I think I speak for everyone when I say that getting ripped off sucks. I really can’t stand seeing people take advantage of others by making them pay more for something than they really should be paying. RELATED: How to Save Money With a Secret Third Carry-On

One way to prevent spending more money when you travel is to always pay in local currency. Rarely do I carry cash anymore, including when I travel internationally. I usually just keep a small amount of local currency for things like public transportation, farmer’s markets and mom-and-pop shops. But other than that, I use my credit cards for everything. TIP: Here are some of the best international credit cards for travel.

One way to prevent spending more money when you travel is to always pay in local currency. Rarely do I carry cash anymore, including when I travel internationally. I usually just keep a small amount of local currency for things like public transportation, farmer’s markets and mom-and-pop shops. But other than that, I use my credit cards for everything. TIP: Here are some of the best international credit cards for travel.

I always carry multiple credit cards from different banks like a Visa, a Mastercard and/or an American Express, just in case one of my cards is not accepted by a merchant or is denied. I make sure all of the cards have no foreign transaction fees so I don’t get dinged another one to three percentage points. Here’s a deep dive on credit cards with no foreign transaction fees.

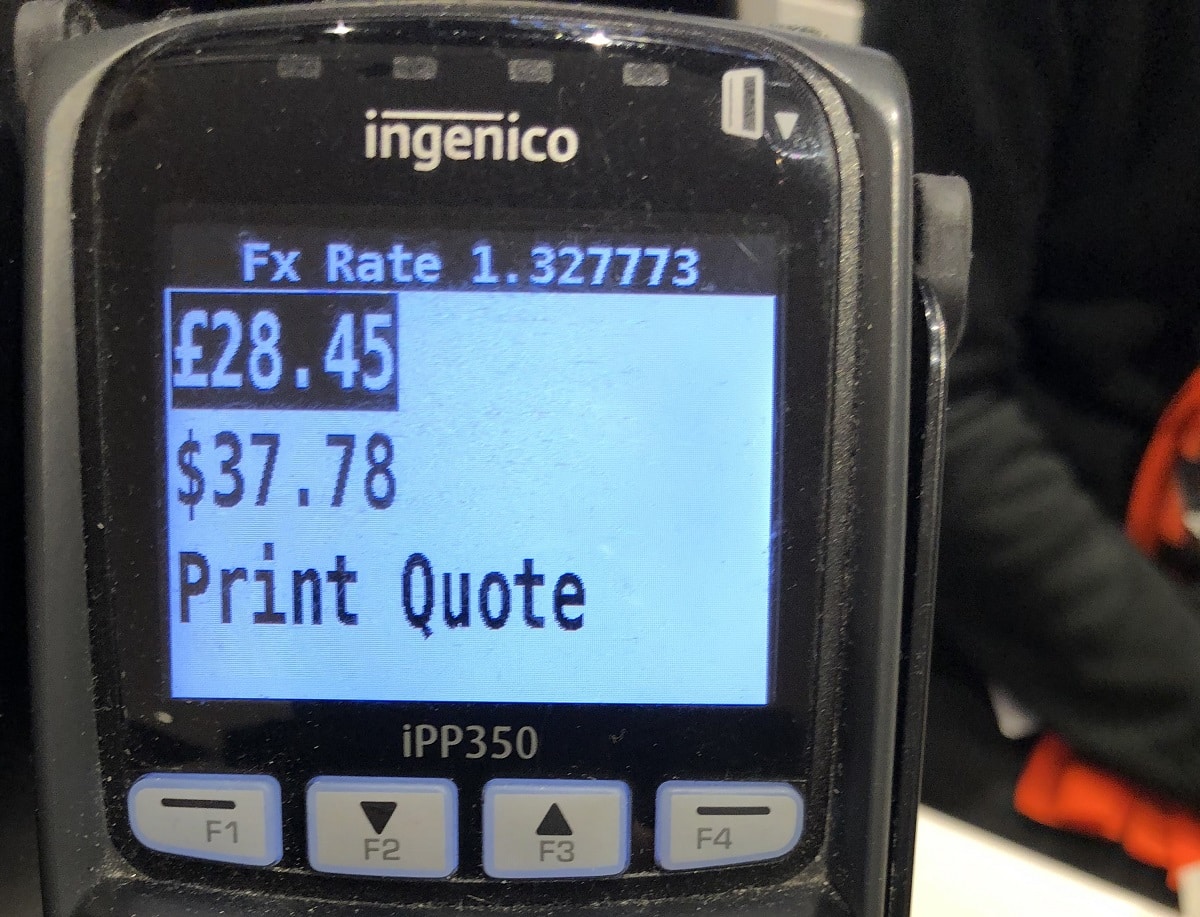

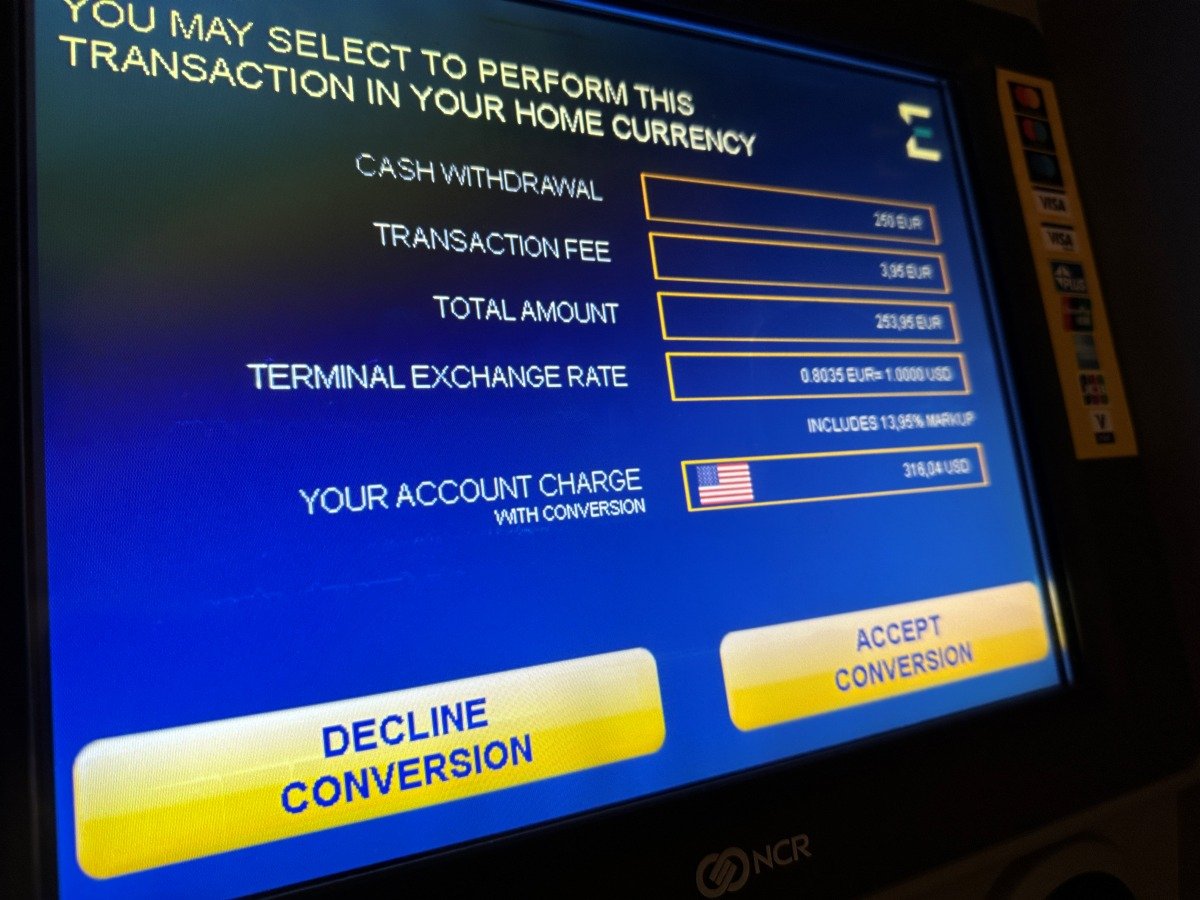

