This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. For an explanation of our Advertising Disclosure, visit this page. Johnny Jet has partnered with CardRatings for our coverage of credit card products. Johnny Jet and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities.

When planning an international trip, it’s important to balance your desire for an enjoyable trip with your need to save money. One tip I personally recommend is to use a credit card that doesn’t charge foreign transaction fees. This can help you save money on every purchase you make while abroad. Moreover, some of the top international credit cards offer additional perks like no fees for checked bags, free hotel nights, and access to travel transfer partners. Additionally, many of these cards come with smart chip contactless technology, which can provide added security while you’re traveling.

Tip: I’ve used the Chase Sapphire Preferred® Card for many of my own international trips since it earns valuable transferrable rewards, has many spending perks, and has a nice 60,000 point bonus: Chase Sapphire Preferred® Card

Here are some of the best credit cards for international travel to consider for 2024.

What are the Best Credit Cards for International Travel in 2024?

- Best flexibility: Chase Sapphire Preferred® Card – $750 Award Travel Bonus

- 75k bonus and at least 2x Rewards on Everything: Capital One Venture Rewards Credit Card

- The biggest Travel Perks: Chase Sapphire Reserve® – Lounge access, $300 annual travel credit

- Best Premium International Card: The Platinum Card® from American Express

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Top International Travel Credit Cards Table

| Credit Card | Category | Annual Fee | Recommended Credit Score | More Information |

|---|---|---|---|---|

| Citi Premier® Card | Travel Credit Card | $95 | 700+ | More Info |

| Chase Sapphire Preferred® Card | Travel Credit Card | $95 | 700 | More Info |

| Capital One Venture Rewards Credit Card | Travel Credit Card | $95 | 700 | More Info |

| Chase Sapphire Reserve® | Travel Credit Card | $550 | 780 | More Info |

| The Platinum Card® from American Express | Travel Credit Card | $695 (See Rates & Fees) | 700+ | More Info |

| British Airways Visa Signature® Card | Airline Credit Card | $95 | 700+ | More Info |

| Marriott Bonvoy Brilliant® American Express® Card | Hotel Credit Card | $650 (See Rates & Fees) | 690+ | More Info |

| Ink Business Preferred® Credit Card | Business Credit Card | $95 | 700+ | More Info |

| Chase Ink Business Cash® Credit Card | Business Credit Card | None! | 700+ | More Info |

What is the Most Accepted Credit Card for International Travel

For near-universal acceptance, choose a Visa or Mastercard international credit card product. But, you might decide to also travel with an American Express product to enjoy upscale travel benefits that other credit cards struggle to offer. These are the most accepted credit cards for international travel. The best credit cards for international travel in 2024 go beyond just having no foreign transaction fees and chip technology. They give points/miles and benefits!

Chase Sapphire Preferred Card – The Best International Credit Card

Arguably the best travel rewards card is the Chase Sapphire Preferred. The Chase Sapphire Preferred review shows how the signup bonus can be maximized. I’ve held the Sapphire Preferred in my wallet for over 10 years.

New Chase Sapphire Preferred® Card cardholders can earn 60,000 bonus points after spending $4,000 on purchases in the first 3 months from account opening. That’s $750 when redeemed through Chase Ultimate Rewards®. Member FDIC

You will also earn 5x points on travel purchased through Chase Ultimate Rewards®, 3x points on dining, and 2x points on all other travel purchases, plus more, making it a great option for purchasing airline flight tickets.

Also, enjoy Chase Sapphire benefits such as a $50 annual Ultimate Rewards Hotel Credit.

Chase Sapphire Preferred Travel Redemption Bonus

But the real value for the Chase Sapphire Preferred Card and what makes it the best international credit card lies in its two valuable travel redemption options:

- 25% travel redemption bonus

- 1:1 point transfers to airline and hotel loyalty programs

The 25% redemption bonus applies to any award travel you book on the Ultimate Rewards travel portal. Having each point worth 1.25 cents each is awesome, but you might find more value in the 1:1 point transfers.

Some of the international 1:1 transfer partners include United Airlines, British Airways, Aer Lingus, and Singapore Airlines. You might transfer your points to British Airways to intra-Europe award flights that start at 4,500 Avios. Or you can fly United or Aer Lingus to avoid the fuel surcharges that most global airlines charge all passengers.

