This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. For an explanation of our Advertising Disclosure, visit this page.

Editor’s Note: Some of the offers below may have expired or are no longer available on our site.

There is a truly an overwhelming selection of travel rewards credit cards on the market, with options for just about every kind of traveler. So, to narrow down those options a bit, we’ve picked out the best travel rewards credit cards for 2018 and compared their most appealing features.

Key Features in Finding the Best Travel Rewards Credit Cards

We’re comparing these travel credit cards based on a few features that might sway your decision:

-

- Annual fee: Some travel rewards credit cards come with no annual fee, some come with a massive annual fee, and some waive their fee for the first year. Generally, the more you pay, the bigger the perks.

- Sign-up bonus: Don’t cheat yourself out of points or miles by signing up for a travel card with no sign-up bonus. Once you decide on what kind of spending minimum you can reliably meet, you can compare the best travel rewards credit cards based on which will give you the most points for that initial spending.

- Extra points: Some travel cards will give you 2x points or miles on all of your purchases, and some will award as much as 5x points or miles on specific spending categories. It’s worth the time to look through your recent credit card statements and compare the rewards you would have earned with different travel cards.

- No foreign transaction fee: Period.

- Travel perks, benefits, and protections: Each travel credit card comes with different perks, but most will offer varying levels of protection for travel mishaps like canceled flights, stolen luggage, and collision damage waivers for car rentals.

You don’t have to find a travel rewards credit card that checks off each of these boxes for you– but you might be able to. We’ll rank the best credit cards based on how they compete in each of these categories. Also, please read this post on Chase’s 5/24 rule if you’re not familiar with it.

The Best Travel Rewards Credit Cards 2018:

Best Travel Rewards Card: Chase Sapphire Preferred (Expired)

The Chase Sapphire Preferred offers a 50,000-point sign-up bonus when you spend $4,000 in the first 3 months from account opening– that’s worth at least $625 toward travel through Ultimate Rewards. But you can receive even more value by transferring your Ultimate Rewards points out to a travel partner.

With a $95 annual fee (waived for the first year), 2x points on travel and dining, and a long list of travel protections, the Chase Sapphire Preferred offers excellent value for its cost.

The Sapphire Preferred’s flexibility comes from its redemption options. You’ll be able to redeem points for statement credit (at a rate of 1 cent per point) or for an elevated rate of 1.25 cents each toward travel booked through Ultimate Rewards.

But your best bet with the Chase Sapphire Preferred card will usually be to take advantage of Chase’s 1:1 transfer ratio (more here) with its hotel and airline transfer partners. That’s a huge draw and makes your Ultimate Rewards points very flexible.

With the Sapphire Preferred, you’ll be able to transfer your points to these airline & hotel loyalty programs:

- British Airways Avois

- Air France/KLM Flying Blue

- Singapore Airlines KrisFlyer

- Southwest Rapid Rewards

- Korean Air Skypass

- United MileagePlus Miles

- Virgin Atlantic Flying Club

- JetBlue

- Aer Lingus

- Hyatt

- IHG

- Marriott

- Ritz Carlton

Another feature that makes this travel rewards card remarkably flexible is your ability to transfer your points immediately to another Ultimate Rewards account held by you, your spouse, or your domestic partner. If you already hold a card like the Chase Freedom or the Chase Ink Business Preferred, that could be a huge boost in meeting your rewards goals. And it’s definitely worth noting, that there’s the Sapphire Reserve card, which comes with a higher annual fee, but also comes with more benefits.

Best Business Card: Chase Ink Preferred

The Ink Business Preferred carries a $95 annual fee, which it more than makes up for with its ridiculously tempting sign-up bonus: 80,000 bonus points when you meet the $5,000 spending minimum in the first 3 months from account opening.

Those 80k bonus points are worth $1,000 towards travel when you redeem them through the Ultimate Rewards portal, or potentially even more if you can transfer them to the right airline partner.

The Chase Ink Business Preferred also offers extra points in some bonus categories that might appeal to freelancers and small business owners: you’ll earn 3x points on travel, shipping purchases, internet, cable, and phone services, and advertising on social media sites and search engines.

Keep in mind, you’ll earn those 3x points on the first $150,000 in combined purchases in each account anniversary year. After that, all purchases will earn 1x points.

This card also comes with some helpful travel protections:

- Trip Cancellation/Interruption Insurance

- Travel and Emergency Assistance Services

- Roadside Dispatch

- Auto Rental Collision Damage Waiver

- Extended Warranty Protection

- Purchase Protection

- Cell Phone Protection

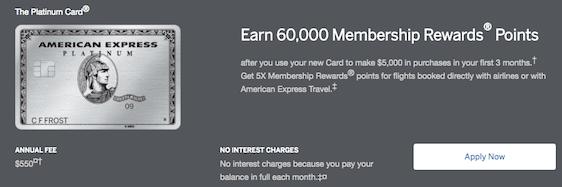

Best Premium Card: The Platinum Card from American Express: Luxury Travel

If you travel frequently, value luxury travel then you might be able to justify the $550 annual fee on the AMEX Platinum Card. It doesn’t have the high rewards offered by some other travel rewards cards, but it does come with some competitive travel perks. And of course, it makes sense to compare the Amex Platinum with the Sapphire Reserve which is also a great premium card.

You’ll be able to earn a 60,000-point sign-up bonus when you use your card to spend $5,000 in the first 3 months.

On top of that sign-up bonus, frequent travelers can earn 5x points on flights booked directly with airlines and 5x points on eligible hotels booked through AMEX travel. Anything else will earn just 1x points.