One of the tactics stores outside of the United States often use is asking customers if they would like to pay for their purchase in U.S. dollars or local currency. Paying in U.S. dollars might seem like the more convenient option, but in reality it’s not. In fact, it’s a total rip-off. The stores that do this charge a higher exchange rate than your bank back home does. So remember to always pay in the local currency of the country you’re in.

One of the tactics stores outside of the United States often use is asking customers if they would like to pay for their purchase in U.S. dollars or local currency. Paying in U.S. dollars might seem like the more convenient option, but in reality it’s not. In fact, it’s a total rip-off. The stores that do this charge a higher exchange rate than your bank back home does. So remember to always pay in the local currency of the country you’re in.

FYI: I find Harrod’s, the popular department store in London, does this every time I buy something (nothing flashy, usually just goodies from their famous Food Halls) but others do it too, including ATM’s so always be on guard.

FYI: I find Harrod’s, the popular department store in London, does this every time I buy something (nothing flashy, usually just goodies from their famous Food Halls) but others do it too, including ATM’s so always be on guard.

KEEP READING:

–12 Passport Tips That Will Save You Time, Money and Headaches

–The Most Important Thing I Do When I Travel Internationally Is …

–Rick Steves Got Pickpocketed in Paris: Here’s What He Wants You to Know

–The Most Important Thing For Travelers to Do According to a Safety Expert

–What You Need To Know About Renewing or Getting an Emergency Passport in the U.S.

