This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. For an explanation of our Advertising Disclosure, visit this page. The information for the American Express® Green Card has been collected independently by Johnny Jet. The card details on this page have not been reviewed or provided by the card issuer.

The long-time leader in rewards cards has been American Express. In recent years, other issuers like Chase Bank have challenged that title by introducing some of the best rewards credit cards, but, Amex still has a loyal customer base. One of the primary reasons is American Express continues to offer some of the most valuable purchase rewards in the credit card industry with the American Express Membership Rewards® points program.

- Horizon Court dessert buffet on Regal Princess. Credit: Johnny Jet

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

American Express Membership Rewards Cards: $0 Annual Fee American Express Membership Rewards Cards

Amex offers several cards that have a $0 annual fee. They do not pack the same punch as the cards that do charge an annual fee, but they still might be an option to consider as a secondary card to supplement another Amex card.

Blue Cash Everyday® Card from American Express (See Rates & Fees)

Annual fee: $0

Welcome Offer: Blue Cash Everyday® Card from American Express welcome bonus is the ability to earn a $200 statement credit after spending $2,000 in purchases on your new Card within the first 6 months.

Purchase Rewards:

- 3% cash back at U.S. supermarkets (up to $6,000 per year in purchases, then 1%)

- 3% cash back at U.S. gas stations (up to $6,000 per year in purchases, then 1%)

- Plus, 3% cash back on U.S. online retail purchases (up to $6,000 per year in purchases, then 1%)

- 1% cash back on general purchases

Cash back is received in the form of Reward Dollars that can be redeemed for statement credits.

Hilton Honors American Express Card (See Rates & Fees)

Annual fee: $0

Welcome Offer: New The Hilton Honors American Express Card cardholders can earn 80,000 Hilton Honors Bonus Points after spending $2,000 in purchases on the Card in the first 6 months of Card Membership.

Purchase Rewards: Earn 7x Hilton Honors bonus points per $1 spent on eligible purchases charged on your card directly with a hotel or resort within the Hilton Portfolio; 5x Hilton Honors bonus points for each dollar of eligible purchases on your Card at U.S. restaurants, at U.S. supermarkets, and at U.S. gas stations; 3x Hilton Honors bonus points on all other purchases

Additional Perks: Complimentary Hilton Honors Silver status

Delta SkyMiles® Blue American Express Card (See Rates & Fees)

Annual fee: $0

Welcome Offer: New Delta SkyMiles® Blue American Express Card cardholders can earn 10,000 bonus miles after spending $1,000 in purchases on their new Card in their first 6 months.

Purchase Rewards: 2x miles per dollar at restaurants worldwide, plus takeout and delivery in the U.S. Additionally, 2x miles per dollar spent on Delta purchases and 1x mile on all other eligible purchases.

Plus, you can Pay with Miles: take up to $50 off the cost of your flight for every 5,000 miles you redeem with Pay with Miles when you book on delta.com.

Additional Perks: Plus, receive a 20% savings in the form of a statement credit after using your Card on eligible Delta in-flight purchases of food and beverages.

Annual Fee American Express Membership Rewards Personal Cards

This comparison only factors in the non-branded Amex cards that earn Membership Rewards points. There are 5 different options to choose from, and are arranged in increasing order based on their annual fee (note the Blue from American Express is listed but has no annual fee). As a brief side note, keep in mind that Amex will only offer you a welcome offer “once in a lifetime” per card.

American Express® Green Card (See Rates & Fees)

Annual fee: $150

Purchase Rewards: Earn 3x Membership Rewards® points on eligible purchases at restaurants worldwide, including takeout and delivery in the US; on travel including airfare, hotels, cruises, tours, car rentals, campgrounds, and vacation rentals; on transit purchases including trains, taxicabs, rideshare services, ferries, tolls, parking, buses, and subways with the American Express® Green Card

Additional Perks: CDW Coverage

American Express® Gold Card (See Rates & Fees)

Annual fee: $250 (and there are no foreign transaction fees)

Welcome Offer: New American Express® Gold Card cardholders can earn 60,000 points after spending $6,000 on eligible purchases in the first 6 months; Also, Rose Gold is back! Cardholders can choose between Gold or Rose Gold.

Purchase Rewards: It earns 4X Membership Rewards® Points at Restaurants, plus takeout and delivery in the U.S., and earns 4X Membership Rewards® Points at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1X). Plus, earn 3X Membership Rewards® Points on flights booked directly with airlines or on amextravel.com.

