate Rewards Hotel Credit, 5x points on travel purchased through Chase Ultimate Rewards®, 3x points on dining, and 2x points on all other travel purchases, plus more.

The annual fee is $95.

This is the best option in this Chase Ultimate Rewards points review if you want a good travel card that won’t break the bank.

Chase Sapphire Reserve Card

Luxury travelers may crave the additional perks that the Chase Sapphire Reserve® offers. Some of the features and benefits include an annual $300 travel credit and complimentary Priority Pass Select airport lounge access.

Your points are also worth 50% more at 1.5 cents each when booking award travel through Chase. In comparison, the Sapphire Preferred only has a 25% redemption bonus, and this can be one of the best reasons to get the Chase Sapphire Reserve.

Your card purchases will earn up to 10x Ultimate Rewards:

- 10x on hotels and car rentals through Chase Travel℠ (after the $300 travel credit)

- 5x on flight bookings through Chase Travel℠ (after the $300 travel credit)

- 3x on all remaining travel purchases (after the $300 travel credit)

- 10x on Chase Dining purchases through Chase Travel℠

- 3x for dining, takeout, and eligible delivery services

- 1x on all remaining purchases

The annual fee is $550 for the primary card and $75 for each authorized user.

Chase Freedom Flex

The information for the Chase Freedom Flex℠ has been collected independently by Johnny Jet. The card details on this page have not been reviewed or provided by the card issuer.

The Chase Freedom Flex℠ is a no-annual-fee cash-back card. It earns 5% cash back on up to $1,500 in combined purchases on quarterly rotating bonus categories. But you must activate them (usually through an email or on the app).

These are the Chase Freedom Flex bonus categories:

- 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate (then 1% back)

- 5% cash back on travel purchased through Chase Ultimate Rewards®

- 3% cash back on dining at restaurants, including takeout and eligible delivery services

- 3% cash back on drugstore purchases

- 1% on all other purchases

New Freedom Flex cardholders can earn a $200 bonus after spending $500 on purchases in the first 3 months from account opening.

Chase Freedom Unlimited

New Chase Freedom Unlimited® cardholders earn unlimited:

- 5% cash back on travel purchased through Chase Travel

- 3% cash back on dining at restaurants, including takeout and eligible delivery services

- 3% cash back on drugstore purchases

- 1.5% cash back on all other purchases

There is no annual fee.

New Chase Freedom Unlimited® cardholders can enjoy an additional 1.5% cash back on everything they buy (on up to $20,000 spent in the first year) – worth up to $300 cash back! That means they can enjoy 6.5% cash back on travel purchased through Chase Travel, Chase’s premier rewards program that lets you redeem rewards for cash back, travel, gift cards, and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

Compare the Chase Freedom Flex and Freedom Unlimited to see which might be best for you.

Note that you can have a Chase Freedom product and a Chase Sapphire product to get more value out of your purchases.

Related: Can You Transfer Freedom Unlimited Points to Sapphire Preferred?

Ink Business Preferred Credit Card

This Chase Ultimate Rewards points review wouldn’t be complete without mentioning a business option. The Ink Business Preferred® Credit Card has a reasonable $95 annual fee, and you earn the highly-regarded Chase Ultimate Rewards points. On the first $150,000 in combined spending, you earn 3 points per $1 on these purchases:

- Travel

- Shipping Purchases

- Internet, Cable, and Phone Services

- Advertising on Social Media and Search Engines

This is one of the best Chase business credit cards. Your points are worth 1 cent each for cash back and gift cards. Saving your points for award travel can be more valuable. They are worth 25% more booking travel on Chase. Plus, you can transfer them on a 1:1 basis to airline and hotel travel loyalty programs like United, Southwest Airlines, and World of Hyatt.

New Ink Business Preferred® Credit Card cardholders can earn 100k bonus points after spending $8,000 on purchases in the first 3 months from account opening. That’s $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠.

This is how hard it is to get the Ink Business Preferred.

Category Bonuses on your Chase Card

The sign-up bonuses for any of the Chase credit cards are stellar, BUT you can earn additional points for every purchase made. The base rate for most Chase credit cards is 1% on all purchases (1.5% for Freedom Unlimited).