The Chase Sapphire Preferred Card also has a budget-friendly $95 annual fee and earns extremely valuable Chase Ultimate Rewards points. Here is the credit score you will need for the Chase Sapphire Preferred.

While there is a $95 annual fee, there are no foreign transaction fees.

Capital One Venture Rewards Credit Card – 2x Miles on All Purchases

The Capital One Venture Rewards Credit Card has always been one of the best cards for international travel, but you have three more reasons to use this card on your next world tour:

- Global Entry or TSA PreCheck application fee credit

- Airline and hotel transfer partners

- Earn unlimited 2x miles on every purchase, worldwide

- 5x miles on hotels and rental cars booked through Capital One Travel

You can transfer your miles to several leading travel partners and also redeem your Capital One miles for travel statement credits or future award travel. You may also be able to visit the new Capital One airport lounges.

Similar to the Chase Sapphire Preferred, there is a $95 annual fee but no foreign transaction fees. You may want to visit our comparison of the Chase Sapphire Preferred vs. Capital One Venture Rewards for a deeper dive into which card is better suited for your lifestyle.

Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel, with the Capital One Venture Rewards Credit Card.

Chase Sapphire Reserve – $300 Annual Travel Credit, Lounge Access

When you want to earn Chase Ultimate Rewards points but want a few premium international travel credit card perks, get the Chase Sapphire Reserve®. It has a $550 annual fee (vs. $95 for the Sapphire Preferred), but these Sapphire Reserve perks can help offset the cost of owning a premium rewards card:

- $300 annual travel credit

- Complimentary Priority Pass Select membership

- Global Entry or TSA PreCheck fee credit

Plus, earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

Chase Sapphire Reserve Travel Redemption Bonus

Like the Sapphire Reserve’s sister card, you can also enjoy a travel redemption bonus with Chase Travel℠. However, instead of 25% (that you enjoy with the Preferred), cardholders can enjoy a 50% travel redemption bonus. Chase Sapphire Reserve cardholders also can maximize their cards with the 1:1 point transfers to airline and hotel loyalty programs.

New Chase Sapphire Reserve® cardholders can earn 60,000 bonus points after spending $4,000 on purchases in the first 3 months from account opening. That’s $900 toward travel when redeemed through Chase Travel℠.

Of course, there are no foreign transaction fees on the Sapphire Reserve. Here’s how the Chase Sapphire Reserve and Chase Sapphire Preferred compare.

The Platinum Card from American Express – The Best Premium International Travel Card

The Platinum Card® from American Express provides an impressive array of air travel perks including up to $200 annually in air travel statement credits for incidental fees at one qualifying airline (in the form of a statement credit; enrollment required), fee credit for TSA PreCheck or Global Entry, and access to several lounge networks like The Centurion and Priority Pass (enrollment required).

Cardholders earn 5x Membership Rewards® Points for flights booked directly with airlines or with American Express Travel, up to $500,000 on these purchases per calendar year, and earn 5x Membership Rewards® points on prepaid hotels booked with American Express Travel.

Cardholders can get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings with American Express Travel when they pay with the Platinum Card®. The Hotel Collection requires a minimum two-night stay.

Also, select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Card.

Plus, American Express has expanded The Centurion® Network to include 40+ Centurion Lounge and Studio locations worldwide. Now there are even more places your Platinum Card® can get you complimentary entry and exclusive perks.

Related: Chase Sapphire Preferred vs. American Express Platinum

The Platinum Card from American Express Benefits

There’s also a digital entertainment credit, making this card one of the best for streaming services. Cardholders can get up to $20 in statement credits each month when they pay for eligible purchases with the Platinum Card®. Enrollment required.

In addition to enjoying TSA PreCheck or Global Entry access, cardholders can also enjoy CLEAR perks. Breeze through security with CLEAR Plus at 100+ airports, stadiums, and entertainment venues nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Platinum Card®.

Another exciting benefit is the ability for cardholders to get up to $300 back each year in the form of statement credits on an Equinox+ subscription or any Equinox club membership when they pay with their Platinum Card. Enrollment required.

