This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. For an explanation of our Advertising Disclosure, visit this page.

One effective strategy to maximize your miles on credit cards is to use a combination of rewards cards that complement each other. For example, by using multiple Chase credit cards that earn points, you can accrue more points on all your purchases, which can then be redeemed in various ways, such as for award travel.

To answer your question, yes, you can certainly use the no-annual-fee Chase Freedom Unlimited® card in conjunction with the premium travel Chase Sapphire Preferred® Card. Using these two cards together can help you earn even more travel miles rewards.

So, it’s a smart move to use these two cards in tandem to maximize your earning potential and make the most out of your credit card rewards.

Chase has cards that don’t have an annual fee but still earn rewards that can be combined with some of their other cards. More specifically, the Ink Business Preferred® Credit Card, the Chase Sapphire Cards, and the Freedom Cards can pool together to give cardholders the most points (known as the Chase trifecta).

As an example, here’s how and why you should transfer your Freedom Unlimited points to the Sapphire Preferred for better redemption options.

No annual fee: Chase Freedom Unlimited®

60,000 Bonus Offer: Chase Sapphire Preferred® Card

Chase Freedom Unlimited Benefits

You might think that the Chase Freedom Unlimited doesn’t seem to offer the most exciting benefits at first glance. But, you can earn more on non-bonus spending when your go-to Chase Sapphire Preferred only earns the base rate of 1 point per $1. Look at this post if you’re looking for a travel card better than the Sapphire Preferred.

Earn Up to 5 Points per $1

Chase Freedom Unlimited cardholders earn unlimited:

- 5% cash back on travel purchased through Chase Travel

- 3% cash back on dining at restaurants, including takeout and eligible delivery services

- 3% cash back on drugstore purchases

- 1.5% cash back on all other purchases

Each Chase Freedom Unlimited® purchase earns between 1.5 and 5 points per $1.

Earning 1.5% cash back instead of just 1% cash back can quickly add up!

However, the Freedom Unlimited points are only worth 1 cent each when redeemed for award travel booked on Chase Travel℠ and for cash redemptions. Gift cards and online shopping credit rewards are only worth 0.8 cents each. Plus, you cannot transfer points to the 1:1 airline and hotel transfer partners via Freedom Unlimited. But, you can transfer to the Sapphire cards, which can then transfer to the Chase travel partners (more on that below).

Chase Freedom Unlimited Signup Bonus

New Chase Freedom Unlimited® cardholders can enjoy an additional 1.5% cash back on everything they buy (on up to $20,000 spent in the first year) – worth up to $300 cash back! That means they can enjoy 6.5% cash back on travel purchased through Chase Travel, Chase’s premier rewards program that lets you redeem rewards for cash back, travel, gift cards, and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

Related: Chase Freedom Unlimited Review

Chase Sapphire Benefits

The Chase Sapphire Preferred earns up to 5x points per $1 on purchases but has more valuable redemption options. The Chase Sapphire Preferred earns unlimited:

- 5x points on travel purchased through Chase Travel℠ (excluding hotel purchases that qualify for the $50 Anniversary Hotel Credit)

- 3x points on dining (including eligible delivery services, takeout, and dining out)

- 3x points on online grocery purchases (excluding Target®, Walmart®, and wholesale clubs)

- Also, 3x points on select streaming services

- 2x points on all other travel purchases

- 1x point per $1 spent on all non-bonus purchases

Travel Perks

There is a $50 annual Hotel Credit. It comes in a statement credit that will automatically be applied to your account when your card is used for hotel accommodation purchases made through the program, up to an annual maximum accumulation of $50. This can be one of the best credit cards for hotels if you like flexibility but don’t use hotels too often.

Plus, you’ll earn bonus points equal to 10% of your total purchases made the previous year on each account anniversary. So, if you spend $25,000 on purchases, you’ll get 2,500 bonus points.

Each point is worth 25% more (1.25 cents each) when booking award travel on Chase. You can also transfer Sapphire points to airlines and hotels at a 1:1 ratio.

As you can see, transferring your Freedom Unlimited points to the Sapphire Preferred can help you get the maximum value from your points when you earn and redeem them.

Chase Sapphire Preferred Signup Bonus

New Chase Sapphire Preferred® Card cardholders can earn 60,000 bonus points after spending $4,000 on purchases in the first 3 months from account opening. That’s $750 when redeemed through Chase Travel℠. Member FDIC

Related: Chase Sapphire Preferred Review

How to Transfer Freedom Unlimited Points

The information for the Chase Freedom Flex℠ has been collected independently by Johnny Jet. The card details on this page have not been reviewed or provided by the card issuer.

It’s easy to transfer your Freedom Unlimited points to a Sapphire Preferred or Chase Sapphire Reserve®. The process can also be the same if you have the Chase Freedom® (no longer open for new applicants) or Chase Freedom Flex℠.