The highest purchase redemption rate is with the Chase Freedom cards. The Chase Freedom Flex earns 5% on specific categories that change every quarter, up to $1,500 in purchases per quarter. All purchases made within the 5% bonus category after reaching the $1,500 purchase limit to receive the 5x point bonus will earn 1 point per dollar for the remainder of the quarter.

The Chase Freedom Unlimited earns:

- 5% cash back on travel purchased through Chase Ultimate Rewards®

- 3% cash back on dining at restaurants, including takeout and eligible delivery services

- 3% cash back on drugstore purchases

- 1.5% cash back on all other purchases

There is no limit to how much cashback can be earned and no annual fee to worry about.

The Chase Ink Business Preferred, one of the best credit cards for small businesses, can earn bonus rates ranging from 2 points to 5 points per dollar depending on the type of purchase.

Chase credit card application terms

We need to talk about the application terms in this Chase Ultimate Rewards points review.

The Chase terms for applying for their products state: “This product is not available to either current cardmembers of this credit card, or previous cardmembers of this credit card who received a new cardmember bonus for this credit card within the last 24 months.”

The rules are more restrictive for the Chase Sapphire cards: “This product is available to you if you do not have any Sapphire card and have not received a new cardmember bonus for any Sapphire card in the past 48 months.”

Also, you will most likely not be approved for any Chase credit cards if you have applied for five or more cards in the last 24 months. This is what’s referred to as the 5/24 rule.

Personally, I keep the Chase Sapphire Preferred, Ink, and Chase Freedom Flex cards in my wallet. I use them as my everyday cards and take advantage of their spending categories to help build up my Ultimate Rewards balance.

Chase Ultimate Rewards Mall or Shopping Portals

Holding one of the Chase rewards cards above gives you access to an Ultimate Rewards mall. UR shopping portals allow you to earn multiple points per $1 for online purchases. Plus, you will earn the standard points that your Chase card earns for the purchase.

This is a great way to “double-dip” your earnings for online shopping.

For example, through the “Shop Chase Ink” Plus portal, you can earn 2x points for Staples purchases. Then you’ll also get 5x points with your card since Staples is in the office supply store category. Double-dipping!

An old saying is to “never pay retail.” Shopping portals are not unique to Chase, as airline and hotel loyalty programs also have their own portals. Shopping at major retailers with the Chase shopping portal will help you earn anywhere from 1 to 25 bonus points per $1 spent, depending on the retailer. There are 250+ retailers to choose from. It pays to take a look at the portal before making any online purchase. Your store might be one of the participating merchants!

Using the Chase Ultimate Rewards mall can also be a great way to earn points while doing your back-to-school shopping or Christmas shopping. For instance, per tradition, Chase Freedom Flex’s 4th quarter bonus spending category is (usually) holiday shopping. If you own the Chase Freedom Flex, you can earn the 5x point bonus purchase plus the shopping portal bonus too!

What will not earn Chase Ultimate Reward Points?

There are a couple of actions that probably will not earn Ultimate Reward Points. Here’s what you should know in this Chase Ultimate Rewards points review.

Booking Travel With the $300 Sapphire Reserve Travel Credit

While Sapphire Reserve cardmembers are reimbursed the first $300 spent on travel purchases each year, these purchases no longer earn any Ultimate Rewards. Until a few years ago, your reimbursed travel purchases also earned 3x points.

Chase automatically applies the credit to qualifying purchases made through Chase Travel℠ or directly from the travel provider. Then, your remaining travel purchases for the year earn unlimited points.

Complaining About New Sign-Up Bonus

Chase is continually offering different sign-up bonus amounts for their credit cards. If the bonus has changed to a higher payout within 90 days since you opened your account, Chase might retroactively allow you to earn the bonus. But, there is nothing in writing that says they have to do this. If you do call to see if they will be gracious, you should be cordial.

Chase does have some of the best credit card offers available.

Threatening to Drop The Card

Companies have been known to offer “retention bonuses” to customers that threaten to leave. When was the last time your satellite tv contract was renewed? ;-)

You can also go this route with Chase, but it probably isn’t recommended as they usually only offer retention bonuses for Chase Ink business customers. Even then, Chase might only offer to waive the annual fee & might not offer additional rewards points. If you do go this route, make sure you are directed to a retention specialist.