The Platinum Card® from American Express (See Rates & Fees)

Annual fee: $695

Welcome Offer: New The Platinum Card® from American Express cardmembers can earn 80,000 Membership Rewards® points after spending $8,000 on purchases on their new Card in the first 6 months of Card Membership.

Purchase Rewards: Earn 5x Membership Rewards® Points for flights booked directly with airlines or with American Express Travel, up to $500,000 on these purchases per calendar year, and earn 5x Membership Rewards® Points on prepaid hotels booked with American Express Travel.

Additional Perks: Up to $200 annual airline fee credit (enrollment required), Global Lounge Access (terms apply), Global Entry or TSA PreCheck fee credit, CLEAR benefits (terms apply)

Get the full details and learn more in our in-depth The Platinum Card from American Express review.

American Express Business Cards

You might be in the position to consider applying for a business Amex instead of a personal card. If so, there are options to choose from that earn Membership Rewards. Plus, applying for a business card will not count against Chase’s 5/24 rule if you intend to apply for a personal Chase credit card in the near future.

The Blue Business® Plus Credit Card from American Express (See Rates & Fees)

Annual fee: $0

Welcome Offer: New The Blue Business® Plus Credit Card from American Express cardholders can earn 15,000 Membership Rewards® points after they spend $3,000 in eligible purchases on the Card within their first 3 months of Card Membership.

Purchase Rewards: 2X Membership Rewards® points on everyday business purchases such as office supplies or client dinners; 2X applies to the first $50,000 in purchases per year, 1 point per dollar thereafter

Additional Perks: Expanded Buying Power to use your card beyond its credit limit. The amount you can spend above your credit limit is not unlimited. It adjusts with your use of the Card, your payment history, credit record, financial resources known to American Express, and other factors.

American Express® Business Gold Card (See Rates & Fees)

Annual Fee: The annual fee is $375 (See Rates & Fees).

Welcome Offer: New American Express® Business Gold Card cardholders can earn 70,000 points after spending $10,000 on eligible purchases with the Business Gold Card within the first 3 months of Card Membership.

Purchase Rewards: The 4x points apply to your first $150,000 in combined annual spending, then 1x. Only the top two categories in each billing cycle will count towards the $150,000 cap. Categories include:

- U.S. purchases at electronic goods retailers and software & cloud system providers

- Monthly wireless telephone service charges that are made directly from a wireless telephone service provider in the U.S.

- Transit purchases including trains, taxicabs, rideshares, ferries, tolls, parking, buses, and subways

- Purchases at U.S. media providers for advertising in select media (online, TV, and radio)

- U.S. purchases at gas stations

- U.S. purchases at restaurants, including takeout and delivery

Additionally, American Express Travel purchases through amextravel.com will now earn 3x points per $1.

All annual spending above $150,000 for the bonus categories and all non-bonus spending earns an unlimited 1x point per $1.

Additional Perks: No preset spending limit giving cardholders flexibility; Unlike a traditional card with a set limit, the amount you can spend adapts based on factors such as your purchase, payment, and credit history.

The Business Platinum Card® from American Express

Annual fee: The annual fee is $695 (See Rates & Fees)

Welcome Offer: New The Business Platinum Card® from American Express cardholders can earn 150,000 Membership Rewards® points after spending $20,000 in eligible purchases on their Card within the first 3 months of Card Membership.

If you’re a big spender that wants travel rewards, you will like The Business Platinum Card® from American Express.

Purchase Rewards: 5x Membership Rewards® points on flights and prepaid hotels on amextravel.com; Use Membership Rewards® Pay with Points for all or part of a flight with your selected qualifying airline, and you can get 35% of the points back, up to 500,000 bonus points per the calendar year

Cardholders earn 1.5x Membership Rewards® points for each eligible purchase of $5,000 or more as well as 1.5x Membership Rewards® points on eligible U.S. purchases in the following select business categories (up to $2 million per calendar year):

- Construction material and hardware suppliers

- Electronic goods retailers and software & cloud system providers

- Shipping providers

The best card will largely depend on your spending habits, as each offers different purchase rewards.

- Pizza at the Royal Continental Hotel in Naples, Italy (June 2023). Credit: Johnny Jet

39 Ways to Maximize American Express Membership Rewards Points

Want travel flexibility with your rewards points? If so, you will want to accrue transferable points. American Express Membership Rewards points are some of the best points that can be transferred out to airlines and hotel loyalty partners.

