Almost every day, my five-year-old son says to me and my wife that he wishes the virus would go away forever. I always say, “Me too, my boy.” I then tell him there were at least a few good things to come out of the pandemic. One: We all got to spend a lot more time together. Two: People got to work from home and will continue to do so forever in some industries. And three: Airlines got rid of those pesky change fees.

Almost every day, my five-year-old son says to me and my wife that he wishes the virus would go away forever. I always say, “Me too, my boy.” I then tell him there were at least a few good things to come out of the pandemic. One: We all got to spend a lot more time together. Two: People got to work from home and will continue to do so forever in some industries. And three: Airlines got rid of those pesky change fees.

Change fees have always been a total scam from the airlines because on many flights, they overbook because they know some people will cancel, regardless of whether there was a fee or not. And there are almost always standbys, either paying passengers or employees or their families getting the most out of their benefits.

The airlines have rightly gotten rid of change fees since no doubt it has prevented people from flying with Covid or some other nasty bug. In the past, many passengers would fly because they didn’t want to be hit with the fee of hundreds of extra dollars and sometimes thousands, depending on their route and how many people in their family. People are still knowingly flying with Covid but definitely not as many as there would have been if not for the removal of change fees.

Well, my buddy Ben sent me a message yesterday: “PSA – while checking in last night, I checked round trip prices to Hawaii, and ended up getting a $500+ credit! Strange new world where tickets cost less the night before departure than tickets booked 21+ days out.”

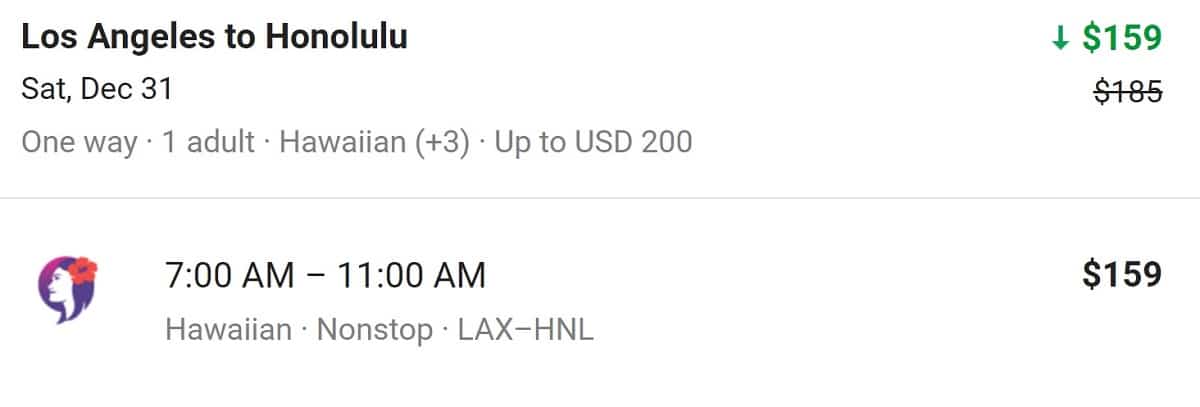

Ben is right and I’ve always told people to set a fare alert (here’s how) before and after booking a ticket so you will know when to buy and when to put the same flight on hold and then cancel the original. See screenshot below of a recent example.

I asked Ben, “Which airline did you fly and did you cancel your tickets and then rebook online or did you call?” Ben said: “American. I called to have tickets placed on hold before the rep canceled and rebooked.”

I did the same in October when the fares dropped for our February flights to Hawaii and saved $280. Here’s that story.

So always make sure you buy tickets that aren’t Basic Economy meaning they can’t be changed without penalty and monitor the fare – even if it’s within 24 hours of departure because you just might save hundreds of dollars.

I thought the days of reserving a seat without purchasing a ticket were long gone (I can remember when that was SOP, along with student standby fares). So I was surprised to see the phrase “tickets placed on hold.” What does that mean, and how exactly does that work?