Two things to keep in mind when making this phone call:

1) How much business do you do with Chase? They are more willing to bend backward if you spend a lot with their cards.

2) Are you prepared if Chase calls your bluff? If you are talking to a retention specialist, you might need to be prepared to tear your Chase credit card in two. You might be able to gently decide to keep the card, but it largely depends on the negotiation.

How much is a Chase Ultimate Rewards point worth?

As credit card issuers have modified their reward programs, it is time to focus on the benefits of the Chase Ultimate Rewards program and exactly how much a Chase point is worth.

Base Value in Redeeming Chase UR points

Next, in this Chase Ultimate Rewards points review, let’s talk about getting the most value. The floor value of a Chase Ultimate Rewards point is 1 cent each for travel, cash back, and gift cards. However, your points are only worth 0.8 cents for merchandise rewards such as Amazon.com shopping credits.

When points are redeemed for rewards, this means a $100 gift card would be worth 10,000 points. Having a base rate of 1% isn’t too shabby as many reward programs, travel and cash back, often cap at 1%, and many points are worth less than 1 penny each when redeemed rewards other than travel credits, gift cards, statement credits, etc.

The Sapphire Preferred lets you book award travel at 1.25 cents each and each point is worth 1.5 cents with the Sapphire Reserve for travel.

Transferring Chase points

Chase also has partnered with the following airline & hotel rewards programs to transfer Chase points to the respective rewards program on a 1:1 transfer basis!

Chase travel transfer partners include:

- Aer Lingus AerClub

- Aeroplan Air Canada

- British Airways Executive Club

- Air France/KLM Flying Blue

- Emirates

- JetBlue TrueBlue

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying Club

- Iberia Plus

- World of Hyatt

- IHG Rewards Club

- Marriott Bonvoy

Once again, other credit card programs offer point transfers, but you might not have as many transfer options, or the transfer ratio is worse than 1:1.

You can only transfer in 1,000 point increments (i.e., 1,000 Chase points = 1,000 IHG Rewards points), but you still get the base value of 1% and have the potential to increase the value of points, worth at least 1 cent each, after transferring to the other travel partners.

Your best redemption rates will probably be with United MileagePlus or World of Hyatt. The reasons are their award travel costs less in comparison to the other rewards programs. So, you might be able to get 2 nights at a Hyatt compared to only 1 night at a Marriott, for example.

Keep in mind that not every Chase credit card that earns Ultimate Reward points allow you to transfer your points to the above travel partners. To receive full access, you will need to choose the Sapphire Preferred or Sapphire Reserve.

Related: When to Transfer Chase Ultimate Rewards Points to Travel Partners?

Redeeming For Chase Travel Rewards

We have established that the base value for a Chase Ultimate Reward point is 1 cent each. They are worth more if you own the Chase Sapphire Preferred or Chase Sapphire Reserve and redeem the points for travel rewards when you use the Chase Ultimate Rewards Portal.

Each Chase point is worth 1.25 cents apiece when redeemed for travel rewards with the Chase Sapphire Preferred and 1.5 cents each with the Sapphire Reserve. To get the increased rate, you will need to access the rewards portal via your Sapphire Preferred or Reserve account.

For example, let’s compare the redemption value of the Chase point for a $200 travel purchase to see how many points are required for the same ticket with three different Chase credit cards.

- Freedom Unlimited: 20,000 UR points (1 cent each)

- Chase Sapphire Preferred: 16,000 UR points (1.25 cents each)

- Chase Sapphire Reserve: 13,333 UR points (1.5 cents each)

If you want to use your Chase points for travel rewards, your best option is going for the Sapphire Preferred or Sapphire Reserve. Just remember that both of these cards fall under Chase’s 5/24 rule that declines new applicants that have applied for 5 credit cards within the previous 24 months.

Maximizing Chase Points for non-travel rewards

Let’s talk about maximizing your points in the Chase Ultimate Rewards points review. While Chase Ultimate Reward points are most popular among travel aficionados, certain Chase credit cards can make Ultimate Rewards points more valuable for non-travel rewards. The Chase Freedom Unlimited comes with the ability to earn at least 1.5% cash back on all other purchases.