Understanding how your American Express Membership Rewards points work is very important if you want to gain maximum value for the points you’ve earned, so today we’re giving you 39 ways to redeem your Amex MR points.

In addition to transferring your American Express Membership Rewards points to travel partners, you can use the traditional method of cashing them out to approved partners. Your best bet in getting the highest value, however, is to transfer your Amex Membership Rewards points to select hotels and airlines, which we will outline for you here.

Various Options for American Express Membership Rewards Points

Check out the details below for some great ways you can capitalize on your membership rewards and enjoy travel to some pretty amazing places while you do it. Also, be sure to check your American Express Membership Rewards points website where you can look for updates and details regarding bonuses and promotional offers.

When these bonuses are accessible, you can gain an even higher yield for your points. Conducting your research ahead of time will save you lots of miles and money!

Amex Membership Rewards: Hotel Transfer Partners

American Express has three hotel transfer partners. Hilton Honors currently has the highest value for your transfer points as every 1,000 Amex points = 1,500 Hilton HHonors Points. While booking a hotel with your Amex points will not yield the greatest value, it is something to consider, particularly if you don’t fly often.

Amex Membership Rewards: Airline Transfer Partners

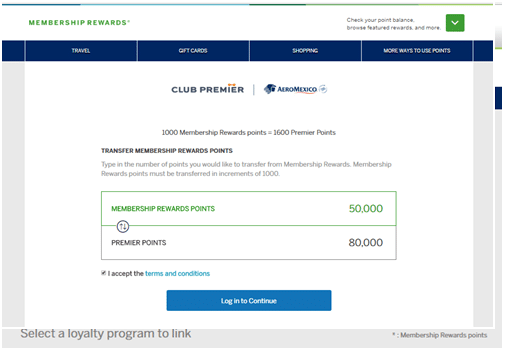

There are lots of options when transferring your Amex Membership Rewards points to their airline loyalty partners. Check back on your Amex Membership Rewards site for changes and promotions. When booking flights, you can get great value for points transfer with Aeromexico, in which case 1,000 Amex points = 1,600 Premier Points.

39 Specific Ways to Maximize American Express Membership Rewards Points

The most important thing you can do before utilizing your Amex Membership Rewards points is to do your research. Look for deals and offers online that will yield the best bang for your buck. Here we’ve listed really great options for you to take into consideration.

Of course, this is not a comprehensive compilation, as rewards programs are constantly changing and adding bonuses so their members can compete in a global market. Still, you might see some appealing offers here that you can capitalize on and get the best value for your points. Note that these offers were available at the time of writing and may since be slightly different.

1. Spend 3 nights at a Category 1 hotel with Hilton Honors.

Booking a hotel using your Amex Membership Rewards points will not provide you with as much value as a flight will. However, there are some good options to consider, especially if you have no intentions of using your points for a flight. When you transfer your membership rewards points you can get a three-night stay at a category 1 hotel for a low 5,000 points per night.

There are currently 10 options for a category 1 hotel in Turkey alone as well as some category 1 hotel options in other cities around the world.

2. Book incredible rates at hotels in Europe with Choice Hotels.

If you transfer your Amex Membership Rewards points to Choice Privileges Rewards, your transfer ratio is 1:1. This makes it incredibly easy to find great hotel redemptions in Europe, and for a good price. There are multiple options available to you through Choice Hotels including stays in Italy and Sweden that start at just 8,000 points per night.

Check back frequently for updates and offers for a stay in cities all over Europe.

3. Book AeroMexico’s Go Round The World Pass.

If you’re up for a round-the-world-trip, AeroMexico offers a sweet deal with their miles program. You can redeem 224,000 km to fly around the globe in economy class with up to 15 stopovers along your trip (there’s a five stop-limit per continent). You’ll need to keep in mind that there will be fuel surcharges when you use this award redemption, but the value of a 15-stop flight is a rare jewel these days. At a transfer ratio of 1:1.6, this is a steal.

4. Fly from the United States to Western Europe with Aeroplan.

You can snag a round-trip flight in economy class to Western Europe from the U.S. for only 60,000 miles with Air Canada. This is similarly priced as other competitors, but you’ll also be eligible for 2 stopovers when you use Aeroplan.