Plus, get a $155 Walmart+ credit, which covers the cost of a $12.95 monthly Walmart+ membership with a statement credit after you pay for Walmart+ each month with your Platinum Card. The cost includes $12.95 plus applicable local sales tax.

Get the full details and learn more in our in-depth The Platinum Card from American Express review.

The annual fee is $695 (See Rates & Fees) but can be offset with the perks, which are valued at over $1,400.

This is one of the best miles cards.

Related: Is the Amex Platinum Card Worth the Annual Fee?

Travel with the Amex Platinum

Your points are worth one cent each when booking award flights on Amex Travel. But you will probably find more value in the 1:1 airline transfer partners that offer many international award flight options. Some of the international transfer partners are:

- Aer Lingus

- ANA

- Asia Miles

- Avianca Lifemiles

- Emirates

- Etihad

- Singapore Airlines

With this lineup, it’s possible to book award flights to any part of the world. Here’s the credit score needed for the Amex Platinum.

Amex Platinum Welcome Bonus Offer

New The Platinum Card® from American Express cardmembers can earn 80,000 Membership Rewards® points after spending $8,000 on purchases on their new Card in the first 6 months of Card Membership.

The annual fee is $695 (See Rates & Fees) but can be offset with the perks, which are valued at over $1,400.

British Airways Visa Signature Card – The Best Airline Credit Card for International Travel

When flying to Europe, the British Airways Visa Signature® Card can help you book short-haul flights or TransAtlantic flights sooner.

For a limited time, new British Airways Visa Signature® Card cardholders can earn 75,000 Avios after spending $5,000 on purchases within the first three months of account opening. Plus, they earn 5x Avios on up to $10k in gas, grocery stores, and dining purchases for the first 12 months!

Cardholders earn 3 Avios per $1 spent on purchases with British Airways, Aer Lingus, Iberia, and LEVEL. Cardholders also earn 2 Avios per $1 spent on hotel accommodations when purchased directly with the hotel. Plus, earn 1 Avios per $1 spent on all other purchases.

The British Airways Visa Signature Card has a $95 annual fee but doesn’t charge a foreign transaction fee.

Spending $30,000 annually also gives you the Travel Together ticket. You only pay the fees and taxes for your travel companion’s seat when you use Avios to buy a roundtrip ticket that originates and returns within the United States.

Aeroplan Credit Card – Great for Travel With Air Canada

The Aeroplan® Credit Card is a co-brand Air Canada card with Chase. Along with a free first checked bag, this card also comes with a 24/7 concierge. Additionally, cardholders can get a fee credit for Global Entry or TSA PreCheck®, or NEXUS.

This card earns:

- 3x points on grocery stores

- 3x points on dining at restaurants

- and 3x points on purchases made directly with Air Canada

All other purchases earn 1x point per $1 spent.

Plus, cardholders can earn an additional 500 bonus points for every $2,000 spent in a calendar month (up to 1,500 points per month).

Other benefits include complimentary Aeroplan 25K Status as a new card member, for the remainder of the calendar year plus the following calendar year.

New Aeroplan® Credit Card cardholders can earn 60,000 bonus points after spending $3,000 on purchases in the first 3 months of account opening.

The annual fee is $95 and there are no foreign transaction fees.

Related: Aeroplan Credit Card Review

Marriott Bonvoy Brilliant American Express Card – Perfect for Frequent Marriott Loyalists

This freshly rebranded premium international hotel credit card can be used to book your airfare and hotel rooms. The Marriott Bonvoy Brilliant® American Express® Card earns:

- 6x points for each dollar of eligible purchases at hotels participating in the Marriott Bonvoy program

- 3x points at restaurants worldwide

- 3x points on flights booked directly with airlines

- 2x points on all other eligible purchases

Each card renewal year, get up to $300 in statement credits per calendar year (up to $25 per month) for eligible purchases at restaurants worldwide.

Other featured benefits include 1 Free Night Award (redemption level at or under 85,000 points) annually after your card renewal month at participating Marriott Bonvoy properties (some hotels have resort fees), up to $100 property credit for qualifying charges at The Ritz-Carlton® or St. Regis® when you book direct using a special rate for a two-night minimum stay using your Card, and complimentary Priority Pass Select airport lounge access.