Additionally, you cannot transfer the points to other travel rewards programs (without also owning the Sapphire Preferred or Sapphire Reserve). The Chase Freedom Unlimited® is one of the best options if you want to earn cash back.

There are very few cash-back credit cards that pay at least 1.5% cash back (and are no annual fee cards!).

If you own the Chase Freedom Flex, you might be able to do better than 1.5% if you can earn more in one of the rotating categories. You can earn 5% cash back on select quarterly spending categories. Cardholders earn 1% on all other purchases.

Combining Ultimate Rewards Points

Another way to boost the value of each Chase point is to own two or more Chase credit cards that earn Ultimate Reward points. Therefore, you can transfer Chase Freedom points to a Sapphire account. This strategy allows you to accumulate the most points possible per purchase.

The base earning rate for all Chase credit cards is 1 point per $1 spent on purchases and rewards select spending behaviors with bonus points.

- Freedom Flex: 5x points on select categories on the first $1,500 in purchases per quarter, 5x points on travel purchased through Chase Ultimate Rewards®, 3x points on dining at restaurants, including takeout and eligible delivery services, 3x points on drugstores, & 1x point on all additional purchases.

- Freedom Unlimited: 5x points on travel purchased through Chase Ultimate Rewards®, 3x points on dining at restaurants, including takeout and eligible delivery services, 3x points on drugstore purchases, 1.5x points earned on all other purchases

- Chase Sapphire Preferred: 5x points on travel purchased through Chase Ultimate Rewards®, 3x points on dining, and 2x points on all other travel purchases, plus more

The Chase Freedom and Freedom Unlimited cards do not charge an annual fee. They also restrict the redemption options for the Ultimate Rewards points as a result. A simple runaround is to own a combination of the Freedom, Sapphire, or Ink products. This way, you’ll be able to maximize your earning and redemption values.

The most affordable way is to choose either Sapphire or Ink products. Use the fee-free Freedom to earn 5 points on the bonus categories. Or, you can use Freedom Unlimited to earn at least 1.5%.

Regardless of how you earn your Ultimate Rewards points, it’s very easy to see that you can easily maximize the value of each Chase point beyond the base 1-cent value.

This is considered the Chase trifecta.

Summary of Chase Ultimate Rewards Points

In summary, hopefully, this Chase Ultimate Rewards points review has helped you out. Earning the right reward points can be very…rewarding! And Chase Ultimate Rewards points are at the top of the game. Additionally, there are many ways that you can earn them. You can go through their travel credit cards to make it easy.

Plus, there are numerous ways you can redeem your Chase Ultimate Rewards points, including for travel, merchandise, events, or cash. You really can’t go wrong with Ultimate Rewards. Hopefully, this Chase Ultimate Rewards Points review has helped you better understand the variety of options you could have.

Related Articles:

Hi there, seems to be conflicting information on the web about whether you earn extra points by booking via the chase portal. I.e. it’s worth using the portal instead of booking directly with the airline, even if you’re only using cash. Saw a business insider article and a few others indicating as of August ’21 you earn extra points booking through the portal if you have any of the four sapphire and freedom cards. But this article (and a points guy article) says there is no extras from using the portal, so don’t bother.

Really appreciate the clarification!

There is a bonus if you hold a Sapphire/Ink credit card of 25%, but usually, you can get a better value when you transfer your points to a travel partner program.

Chase ink ultimate travel reward has been HORRIBLE to say the least I have been a loyal card holder for over 10 years and when using my points have had very few problems UNTIL lately… i book a flight it is unconfirmed after 7 days, then status is UNKOWN and I’m told to call to pay for my booking….what!! after numerous calls to over 20 reps i still have no reservation and have no idea if i will fly tomorrow or not as they give priority to bookings within 24 hours yet my points are gone. I have been dealing with this horror for over a week and i certainly have more than enough points for this short trip. I will be closing this acct and NEVER use chase for anything. hope this help someone else avoid this horror in the future…. stay clear of chase ultimate rewards.

Did you get an email confirmation on your booking w/ a reservation #?