5. Book Aeroplan’s cheap short-haul flight on Air Canada.

Flights within Canada on Air Canada are often fairly expensive if you’re paying with cash. You can book a short-haul flight with Aeroplan rewards for just 15,000 miles round-trip. This includes flights on Air Canada Express, Air Canada, and other partners that fly domestically.

6. Use Aeroplan miles to travel with an infant child.

If you’ve traveled by plane with an infant child, you know that the cost can vary drastically between airlines. While some will only charge 10% of your ticket cost, others add additional fees and ticket costs that get quite expensive. If you fly with Air Canada for a short-haul Canada flight, you’ll only pay $125 for a first-class ticket which is 12,500 miles. As far as using your Amex Membership Rewards points, Air Canada is a better option for using your miles to travel with an infant on your lap.

7. Fly AirFrance business class when you book in advance with Delta SkyMiles.

Use your SkyMiles reward transfer to book a flight with Air France in business class. You’ll have to book at least 331 days in advance. If you opt to fly Air France to Europe from the U.S., your best bet in getting a business class seat is to book at least 306-331 days before your departure date. You can use your Delta SkyMiles® Gold American Express Card to earn and save.

8. Fly to Hawaii from the continental U.S. on Delta with AirFrance’s loyalty program.

Flying Blue is a loyalty program for Air France. You can redeem your Amex Membership Rewards points for a reasonably priced ticket from the continental U.S. to Hawaii using just 30,000 miles. When booking this round-trip flight, you’ll also have less than $10 in fees. This is an especially great deal if you’re flying from the East.

9. Enjoy AirFrance’s Flying Blue promo awards for huge savings.

Throughout the year, Flying Blue has Promo Awards that offer special pricing on flights for economy and business class tickets. These promotions range from 25% to 50% off tickets from Europe to specific cities all over the world. If you book a flight for 50% off you can fly round-trip for 25,000 miles in economy or 50,000 miles in business class. You need to keep in mind that your surcharges on flights like these have a tendency to be higher but the promo deal compensates for that, making this a great option to consider.

10. Book a flight to the Caribbean from the U.S. with Flying Blue miles.

You can save 5,000+ miles on a flight from the United States to the Caribbean when you choose Air France’s Flying Blue miles program over most American airline competitors. A round-trip flight will only cost 30,000 miles if you fly in economy class with Flying Blue.

11. Fly from the U.S. to South America with Alitalia.

If you want to travel from the U.S. to the southern part of South America, there is a great deal to consider through Alitalia. You can head to Argentina or Chile with a round-trip economy ticket that costs just 50,000 miles. Business-class seats for the same flight will cost you 75,000 miles, which is a great deal.

12. Book a trip to Europe from the U.S. with Alitalia.

Travel to Europe from the United States is fairly common, so don’t settle for an expensive ticket. Finding a good price for your ticket is easy when you transfer your Amex Membership Rewards points through Alitalia. You can fly round-trip in economy for just 50,000 miles or in business for 80,000 miles. If you’ve always wanted to eat genuine Spanish food or see the sights of Rome, this is a great way to do it!

13. Travel to Southern South America from the U.S. with All Nippon Airways.

Another great option for reasonable travel to the southern part of South America from the United States is with All Nippon Airways. While most award charts consider South America to be two regions, ANA considers it to be one region. This will save you money when booking flights to countries like Uruguay, Chile or Argentina. On a round-trip flight with United, you’d spend 60,000 miles to travel in economy, but with ANA you’d save an additional 10,000 miles for the same trip!

14. Fly All Nippon Airways round-trip to Japan.

Use your Amex Membership Rewards by transferring to ANA for a flight to Japan. In this particular instance, you can fly round-trip in business class for just 85,000 miles during peak season. Those rates go down even further during the slow season (January, February, and April). If you prefer to fly economy, you will only use 40,000 miles during the slow season and that’s 10,000 miles less than you’ll spend on flights to Japan with other partners.

15. Travel from North America to Asia Zone 1 via All Nippon Airways Mileage Club.

ANA includes China, Guam, Korea, Hong Kong, Taiwan and the Philippines in the category of “Asia Zone 1.” If you want to book a round-trip business-class ticket, you’ll only use 80,000 miles during low season. You can save even more when you fly economy and only use 45,000 miles for a round-trip flight.

