This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. For an explanation of our Advertising Disclosure, visit this page.

Are you wondering how many credit cards should I have? Have you ever searched for answers on the “How many credit cards should I have Reddit”? Several Reddit users have asked this question, and the responses are quite interesting.

All of us use credit cards differently and have different reasons for why we apply for new ones. Reddit is a free resource that gathers these various opinions to help you pick the best option for your own situation.

Below is an example of what type of questions Reddit users ask about how many credits to own at once.

How Many Credit Cards Should You Have?

There is almost no limit to how many credit cards you can own. The current world record is 1,497 credit cards.

Most people need A LOT fewer cards to maximize each purchase and enjoy valuable benefits in the process. And you don’t always have to apply for a new card every 6 months to get the best bonus. But if you want to beat the current world record or become an expert card churner (while keeping excellent credit), you can pursue these goals.

Here are some nuggets of advice from different Reddit users for this question.

As Many As You Can Manage Responsibly

Credit cards are an easy way to earn cash or travel rewards points that help you save money on future purchases. The best credit cards for miles also offer additional perks like travel credits, free hotel night certificates, and waive fees for other optional travel charges like Global Entry or airport lounges.

However, you should only consider applying for a new credit card when it passes these two conditions:

- You can pay the balance in full each month

- The benefits are worth more than the annual fee

A third condition you might add is if you can earn the signup bonus. These bonuses are one main reason why you might apply for multiple credit cards.

Damaged credit and paying an annual fee or interest on unpaid balances are all costs that reduce the value of the rewards you earn during the year. If a new card is going to be a net expense, it’s probably best not to apply.

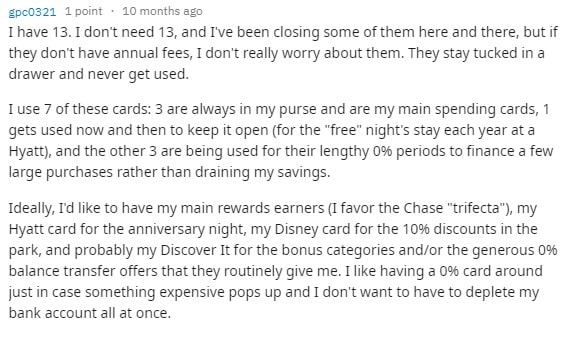

Keep No Annual Fee Credit Cards

Reddit user gpc0321 recommends keeping the credit cards with no annual fee. These cards are a free way to build credit. Keeping these accounts open extends your average account age. Making a periodic purchase and paying in full keeps the account active and also reports a positive payment history.

Having these extra cards also makes it easy to keep your total credit utilization ratio below 30%. It is a good idea to use a free credit monitoring service to make sure someone doesn’t steal your information, go on a spending spree, and let you pay the bill.

You might also use no annual fee travel credit cards like a Hilton Honors Card to keep your Hilton Honors points from expiring. Each loyalty program may require you to make a credit card purchase every 12 to 24 months to keep your points balance active.

Only Apply When You Can Earn Signup Bonus

Only Apply When You Can Earn Signup Bonus

Elasee recommends applying for new credit cards when you can earn a signup bonus. These one-time bonuses are free cash, especially if you are going to make a large purchase soon. One of the easiest signup bonuses to earn from the Chase Freedom family.

Also waiting to apply once a card runs a limited time signup bonus is another good idea. Many airline and hotel credit cards run promotions at least once a year.

If you plan on churning several cards, pay attention to the bonus offer terms and conditions. You usually can’t earn a new bonus if you currently own another card in that family. One good example is the Chase Sapphire Reserve® and Chase Sapphire Preferred® Card. To earn the bonus on the card you don’t own, you must cancel your current account and have not earned the first bonus offer within the last 4 years.

Also, make sure you can use the bonus points and regular purchase rewards. It’s never fun having a stockpile of points that you can’t use.

Get Credit Cards from Different Banks

It’s also a good idea to have credit cards from different banks and credit card issuers. For example, you might have a card from Chase and American Express. You can take it a step further and have a mixture of Visa, Mastercard, and American Express credit cards. Diversifying your wallet reduces the risk of using a merchant that doesn’t except a certain credit card issuer.

It’s a good idea to own at least one Visa or Mastercard. Even if a Discover or American Express product (like The Platinum Card® from American Express) is your go-to credit card for earning points, Visa and Mastercard are almost universally accepted.

When New Credit Cards Have Better Rewards and Benefits

As your credit score improves, you can qualify for better credit cards. For example, the best credit cards for excellent credit have some of the best purchase rewards and benefits. But you may only qualify for these cards if you currently own at least one credit card to demonstrate a positive payment history.

Avoid Too Many Recent Applications

Some banks will automatically decline your application if they believe you have too many recent applications. The most notorious policy is the Chase 5/24 rule. This policy isn’t publicly published but is talked about often in various credit card forums including Reddit.

Essentially opening or being listed as an authorized user on at least 5 credit cards in the last 24 months means your application for most Chase-issued travel credit cards will be declined. Your options are to wait until you only have 4 or fewer new credit card accounts in the last 24 months. Or, you can apply for a card from another bank like American Express, Barclays, or Capital One.

This 5/24 rule might be one reason why you apply for the Capital One Venture Rewards Credit Card instead of the Chase Sapphire Preferred.

Summary of How Many Credit Cards I Can Have

The various answers to the “How many credit cards should I have?” Reddit threads provide good reasons to only have as few or as many cards as you want. The decision is ultimately up to you. Just make sure every new card you apply for has benefits and rewards programs that maximize your current purchase power and travel habits.