Additionally, cardholders can enjoy a fee credit for TSA PreCheck or Global Entry, up to $800 in cellphone protection, and 25 Elite Night Credits toward the next level of Marriott Bonvoy Elite status (terms apply).

Marriott Bonvoy Platinum Elite members earn 50% more points on eligible purchases at participating hotels for each U.S. dollar (or the currency equivalent) that is incurred and paid for by the member.

Each calendar year after spending $60,000 on eligible purchases, Card Members are eligible to select an Earned Choice Award benefit. You can only earn one Earned Choice Award per calendar year. See https://www.choice-benefit.marriott.com/brilliant for Award options.

Marriott Bonvoy Brilliant Welcome Bonus

New Marriott Bonvoy Brilliant® American Express® Card cardholders earn 185,000 Marriott Bonvoy bonus points after spending $6,000 in purchases within the first 6 months of Card Membership.

Although this card has a $650 annual fee and no foreign transaction fees (See Rates & Fees), it has plenty of benefits that are worth a lot more.

Citi Premier Card: Earn Rewards At Home and When Traveling

The information for the Citi Premier® Card has been collected independently by Johnny Jet. The card details on this page have not been reviewed or provided by the card issuer.

For many people, international travel only happens every so often. Because of this, having a card that earns while traveling but also when going about your day-to-day life is ideal. Enter the Citi Premier® Card. I’ve had the Citi Premier card and used its ThankYou points for a trip to Italy.

The Citi Premier Card earns:

- 3 Points per $1 spent at Restaurants and Supermarkets

- 3 Points per $1 spent at Gas Stations, Air Travel, and Hotels

- 1 Point per $1 spent on all other purchases

You can transfer your points to several top airline partners, including Emirates, Air France, JetBlue, and Singapore Airlines.

Our Citi Premier review also details how this card comes with an annual hotel savings benefit. Cardholders can enjoy $100 off a single hotel stay of $500 or more (excluding taxes and fees) booked through thankyou.com, once annually.

This card is also a World Elite Mastercard, which gives cardholders perks like discounts and protection on relevant purchases.

New Citi Premier® Card cardmembers can earn 60,000 bonus ThankYou® Points after spending $4,000 in purchases within the first 3 months of account opening. This bonus is redeemable for $600 in gift cards or travel rewards when redeemed at thankyou.com. Plus, for a limited time, earn a total of 10 ThankYou® Points per $1 spent on hotel, car rentals, and attractions (excluding air travel) booked on the Citi Travel℠ portal through June 30, 2024.

With the free CardMatch™ tool, you can see what credit cards you have the best approval chances of, including with the Citi Premier Card. You may also get the chance to earn a higher welcome/signup bonus than what is being offered to the general public.

The Premier has a $95 annual fee but a $0 foreign transaction fee.

Related: Citi Premier vs. Capital One Venture Rewards

What is the Best Credit Card to Use While Traveling?

The best best credit cards to use while traveling will charge no foreign transaction fees, have chip technology, and safety measures, and earn you valuable travel rewards.

- Best flexibility: Chase Sapphire Preferred® Card – $750 Award Travel Bonus

- At least 2x Rewards on Everything: Capital One Venture Rewards Credit Card

- The biggest Travel Perks: Chase Sapphire Reserve® – Lounge access, $300 annual travel credit

- Best Premium International Card: The Platinum Card® from American Express

Whether you want cash or travel rewards, one of these small business credit cards for travel can be a perfect fit for your business.

Despite being business credit cards, only try for them if you don’t have at least 5 new credit cards in the last 24 months to stay below the “Chase 5/24 rule.” You will also need a 740 credit score to qualify for these cards.

Chase Ink Business Preferred Credit Card – 100k Bonus

The Ink Business Preferred® Credit Card earns 3x points on the first $150,000 spent in combined purchases on travel, shipping purchases, internet, cable, and phone services, and on advertising purchases made with social media sites and search engines each account anniversary year. All other purchases earn 1 point per $1 spent.

The business version of the Chase Sapphire Preferred, with the Ink Business Preferred Credit Card, your points are worth 25% more when redeemed for travel and can be transferred to the 1:1 Chase transfer partners. Points do not expire as long as your account is open.

The annual fee is $95 and no foreign transaction fee.