16. Fly from North America to Asia Zone 2 via All Nippon Airways Mileage Club.

Asia Zone 2 includes India, Indonesia, Vietnam, Thailand, Singapore, Malaysia, and Myanmar, according to All Nippon Airways. You can also travel to Uzbekistan, Pakistan, and Kazakhstan using APA here as well. Depending on where you’re traveling to in Asia Zone 2, your fares can be quite expensive. Using your Amex Membership Rewards points might be a much better option for great value. A round-trip business class ticket will cost only 100,000 miles during the low season and nearly half that at 55,000 miles in economy.

17. Travel from the U.S. East Coast to Europe with Asia Miles.

Asia Miles gives a huge incentive to customers by offering up to four stopovers on a round-trip award ticket. If you’re flying from the United States East Coast, you could book a trip in economy class for 60,000 points round-trip. Hit multiple cities on your travels and get a great value for your miles.

18. Fly First Class from New York to Vancouver with Asia Miles.

When looking at the best options for redemption for your Amex Membership Rewards points, flying with Asia Miles is a good choice. With Asia Miles, you can get from New York to Vancouver in a first-class seat with Cathay Pacific. At only 35,000 miles each way, this is a fabulous way to affordably check out first-class and travel to an amazingly beautiful place on the planet.

Tip: it’s a better deal to transfer Chase Ultimate Rewards to British Airways Avios.

19. Book a short-haul flight with British Airways Avios.

Unfortunately, the current transfer ratio from Amex Membership Rewards points to British Airways is only a 1.25:1 ratio. While this change is less than its previous 1:1 ratio, there are still great deals to consider. Short-haul flights, for example, will cost 5,625 Amex Membership Rewards points when you’re flying less than 650 miles internationally from Dublin to London for example.

20. Go to Europe from the United States East Coast via British Airways.

Transfer your points to Avios through British Airways and book a flight from the East Coast to Europe on Air Berlin. There are a few options available that will only cost 20,000 Avios each way in economy class. This is a particularly great choice because, in addition to the low cost, Air Berlin generally has lower surcharges than many other competitors.

21. First Class flight from New York to Vancouver using British Airways Avios.

Travel in Cathay first class from JFK, New York to Vancouver for a mere 50,000 Avios each way. This is also an insane deal for you to consider if you need to travel to the Pacific Northwest. You can easily book a flight from Vancouver to Seattle and get from East Coast to West Coast on a budget.

22. Travel from Miami to Lima with British Airways.

A way to travel from Miami to Lima, Peru is via British Airway Avios with a cost of only 20,000 Amex Membership Rewards points.

23. Enjoy British Airways low fees for last-minute travel.

When you book a last-minute flight with British Airways with their Avios program, you will not incur additional fees as with some other competitors. Furthermore, if you have to cancel a flight last minute, you’ll only pay the cost of your taxes for the cancellation (up to $40). If you aren’t sure about a particular flight, or you have to make last-minute changes to your plans, British Airways is the way to go.

24. Fly to Japan from L.A. on British Airways.

If you’re headed to Tokyo from Los Angeles, California, you can snag an economy class ticket for 25,000 Avios miles via Japan Airlines. Even though the transfer from your Amex points to Avios is at a 1.25:1 ratio, this option is reasonable, especially considering that you’ll pay less than $40 in taxes for this flight.

25. Use Delta’s SkyMiles to fly Chinese airlines in renowned business class.

Using Delta’s SkyMiles you have the option to book a China Eastern or China Airlines flight in business class. These airlines have well-recognized business class options and in the case of transferring your Amex Membership Rewards points, they are reasonably priced. For either airline, you can use 80,000 SkyMiles one way for your business class ticket. As long as there is availability to your desired destination, China Eastern would be the finer choice but in the long run, both are good selections.

26. Book low-mileage flights within the U.S. using Delta’s SkyMiles program.

Amex charges a minimal fee of 0.06 cents per point to transfer your Membership Rewards points to Delta’s SkyMiles program. There is a maximum charge of $99 for a U.S. domestic airline. Even with this consideration, Delta offers great selections for short flights within the continental United States.

Depending on availability, you could find a flight for as low as 5,000 SkyMiles on specific flights. You’ll want to check Delta’s pricing before booking your flight, as the cost of redemption for SkyMiles can change closer to the departure date.

27. Snag a crazy cheap flight to Europe with Etihad Airways.

Brussels Airlines is a partner of Etihad Airways and offers insanely inexpensive flights to Europe. A round-trip flight from New York to Brussels, for example, will only cost you 36,625 miles in business class. You heard that right! As you can imagine, these deals are often difficult to find. If there is availability, this is a top-of-the-line savings to check out.

