No one likes to get nickeled and dimed and the airlines, especially low fare carriers, have made quite a business doing it. And nickels and dimes are an understatement. As reported by Business Insider, the federal Bureau of Transportation Statistics reported that “U.S. airlines collected $6.8 billion in baggage fees in 2022.” Savvy travelers know how to avoid them altogether. Here’s how:

This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. For an explanation of our Advertising Disclosure, visit this page.

1. Research Baggage Fees

No matter which carrier you are flying, always research the luggage fees with the fare you purchased. And believe it or not, you should not only research the fees for checked baggage but for carry-on as well, as sometimes, basic economy fares don’t even allow passengers to use the overhead bin space and will charge you up to $65 for bringing a bag onto the plane – not checking it. Many international airlines are very strict and will even weigh carry-on bags so know how much you’re allowed to bring, the dimensions of the bags allowed and the weight limit.

RELATED: How to Save Money With a Secret Third Carry-On

2. Buy a Luggage Scale

If you don’t have access to a scale at home or when you’re on the road, then buy a portable luggage scale so you can quickly and easily find out how much your bags weigh and avoid any surprises at the airport. If you do have a scale at home, just weigh yourself while holding your bag, then again without the bag and subtract your solo weight. Buy a portable luggage scale here.

3. Fly Southwest Airlines

Southwest Airlines gives customers two free bags, up to 50 pounds each. Just keep in mind that they sometimes have higher fares because they automatically build those fees into their fares.

4. Get a Scottevest

I’m a big fan of Scottevest vests and jackets and have written about them many times before, They act as a secret third carry-on. These garments have 20+ pockets and some of them are large enough to fit your laptop. Not only does that mean you can pack less to avoid baggage fees, but they also keep your valuables safe and secure on your person while you’re out and about. Full disclosure: Scottevest is a past JohnnyJet.com sponsor but I continue to recommend them because they are a quality product, perfect for travelers.

RELATED: 12 Passport Tips to Save You Time, Money and Headaches

5. Use a Fishing Vest

If you don’t want to splurge for a Scottevest and aren’t too concerned about style, then you could consider a less expensive fishing vest as an alternative. They too have multiple pockets and will allow you to pack more items on your person and stay organized.