New Ink Business Preferred® Credit Card cardholders can earn 100k bonus points after spending $8,000 on purchases in the first 3 months from account opening. That’s $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠.

This is one of the best Chase Business credit cards.

Chase Ink Business Cash Credit Card – $0 Annual Fee

If you don’t want to pay an annual fee, the Chase Ink Business Cash® Credit Card offers 5% back (on the first $25,000 in combined spending) office supply store, internet, phone, and cable services. You get 2% back (on the first $25,000 in combined spending) at gas stations and restaurants. All remaining purchases earn an unlimited 1% back.

Each point is worth 1 cent each when redeemed for travel, cash, and gift cards.

New Ink Business Cash® Credit Card cardholders can earn up to a $750 bonus cash back! Earn $350 after spending $3,000 on purchases in the first three months from account opening. Then, earn an additional $400 after spending $6,000 on purchases in the first six months after account opening.

Capital One Spark Miles for Business – 2x Miles

The Capital One Spark Miles for Business is a top choice in the corporate credit card world due to its many extras. New card applicants can take advantage of the ability to earn 50,000 miles after spending $4,500 in the first 3 months of account opening.

Cardholders also earn an unlimited 2x miles earned per dollar spent, everywhere. They also earn 5x miles on hotels and car rentals booked through Capital One Travel. There are no foreign transaction fees and cardholders receive up to $100 statement credit for one Global Entry or TSA PreCheck application fee.

Related Articles:

- Best Business Credit Cards and Business Checking Account Combos

- Best No Annual Fee Business Cards for 2024

- The Best Credit Card Offers

What Credit Cards are Best to Use Internationally?

While free travel is great—it also makes sense to consider your own hotel and airline brand preference and hotel price preference. You want to make sure that you’re choosing a credit card that makes sense for your own personal spending habits and travel needs. A premium travel credit card may not make sense if you’re typically a budget traveler.

It’s also important to take a look at the point system that is in place. Are you going to get a good return on the points that you earn? Finally, don’t forget to look at fees and other costs, like the card’s APR (in case you ever carry a balance). You want to make sure that you’re getting great value with the card of your choosing.

The Best Loyalty Programs For Lounge Access for International Travel

Airport lounges can differ in quality and amenities, but nearly all of them offer one primary perk — a getaway from the crazy hubbub of the airport and a quiet respite for a little bit of relaxation or possibly some work. However, accessing airport lounges can be pricey, especially if you don’t have the right credit card. Which international credit cards are best for your flying habits and lounge preferences?

American Express Membership Rewards

The American Express Membership Rewards program comes with a variety of international credit cards. But, there’s one in particular that you’ll want if you’re a member of this loyalty program.

Things to Know about The Platinum Card from American Express

The Platinum Card® from American Express offers some great benefits. However, the annual fee is $695 (See Rates & Fees) but can be offset with the perks, which are valued at over $1,400.

Don’t take this annual fee at face value, though. The international card comes with lots of credits and fee waivers that, if taken into consideration, reduce the fee nominally. For example, you’ll receive up to $200 for airline fees (in the form of a statement credit; enrollment required), a $100 statement credit for purchases at Saks Fifth Avenue (enrollment required), and a $100 statement credit for Global Entry or TSA PreCheck.

In addition to enjoying TSA PreCheck or Global Entry access, cardholders can also enjoy CLEAR perks. Cardholders can use their Card and get up to $189 back per year on their CLEAR® membership. Terms apply.

If you take full advantage of all of the above, that more than covers the annual fee.

The Platinum Card and Lounge Access

But what about the lounge access? The Platinum Card from American Express gives you access to its own American Express Centurion Lounges. You will also get access to Delta Sky Clubs when you’re traveling with Delta. How do you know if both of those are a good fit for you?

Plus, American Express has expanded The Centurion® Network to include 40+ Centurion Lounge and Studio locations worldwide. Now there are even more places your Platinum Card® can get you complimentary entry and exclusive perks.

If you fly Delta frequently but do not have a Delta co-branded credit card that allows you Sky Club access, this might be an appealing option. The Centurion Lounges are quickly becoming the crème de la crème of airport lounges. But, they are in limited airports thus far.