28. Travel with an infant on Etihad.

In addition to really sweet deals on Brussels Airlines, Etihad charges a mere 10% of the mileage cost for your infant to travel with you on your lap. Especially on low-cost flights economy and business class tickets, you can travel with your small child for a very low cost. That business class ticket from New York to Brussels would only cost you 3,663 miles for your infant ticket!

- Honolulu to LAX on Hawaiian Airlines (March 9, 2022). Credit: Johnny Jet

29. Hop over to Hawaii from North America with Hawaiian Airlines.

Since Hawaiian Airlines offers a 1:1 transfer ratio from your Amex Membership Rewards points, you can get a great deal on a flight. Flying from North America to Hawaii will only cost you 20,000 miles one-way with the Coach SuperSaver award. You can also upgrade your flight to the First Class Saver award if you call reservations at least 26 hours before your flight departure. Snag this deal for only 25,000 miles and have points left over for your hotel expenses while you’re there!

30. Fly in top-rated suites with Singapore Airlines.

The Singapore KrisFlyer miles program is an incredible transfer opportunity for your Amex membership rewards points. Singapore Airlines Suites tickets are world-famous for their first-class luxury. Suites feature a luxury double bed among other options and are relatively affordable in comparison to their counterparts. There are first-class suite tickets available as low as 25,000 miles. Check out their award chart for other options and details.

31. Travel on Singapore Airlines between the continental U.S. and Hawaii.

Another great option with Singapore Airlines is to redeem your KrisFlyer miles for a flight between the continental United States and Hawaii. You have the option to fly all classes of service on Star Alliance Airlines. Prices for a one-way trip range between 17,500 miles and 40,000 miles.

32. Book an economy ticket on Star Alliance Airlines from Europe to the U.S. using KrisFlyer miles.

You can book a flight from the United States to Europe for just 27,500 miles one-way on a Star Alliance member airline. This is a savings of 2,500 miles in comparison with other competitors in the U.S. like Delta and American. All of these savings really add up and make this a deal worth exploring!

33. Fly to the Middle East or Northern Africa from the U.S. on Singapore Airlines.

If you’re traveling from the United States to either the Middle East or North Africa, Singapore Airlines offers awesome prices. Your Amex membership rewards can be transferred for KrisFlyer Miles on Star Alliance airlines, which includes EgyptAir, Ethiopian, Lufthansa, Swiss, and United. You can travel for 37,500 miles in economy, 57,500 miles in business, or 75,000 miles in first class (one-way).

34. Fly Singapore Airlines from the United States to Africa with KrisFlyer Miles.

When you want to head to Central or South Africa, consider flying with Singapore Airlines. Using your KrisFlyer transfer miles, you’ll pay 72,500 each way for a business class ticket. This is a great saving in comparison to United’s cost of 80,000 miles each way for the same ticket with a Star Alliance partner flight.

35. Use KrisFlyer Miles to travel from Virgin America to Europe.

When using KrisFlyer Miles through Singapore Airlines, another option is to fly via Virgin America to Europe. This will cost even less than a Star Alliance flight. Take a trip to Europe in Virgin Atlantic Upper Class for a mere 100,000 miles round-trip! The availability on these flights is generally good and you’re guaranteed to save thousands of miles taking this route.

36. Fly First Class On Lufthansa to Europe with Singapore Airlines.

If you’ve been interested in flying Lufthansa First Class, this is the best way to do it. You will have some surcharges of around 400 Euro, but even so, your overall cost is very competitive in the current market. With your Singapore Airlines’ KrisFlyer Miles, you’ll pay around 160,000 miles to fly round-trip.

37. Fly to Dubai from the U.S. with Virgin Atlantic.

At a 1:1 transfer ratio, booking a flight with Virgin Atlantic’s Flying Club is another great travel option. For an economy class ticket, you’ll spend just 73,500 miles for a round-trip ticket from Boston, Chicago, or Washington D.C. to Dubai. Whether you’re booking a flight for business, or just to enjoy the luxury shopping, modern architecture, and incredible food, it’s a flight worth considering.