If you’re thinking about applying for the Chase Sapphire Preferred, you can continue accumulating Freedom Unlimited points now and transfer them to your Sapphire account later.

It’s free to transfer your points, and there isn’t a transfer minimum like the 1,000-point minimum for the travel transfer partners.

Related: Chase Sapphire Preferred Credit Score: What You Need to Know

Here’s how to transfer your rewards.

Step 1: Log Into Chase Freedom Unlimited Account

The first step is to log into your Chase account at Chase.com or use the Chase mobile app.

From here, you go to your Chase Freedom Unlimited® account.

Step 2: Choose “Combine Points”

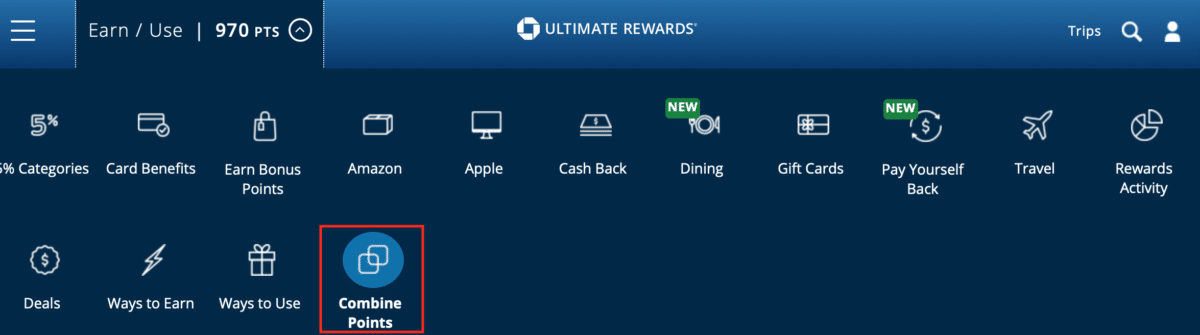

Under the “Earn/Use” button, once you access your account, tap the “Combine Points” option.

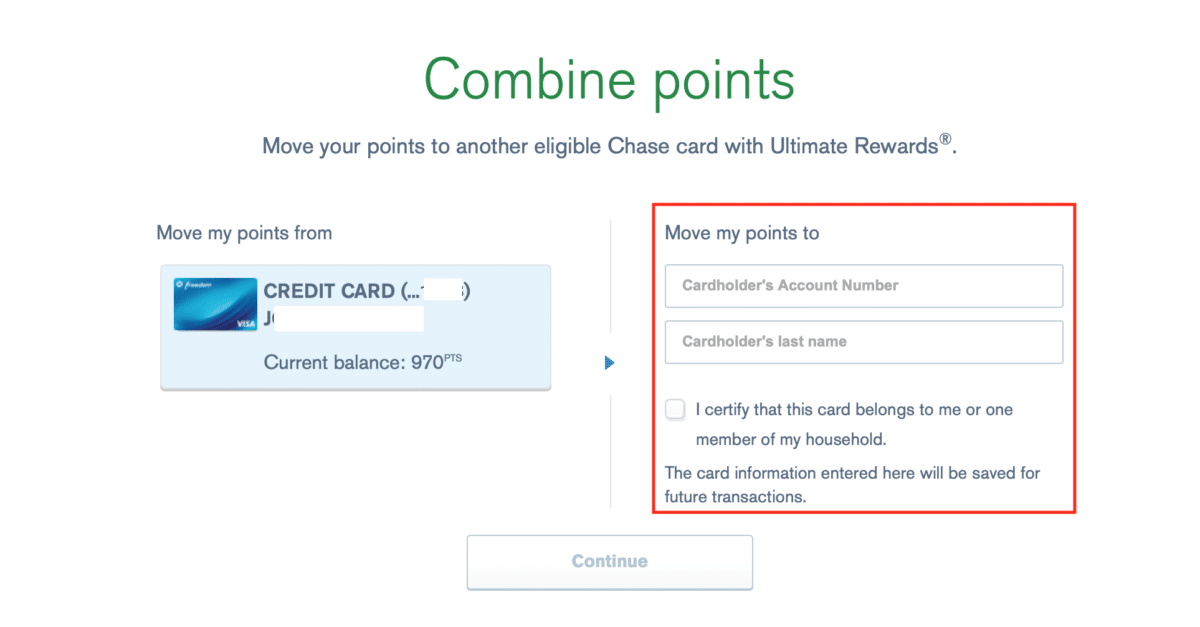

Step 3: Enter Sapphire Preferred Card Details

The next step is entering the cardholder’s last name and card number of the Chase Sapphire Preferred® Card.

You will need to certify if the Sapphire Preferred card belongs to you or another person in your household.

It’s also possible to transfer your points to other consumer and business cards that earn points, including:

Step 4: Complete the Transfer

The final step is to complete the transfer after linking the card accounts. The transfer should complete almost instantly.