Hilton Honors

For example, The Hilton Honors American Express Business Card gives you a complimentary Priority Pass membership (enrollment required). But only 10 visits per year are free. This will be used up quickly if you fly frequently.

Another perk includes Hilton Honors Gold status.

Cardholders earn Hilton Honors bonus points for each dollar of eligible purchases on their Card:

- 12x Hilton Honors Bonus Points on eligible Hilton purchases.

- 5x Hilton Honors Bonus Points on other purchases made using the Hilton Honors Business Card on the first $100,000 in purchases each calendar year, 3X points thereafter.

- 3x on all other eligible purchases

Additionally, enjoy up to $240 back each year for eligible purchases made directly with Hilton.

New The Hilton Honors American Express Business Card cardholders earn 175,000 Hilton Honors Bonus Points after spending $8,000 in purchases within the first 6 months of Card Membership. Offer Ends 6/5.

There is a $195 annual fee (See Rates & Fees).

United Explorer Card – Airline International Credit Card for United

What if you’re not a frequent traveler, but you want to visit a lounge on occasion when you do fly? If that’s the case, the United℠ Explorer Card may be a good fit. The United Explorer Card grants you access twice each year to a United Lounge. This is convenient, mainly because most airports have a United lounge and are serviced by United.

This means if you’re not a frequent traveler, it won’t impact you much to start flying United and take advantage of the lounges. If you only fly a handful of times per year, the likelihood of you having multiple long layovers to really enjoy a lounge is slim. You won’t feel like you’re wasting your two passes when you do use them.

In addition, United lounges are often above and beyond satisfactory, with free dining, drinks, WiFi, and plenty of space and privacy. You might want to compare this to the other United credit cards.

How to Expedite a Pending International Credit Card Decision

Okay, so you’re ready to try for your international credit card, but you have a pending decision. Here’s how you can expedite your approval. Most banks provide instant decisions when you try for a new credit card. But, there are times when your application requires further review.

While you can impatiently wait for the bank to manually review your application, there are ways you can speed up a pending credit card decision. Let’s review how.

Why You Might Have a Pending Travel Credit Card Decision

Reading the words “Your application is pending further review” is frustrating. In most cases, the bank will also go on to state that it can take seven to ten days to reach a final decision. After that, it can still be another five business days before your new card arrives in the mail.

Pending credit decisions cause more delay than you think. This can be especially frustrating if you need a card ASAP because you’re hoping to qualify for a signup bonus.

Every credit card company has its own approval criteria. By no means is this list all-encompassing. However, these are a few common reasons why your application is pending.

Too Many Recent Credit Card Applications

If you’re a travel rewards junkie, you most likely have several credit cards in your wallet. It is recommended that you keep tabs on how many applications you have in the most recent 24 months. After 24 months, the credit card inquiry drops off your credit report.

Usually, if the bank decides you have too many recent applications, your application gets declined. The only thing you can do is wait until your hard inquiry count drops. These are two of the bank rules you should know about:

- Chase: The “Chase 5/24 Rule” is the most well-known rule. If you apply for at least 5 credit cards in the last 24 months, your application for select Chase cards is declined. Being listed as an authorized user counts as one of the 5 applications too. And, it doesn’t matter which bank is offering the credit card. Some of the cards subject to the 5/24 rule include the Sapphire Reserve and Preferred application rules, Ink Business Preferred, and some of the co-brand credit cards.

- Bank of America: The BofA has a”2/3/4 rule.” You can’t apply for more than 2 BofA credit cards every 2 months. You also can’t apply for more than 3 cards in a year or 4 cards in two years.

Must Verify Your Identity or Income

Other banks want to review your identity and income to prevent credit fraud. In most cases, you can clarify this information with a phone call or by submitting an additional online form. In extreme cases, you may have to mail a copy of your tax return to prove your income or other official documents.

One example can be applying for a premium income with a relatively low income or net worth. Another example is if you’re self-employed (which makes any credit card or loan application slightly more difficult).