Those Membership Rewards points can be redeemed for statement credit, gift cards, and Uber credits, but you’ll get the most value out of using them to book travel through amextravel.com or by transferring them to an airline or hotel partner:

- AeroMexico

- Air France/KLM Flying Blue

- Alitalia Millemiglia

- ANA Mileage Club

- Asia Miles

- Delta SkyMiles

- El Al Israel Airlines

- Emirates Skywards

- Etihad Airways

- Hawaiian Airlines

- Iberia Plus

- JetBlue True Blue

- Virgin America

- Virgin Atlantic Flying Club

- Choice Privileges (Hotels)

- Hilton HHonors

- Starwood Preferred Guest

Again, you won’t get a 1:1 transfer ratio with all partners, so it’s worth checking before you make any final decisions.

The Platinum’s travel perks include $200 in Uber credits annually, a $200 airline fee for incidentals on your preselected qualifying airline, access to the Global Lounge Collection, and valuable benefits when you stay at a property in the Fine Hotels & Resorts collection. If you can take full advantage of this card’s sign-up bonus, annual credits, and airline transfer partners, it might be worth its $550 annual fee.

Additionally, cardholders can get up to $100 in statement credits annually for purchases at Saks Fifth Avenue on their Platinum Card®. That’s up to $50 in statement credits semi-annually. However, they must be enrolled for this benefit to apply.

Here’s how hard it is to get approved for the Amex Platinum, and the credit score needed for approval.

Best Flat Rate: Capital One Venture Rewards Card: Everyday Rewards

Like the Chase Sapphire Preferred, the Capital One Venture Rewards card has a $95 annual fee (waived for the first year) and offers a 50,000-mile sign-up bonus. Unlike the Sapphire Preferred, that bonus will be worth only $500– but you’ll only have to spend $3,000 in the first 3 months to earn it.

The Venture card stands out for awarding 2x miles on all purchases unlike the CSPs 2x on dining & travel, with miles worth 1 cent each as travel statement credit. That means this card carries a flat rewards rate of 2%, with miles redeemable toward eligible travel-related purchases made in the last 90 days or toward travel purchases made through the Capital One portal.

Frequent travelers might get more value out of a card that offers extra points on travel spending, and you won’t get much in the way of perks and protections out of the Venture card. Still, the card’s flexible statement credit redemption option and 2x miles on all purchases makes it a solid option for people who want to rack up rewards on everyday purchases for their next trip.

Best No Annual Fee Travel Card: Discover It Miles: No Annual Fee

The Discover It Miles carries no annual fee and no sign-up bonus, but it does award 1.5x miles on all purchases— with a mile match at the end of your first year. Basically, at the end of your first year, Discover will match whatever miles you’ve earned, effectively making this a 3x miles card for the first year.

This Discover It has a similar rewards structure to the Venture card: you can redeem miles for travel statement credit (at a rate of 1 cent per mile), meaning you’ll get a flat rewards rate of 3% the first year and 1.5% each year after that.

Overall, this travel card is a great option for budget travelers who want to use their rewards to pay for travel purchases. Otherwise, it’s a pretty no-frills card. You won’t pay a foreign transaction fee when you use it abroad, but you won’t be covered by travel protections, either.

There’s also the recently released no annual fee United TravelBank and Delta SkyMiles cards.

Hotel Credit Card: Starwood Preferred Guest Card from American Express: Hotel Stays (Expired)

This information could change since Hilton is changing its offers in 2018 and there will be 4 new Marriott – SPG credit cards in 2018.

The Starwood Preferred Guest card also has a $95 annual fee– with a $0 introductory annual fee for the first year– and 75,000 Bonus Points after you use your new Card to make $3,000 in purchases within the first 3 months.

This card is definitely geared toward people who frequently stay at hotels and want to benefit from elevated status. With the SPG card, you’ll earn 6x Starpoints on purchases at Starwood and Marriott properties, and 2x Starpoints on all other purchases.

When you use your Preferred Guest account to sign up for Crossover Rewards, you’ll be able to enjoy extra benefits on Delta flights. And even if you’re not flying with Delta, you can transfer your points to one of Starwood’s airline transfer partners. As an added bonus, for every 20,000 points that you transfer to an airline partner, you’ll get 5,000 points back.

With Starwood, you can transfer your points to:

- Alaska Airlines Mileage Plan

- Alitalia Millemiglia

- All Nippon Airways Mileage Club

- Asia Miles

- British Airways Executive Club

- Delta SkyMiles

- Emirates Skywards

- Etihad Airways

- Air France/KLM Flying Blue

- Korean Air

- Qatar Airways

- Singapore Airlines KrisFlyer

- United Mileage Plus

- Virgin Atlantic Flying Club

The full list includes over 30 frequent flyer programs, but keep in mind that not all of them offer a 1:1 transfer ratio. You’ll want to check on your preferred airline before you finalize any transfers.

Other Travel Rewards Credit Card Options

These travel credit cards each offer great value in different areas, but they aren’t the only valuable travel rewards cards out there.

If none of these credit cards suit your needs, don’t worry– you’ve still got options. Some other rewards credit cards options include valuable cash back rewards cards like the American Express Blue Cash EveryDay, or no-annual-fee rewards cards like the AMEX EveryDay from American Express.

what is the best card for using to travel for insurance purposes

car air hotel and cruise. I had called and it seemed like Marriott

covered the most so you dont have to add on insurance on travel

Any help or ideas

The Chase Sapphire Preferred and Reserve both have good travel insurance policies.

You made my day.

Time to apply for a new credit card.

If I only knew this more earlier

Which cards are best for replacing car rental insurance charges? They are going up like crazy!

The Chase Sapphire Preferred offers primary coverage. https://johnnyjet.com/5-reasons-why-you-should-have-the-chase-sapphire-preferred/

Nice write up. My credit score was recently improved by cyberh59 AT gmail . com after getting referred on quora to contact him. He also helped delete all negatives from my credit.