6. Book First or Business

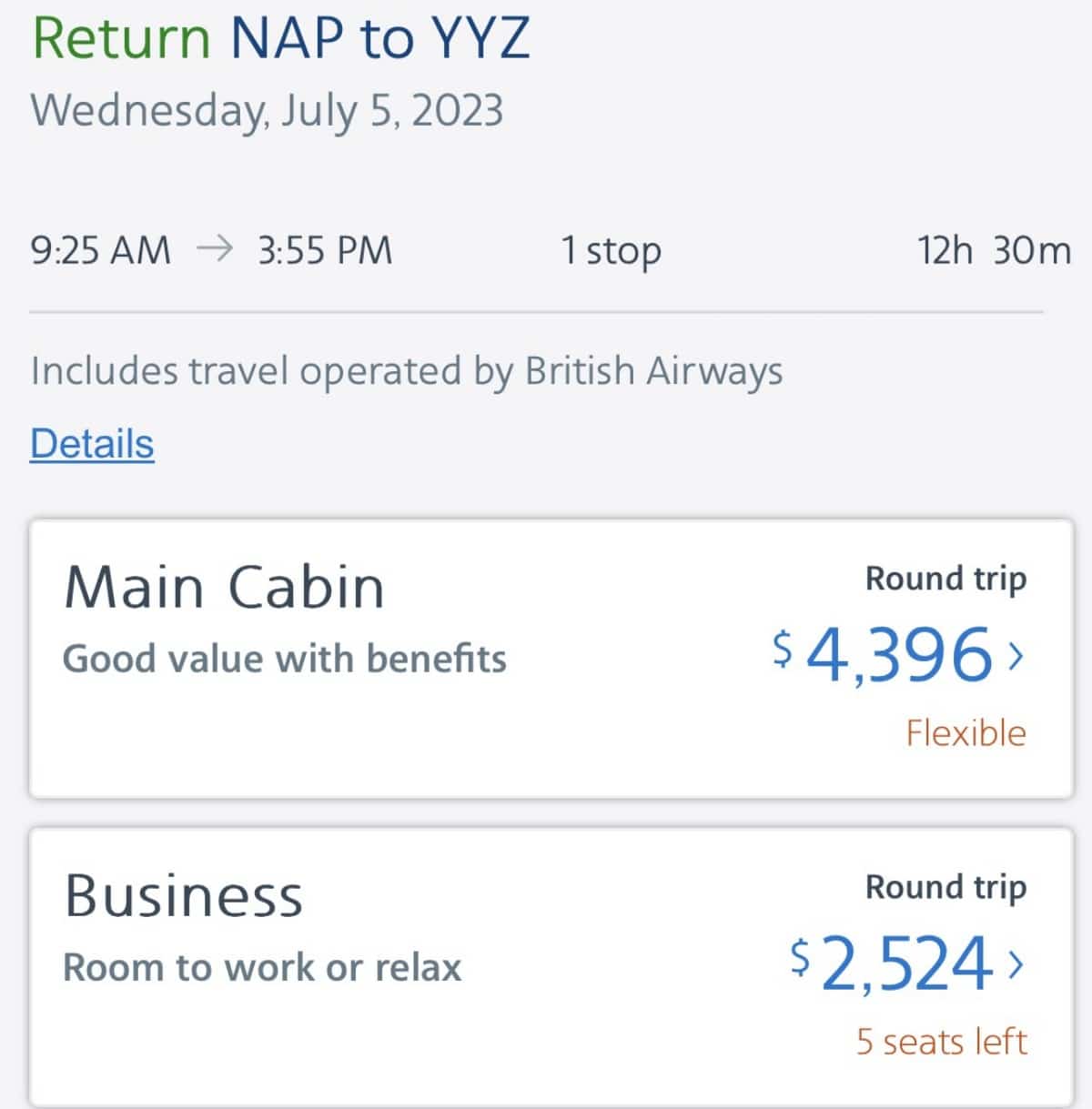

6. Book First or Business

Believe it or not, it’s sometimes actually cheaper to fly First or Business Class (see recent example above) but it’s especially true when you factor in all the other costs like baggage fees, seat selection and food that are added on to economy fares.

7. Try the Neck Pillow Trick

One trick some budget travelers use to bring more stuff onto the airplane with them is replacing the interior foam of a neck pillow with their clothes. Some roll up their underwear, t-shirts or even squeeze a couple of sweatshirts in there – perfect for when you’re on a chilly aircraft as well.

8. Earn Elite Status

If you fly often, stick to one airline and sign up to their frequent flier program so you can earn elite status. Even low-level status enables customers to get free checked baggage. My family and I recently flew from L.A. to Toronto via Philadelphia (PHL). We went via PHL on American Airlines (AA) and not the nonstop offered by Air Canada because I have elite status on AA so we get free checked bags among other benefits.

9. Get an Airline Credit Card

If you fly a particular airline several times a year but don’t spend enough money to earn elite status, then look into getting an airline credit card that offers free checked baggage for you and everyone on your reservation.

10. Don’t Put Everyone’s Luggage on One Reservation

If you’re flying with a loved one and you’re each checking a bag, don’t check both bags under one name. I know it’s easier, but it will cost you more. For example, my wife, kids and I were flying from Honolulu to Los Angeles in March and the first checked bag was $30. The second bag was $40. So, we saved $10 by each checking a bag instead of putting them both on the same reservation.

11. Travel with Carry-On Only

11. Travel with Carry-On Only

Duh! But seriously, Americans are notorious for overpacking … You should have seen the size of my bag on my first trip to Europe! Big mistake and I learned the hard way. Actually, I just posted the photo above for a good laugh. You really don’t need as much stuff as you think you do. In fact, here are 10 things you don’t need to pack so that you can travel much lighter.

12. Use Compression Packing Cubes

Packing cubes are a great way to stay organized when you travel but compression packing cubes will also allow you to fit more stuff into your suitcase without taking up much more space. Another benefit is that if you’re traveling with more than one suitcase and one suitcase is overweight, you can simply remove a packing cube from one bag and transfer it to another instead of trying to take individual items out of your bag. Buy compression packing cubes here (they’re currently 40% off).

Here are my tip for saving money on baggage fees. I think I covered all the bases but if I left one (or two) out please leave a comment below.

Does your comment noting to not place everyone on the same reservation in order to receive a better checked bag rate mean one must book, as in your case, 4 separate reservations? If so, that seems a bit risky to me. Please clarify. Thanks.

It depends on the airline. If the airline only charges $25 for the first bag and then $35 for the second (or something like that) then yes. Doesn’t matter if they’re all separate names

I got burned flying from Auckland to Sydney on Air New Zealand (a United code share). Carry on’s had a 7kg weight limit. Cost me $100 to check the bag. Cost our travel partners $200. We were worried about our backpacks, but nothing was said at the gate.

Unfortunately, numbers 1, 2, and 12 don’t save a passenger money on baggage fees, but thanks for the suggestions. Here’s another goodie:

Many airlines keep their charges for skis and golf clubs low because the competition between airlines to attract revenue from this socio-economic class is fierce on several levels. 50 pound ski and golf bags are not unusual, and who cares if you don’t ski or golf?

I’m happy to say I challenged Frontier on charging me $60 at the gate for an “oversized” carryon. On boarding, there were jackets, backpacks and all sorts of stuff in the overheads I was sure nobody paid for. My bag fit with no problem. Upon request, they refunded me. Keep your receipts!

And another just to be kind: Airlines know how little the flying public will use those travel vouchers. It’s such a steady statistic, they bank on it. Always take the cash.