Want more travel news, tips and deals? Sign up to Johnny Jet’s free newsletter and check out these popular posts: The Travel Gadget Flight Attendants Never Leave Home Without and 12 Ways to Save Money on Baggage Fees. Follow Johnny Jet on MSN, Facebook, Instagram, Pinterest, and YouTube for all of my travel posts.

Absolutely! Excellent tip. I always make sure to pay in local currency. This is called Dynamic Currency Conversion and it’s basically a money-making scheme for merchants dosguised as an excuse for them to shift processing fees to the consumer. Also, it’s a fee that the customer many never see, so say NO to this.

Totally agree with you. That’s why we always exchange money before leaving the States.

I am wondering if one’s credit is dinged if we apply for the card, get the mileage, and then cancel after the year is up? It can get expensive to have a pile of travel credit cards in your pocket with all the annual fees. I already have the AMEX Platinum with their hefty fee. Any advice on this? Thank you!

Yes, your credit will be dinged slightly, but if you pay on time and keep your payments up to date you’ll be fine and can apply for cards almost every other months (people do it every month, I only do it once or twice a year), but my conservative advice is to save it up and do 3-4 cards all on one day since that will only take one ding to your credit…

Great advice. Thank you so very much!

In addition to credit cards with no foreign transaction fee, you should also carry a debit card that doesn’t charge a foreign transaction fee for ATM withdrawals (Charles Schwab and Capital One 360 are two that I know of).

A variant of this is accepting the guaranteed rate from an ATM machine. We live in Mexico and get pesos to cover a lot of daily expenses. On an exchange that costs us roughly $500, the ever so nicely offer to guarantee roughly $560 as the exchange rate.

A Charles Schwab atm card also allows you to obtain local currency while traveling outside of the USA from a international atm with no atm fees or foreign transaction fees

Awesome! The tip to apply for 3-4 cards on one day for one ding!!! Thank you.

SoFi Money debit card also returns the fee

Don’t you mean canceling 3-4 cards on one day for one ding?

A friend who travels to numerous foreign countries contacts his local bank before the trip and orders various amounts of foreign countries. No more exchanging currencies when he arrives in the countries.

PLUS The charge still post to your Credit Card as a Foreign Transaction even though the charge is denominated in Dollars. The Credit card companies add on their “Foreign Transaction ” fee to your bill regardless of the charge being in Us Dollars. That’s a double whammy on you !

Unless you have a card that does not charge the usual 5% or so for foreign purchases. If not then get a new card for your travels that does not charge a fee for foreign transactions.

YES. But he pays about 10% for that “Convenience”. and then another 10% if he returns some of his unspent currency notes back to US dollars. Your friend is losing both coming and going. where as he could just use a debit card to get cash out of a foreign ATM at the international market exchange rate on the day he makes the withdrawal. (at least this is the case when using a VISA or MASTERCARD product per my experience ) And with no fees from his bank – if he is using a card that does not charge a fee on the currency received. or a flat fee on withdrawals, plus a fee for on the amount he draws out.

But one needs to watch that the foreign bank’s A TM fee for using their ATM is not to high. Usually is just small flat fee. So try to get enough out of the ATM to last you a while versus multiple withdrawals while your on a trip. But beware of NON BANK ATM’s !, they are a total rip offs when it comes to the exchange fees charged. USE only ATM’s that you are very sure are a real Bank’s ATM and pay attention to the fees the hopefully will display to you before you proceed to complete the transaction. Thus you need to know about what the international market exchange rate should be that day. You can do that by using an APP on your phone that reports on those rates and are refreshed about every 15 minutes during trading hours.

Some of my best ATM deals come from using a Debit card from one of my Credit Union accounts. But even Wells Fargo, N.A. does not charge me (or others as far as I know) a fee on the amount of currency withdrawn from an foreign ATM , but usually I have to pay the flat $5 ATM fee for being out of network. (plus sometimes a a local banks flat “convenience fee”, but with no fee on the amount of the transaction itself. Some customers have a relationship with their home bank where those fees are also waived.

If you’re buying foreign currency in the US, you’re also probably getting robbed. Never exchange more than what you’ll need to get you from the plane or border to the nearest bank ATM upon arrival.

Buying currency from a US bank in the US, you’ll typically get a mediocre exchange rate AND have to pay fees associated with delivering the currency to your branch. It’s a racket left over from when people actually NEEDED to have currency upon arrival. I haven’t purchased foreign currency in a US bank in 30 years.

Bank Of America ATM card in listed foreign bank ATMs have no charge/fee. Some credit unions also offer this……but ask your bank.

Excellent article. I have the Chase Saphire Preferred card and like the features which it offers. The one exception users must be aware of, that being the difference between hotel rates and cancellation policies available on the Chase Travel site versus rates from hotel sites or others. I always check rates offered by Chase Travel (Expedia) then check other sites. Many times other sites offer better rates and cancellation policies.