Transfer Rules

Current guidelines let you transfer your Freedom Unlimited points to another Chase account that you hold or another household member has.

During the transfer process, you will check a box certifying you’re transferring your points to a qualifying credit card account.

Violating the transfer rules can result in the immediate closure of your Freedom Unlimited credit card. You may also get a temporary suspension from earning future points.

Prohibited transfer reasons include:

- Buying or selling points

- Transferring to an unauthorized non-household account

- Repeatedly opening the same credit cards for generating points

Many people convert their Freedom points into Sapphire points. A standard transfer shouldn’t raise any red flags with Chase.

Should You Transfer Points to the Sapphire Preferred?

Several reasons make sense to transfer your points to the Chase Sapphire Preferred® Card.

25% Travel Redemption Bonus

Each Sapphire Preferred point is worth 1.25 cents each when booking award travel using Chase Travel℠. Freedom Unlimited points are only worth 1.00 cents each.

1:1 Point Transfers

Only Chase credit cards that have an annual fee have 1:1 point transfer capability to airlines and hotels. The Chase Freedom Unlimited® doesn’t charge an annual fee and therefore doesn’t support points transfers to travel partners.

Some of the transfer partners include:

- United Airlines

- Southwest Airlines

- JetBlue

- World of Hyatt

- IHG Rewards Club

- Marriott Bonvoy

No Transfer Fees

There are no transfer fees for point transfers between Chase accounts.

When Not to Transfer Points to Sapphire

Here are some instances of why you wouldn’t transfer your Freedom Unlimited points.

Redeeming Points for Cash Rewards

Cash statement credits and bank deposits for either card are only worth 1 cent each. Transferring your Freedom and Freedom Unlimited points is worth it when you can take advantage of the 25% travel redemption bonus or 1:1 point transfers.

Can’t Transfer to a Qualifying Card Account

It’s not worth transferring your points to an ineligible account and risking account closure. Points are some of the most valuable credit card points, and closing a credit card can also temporarily damage your credit history.

Summary on Combining Freedom & Sapphire Points

Transferring your Chase Freedom Unlimited® points to a Chase Sapphire Preferred® Card or Chase Sapphire Reserve® is free and effortless. If you’re transferring to another card in your wallet, you can complete the process within a few minutes and access more valuable redemption options.

No annual fee: Chase Freedom Unlimited®

60,000 Bonus Offer: Chase Sapphire Preferred® Card

FAQs

Can you transfer Freedom Unlimited points?

It’s possible to transfer Freedom Unlimited points to another credit card that earns Chase Travel points. One stipulation is that you or another household member must be a cardholder.

You can’t transfer Freedom or Freedom Unlimited points to the airline or hotel transfer partners. Only the Chase Sapphire Preferred, Chase Sapphire Reserve®, and Chase Ink Business Preferred® Credit Card support point transfers.

Which is better? Chase Freedom Unlimited or Sapphire Preferred?

The Chase Freedom Unlimited® can be better if you want a credit card without an annual fee. It can also earn more points than the Sapphire Preferred on non-bonus purchases (1.5x points vs. 1x points).

Each Freedom Unlimited point is worth 1 cent each for award travel and cash redemptions, but 1:1 point transfers are unavailable.

You may prefer the Chase Sapphire Preferred® Card if you can maximize the 25% travel redemption bonus or the 1:1 travel partner point transfers.

Each Sapphire Preferred point is worth 1.25 cents (25% more) for award travel through Chase Travel℠. You can also transfer them in 1,000-point increments to popular airline and hotel loyalty programs.

Travel purchases made directly with the travel provider or third-party booking sites earn bonus points instead of only the Chase Travel℠ portal.

You must decide if the enhanced points opportunities are worth the $95 annual fee.

Can I have the Chase Freedom Unlimited and a Sapphire Card?

Yes, it’s possible to hold both the Freedom Unlimited and a Sapphire card (Sapphire Preferred or Sapphire Reserve) simultaneously.

You can use the Chase Freedom Unlimited® for purchases that earn more points than the Sapphire. Then, you can transfer your points to your Sapphire account to get better award travel options.

If you currently have neither card, you can only try one at a time. You will need to wait at least 30 days between card applications. Waiting between 3 and 6 months can be a better move as you have ample time to meet the sign-up bonus spending requirement and establish a positive payment history on your first card.

If you’re a “card churner,” keep an eye on the Chase 5/24 rule. Chase will most likely decline your application if you have 5 or more new credit card accounts that are less than 24 months old.

Related Articles:

Do you know if it is possible to transfer points from the Freedom card to a Chase United Explorer card belonging to the same card holder? I know you mention that only the “Chase Sapphire Preferred, Chase Sapphire Reserve®, and Chase Ink Business Preferred® Credit Card support point transfers.” However, I was curious if you knew about the possibility of this? Thank you.

You would need to transfer your Freedom points to the Chase Sapphire Preferred/Ink/Reserve, etc. before you can transfer your points out to United.