38. Head to London from Atlanta using Virgin Atlantic’s Flying Club miles.

This is a trip worth taking, especially if you’re down with flying in economy class. At a low cost of only 35,000 miles, you can travel round-trip in economy class from Atlanta to London. That’s an incredible steal. A premium economy ticket will set you back 55,000 miles for the same trip but is still a great choice to think about. Keep in mind, there may be carrier-imposed surcharges or other taxes and fees to budget for as well.

39. Use Virgin Atlantic’s Flying Club miles to travel to India from New York.

A one-way ticket from New York to Delhi will cost a low 38,750 miles in economy class. This is a really affordable option that won’t set you back 40,000+ miles in your Membership Rewards points. Be sure to calculate your taxes and fees before booking your flight to get a better idea of the total ticket cost.

- New York’s JFK Airport. Credit: Johnny Jet

Frequently Asked Questions About American Express Membership Rewards

What is the American Express Membership Rewards points program?

American Express provides its cardholders with an incentive program called Membership Rewards. Each time you use your card for approved purchases, you earn rewards that can be cashed in for gift cards, shopping, travel, entertainment, and more. Through this program, you can use your points by making purchases on the Amex website, or you can opt to transfer your points to approved partners. In the case of your Amex card, the highest value of redemption is on airlines and hotels via partner redemption options.

How do I sign up for American Express Membership Rewards?

Once you’ve been approved for an Amex card, you are automatically enrolled in the Membership Rewards program. Many cards provide a welcome bonus or limited-time offer once you are approved and meet the conditions. You begin to accumulate additional points as soon as you use your card. See the terms and conditions for each specific card for details regarding how to earn extra points on your daily purchases.

Can I easily check my Membership Rewards account?

After you create a unique username and password for your American Express card account, you can log in easily to check the status of your Membership Rewards points. The Point Summary will show you how many points you have earned and are eligible to redeem.

Do my American Express Membership Rewards points expire?

Your American Express Membership Rewards points have no expiration date as long as your card is active. However, you do need to carefully read the program terms, as they may be forfeited as described.

What are Amex Membership Rewards pending points?

Each month you will earn points as you spend money with your card. Before the end of the billing cycle, points will show on your statement as pending. When a full billing cycle has ended and you pay your bill, they will become redeemable points in your account.

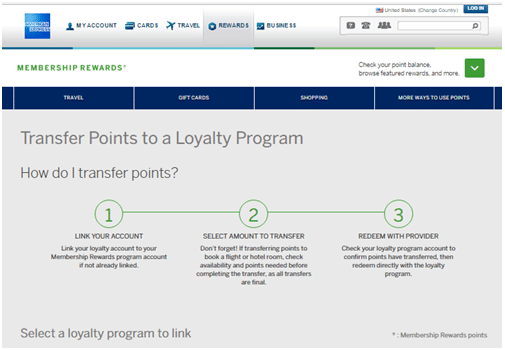

How do I transfer American Express Membership Rewards points to approved partners?

Visit your American Express Membership Rewards website to transfer your points to a loyalty program. Click the Get Started link under the Transfer Points tab.

Visit your membership rewards website to transfer points to an approved partner. You’ll be redirected to the page where you can select your preferred method of transfer. Scroll down to the hotel or airline of your choice and click on the link provided.

Select your preferred method of points transfer and redeem with an approved provider. When you arrive at the page for your transfer, you’ll need to enter in the amount of Amex Membership Rewards points you’d like to transfer. Your redeemable transfer points will show up in the box below. You’ll need to read and accept the terms and conditions before logging in to continue the process.

Log in to transfer your Membership Rewards points. Once you’ve logged in and transferred your points, be aware that you cannot reverse the decision. Carefully look over your selection to make sure it is correct before submitting the request. Also, be sure to check back frequently for available offers that will get you, even more, bang for your buck. Promotions will be added throughout the year and may provide you with an incredible deal that you just can’t pass up.

Visit London and other cities throughout Europe for a fraction of the ticket price when you transfer your Amex Membership Rewards points.

Summary of the Guide to American Express Membership Rewards

In conclusion, there are plenty of ways to earn American Express Membership Rewards. The American Express® Gold Card is great for earning those valuable Membership Rewards Points and is just one example of the various options consumers have. Whether you want to earn for supermarket purchases or need a business card or prefer cash back, there are many choices available.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/

For rates and fees of The Blue Business® Plus Credit Card from American Express, please click here.

For rates and fees of the American Express® Business Gold Card, please click here.

And For rates and fees of The Business Platinum Card® from American Express, please click here.