I also just had a horrible experience with Chase Ultimate Rewards Travel portal. We booked a flight for our family back in January, through the portal and using a combination of points and cash. We received the confirmation emails and assumed all was well. Two days before the trip, in late March, I contacted the travel center to ask about baggage allowances. The service rep asked for my confirmation number, seemingly confirmed the flight, and then advised me to contact the airline directly to find out about baggage allowance. When I did so, I was told that our reservations had been cancelled Feb 4 and that we had been issued a full refund Feb 4!! I checked our credit card statement and there was no refund whatsoever, nor was there any email or communication from the airline or from Chase, and I checked our spam folder as well as as our inbox very carefully. We then had to rebook flights at 3x the original cost, being such short notice, but I just kept imagining if I hadn’t called and we had showed up at the airport for our early morning flight, only to be told it had been cancelled 6 weeks ago, with not a word. I understand that Chase isn’t responsible for the flight cancellation, but as the intermediary through whom we booked the travel, they are absolutely responsible for the lack of communication. We have been Chase Sapphire Preferred members for many years, but unfortunately I can no longer use them to book travel, as I can’t be confident that we will be told if there are changes or cancellations to our flight itinerary. They are refusing to take any responsibility for this situation.

I call BS on this “benefit”. The prices chase charges for their “award” travel is often twice the price of the ticket I can purchase through the actual airline. Complete rip-off.

How can you get the actual Southwest confirmation number for the Chase Rewards booked flight. We also had a case where a booking at Southwest changed without our knowledge. Fortunately our travel companions received an email notification about the flight change so we knew we had to rebook for a more workable flight time. That process took hours talking to chase and waiting while they talked with Southwest since we did not know the Southwest confirmation number. I imagine that Chase uses Expedia to make the reservation, so we are trying to learn how we can get ahold of that Southwest confirmation number and request that our email be attached to it for any notifications.

Any Advice?

There should have been a place to put your SW Rapid Rewards # in during the reservation booking. Also, did you check the reservation email?

I just got the Sapphire Reserve and 80k bonus points will be coming to me pretty soon, look forward to using. Looks like you can get some real value for these points, from Apple products to travel. My question is in regards to earning these precious points. Using Chase UR site to earn extra points seems to come at a cost, as in my limited experience, their prices seem to be higher than one can get booking directly (especially when using AA or state government discounts). Am I right I can only earn 3x points by booking directly through airlines, hotels, etc? Any tricks to get more points? I’m not sure this card is for me as I don’t like paying more than other sites charge.

Am I missing something? Is there somehow to justify paying more for tickets?

Thanks!

Is it possible to buy an United Air ticket on the CHASE Travel Portal using a combination of UR Points and a Chase United Quest Card to receive the 2 free checked baggage benefit?

It appears that when purchasing a ticket on Chase Portal with points and credit card, Chase then goes and buys the ticket at United using their own institutional credit card (i.e. ending in 8909) and the United reservation does not show the original United Quest card that was used to pay on the Chase Portal. Thus, baggage benefits are not recognized.

Any help/experience with this is appreciated…

Functionality of Ultimate Rewards portal is below the recognized good quality standards as well as the performance of this Chase Bank subcontractor. Today, my wife spent 1 1/2 hour for buying an airline ticket there.

First, she tried to buy it herself, but after several attempts to do that and receiving, as many times, a rejection message that her transaction cannot be processed, she contacted a representative at the Ultimate Rewards, to buy the ticket via a human being. It took three agents to accomplish this. One was as incompetent as another.

In the meantime, our credit card account activity shows 10 charges and 10 corresponding debits for the transaction that my wife was trying to execute herself. An agent at CHASE told us that it is due to some issue with the payment processing system at the Ultimate Rewards.

So, your articles should cover quality of services that all those credit cards perks provide.

I second the problems booking through Ultimate Rewards. Just spent 42 minutes booking a flight I could have booked in 3 minutes on expedia or the airline site directly. Issue seems to be that Ultimate Rewards doesn’t like to book the lower fares, and will only do so if you really push via a supervisor. Not sure if the 7500 points I saved was worth the time spent. It is definitely not a premium booking experience.

That said, transferring miles to airline partners mileage programs to book business class flights to Europe worked flawlessly.

Such a great article! thanks for sharing.