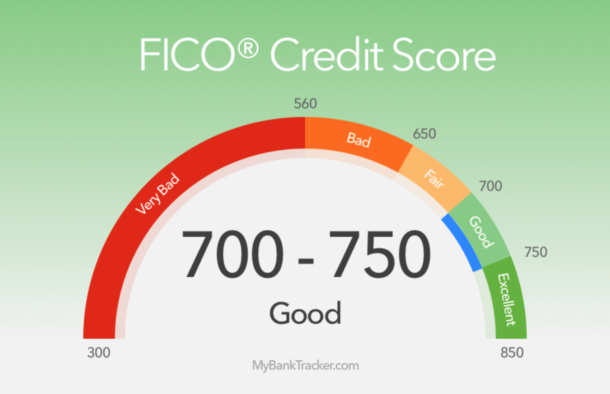

A Low Credit Score

A “low” credit score and a “bad” credit score aren’t always the same thing. You can have good credit, but it might not be good enough for the best credit cards yet. Maybe this is the first credit card you’re applying for. Or perhaps you’re in the process of rebuilding your score. Some cards that require excellent credit (a score above 780) may review your application if your score is slightly below that mark.

Whether you receive an instant decision or get flagged for further review depends on your other personal and credit factors too. If you still only have good credit, it can be better to apply for a credit card for good credit. Your approval odds are higher so you have a better chance of receiving instant approval.

Recent Missed Payments or High Card Balances

Even if you’re credit score is still within the range of most applicants, a history of recently missed payments or high balances puts your approval odds at risk. The bank might be unsure if these two negative factors were one-time accidents or the start of a new trend. They may pass your application to a manager for review.

The Bank Has Too Many Applications

Sometimes, new credit cards go “viral.” If so, the approval department has to work more hours to process applications. Once the backlog clears, you will receive your pending credit card decision.

How to Speed Up Your Pending Credit Card Decision

While you probably won’t see the reason why your application is pending review on the application screen, the bank has a note in its records. The review team may contact you about the review. Or, they may do the research themselves without calling you. However, you don’t know when they may call. It is possible to check your credit card application status online.

Basically, the only way to receive a decision sooner is to call the bank’s customer service number. You can call the number provided on the application screen.

Most banks now give you the capability to track your application status in real time. If you don’t receive an update in one or two business days, you should call the bank. The person you talk to usually has the option to approve your application. Or, they can transfer you to their manager who can make the final decision.

Chase is the one large bank that doesn’t let you track your card application status in real time. You must call their reconsideration line to receive updates:

- Personal Credit Cards: 1-888-270-2127

- Business Credit Cards: 1-800-453-9719

Call the Bank

When calling the bank, ask for the credit reconsideration department. At most, wait two days before you call if they don’t contact you first. Once you’re talking with the credit representative, remember to always be kind. Kindness can go a long way in these conversations.

If you also happen to have another credit card, loan, or bank account with the bank, have this information handy. You can use it to verify some personal questions they may ask.

As the conversation progresses, you may be put on hold as the agent reviews your file. Or, they may have to get secondary approval from their supervisor before they can say “Yes” or “No.” To get approved, you may have to accept a smaller credit limit.

This concession makes you a less risky credit card owner. Plus, you at least still get approved and have the chance to build your credit score with your credit card. Once you receive verbal approval, you may have to return online to add an authorized user. But, your new credit card will print in the next batch.

What is the best credit card to use while traveling? The right card can get you complimentary benefits that can otherwise be expensive to purchase. Some of these benefits are even exclusive to cardholders, like Capital One with their entrainment access! Or for instance, the Chase Sapphire Preferred® Card has a nice bonus, but it also has valuable travel benefits like no foreign transaction fees and travel insurance. The use of these cards goes beyond earning the most points as you can enjoy plenty of unique benefits.

Best Cards to Use While Traveling: A Variety of Options

Here is a preview of some of the options available when it comes to finding the best credit card to use while traveling.

- The Platinum Card® from American Express: Best for Flying and Luxury Travel

- Capital One Venture X Rewards Credit Card: Best for Airport Benefits

- Chase Sapphire Preferred® Card: Best Credit Card Travel Insurance

- American Express® Gold Card: Dining and Takeout Rewards

- Chase Freedom Unlimited®: Best Card with No Annual Fee

- Ink Business Unlimited® Credit Card: Best Business Credit Card

The Platinum Card from American Express

The Platinum Card® from American Express receives many accolades. Namely, it’s the best card for flying, and it’s also excellent for luxury travel.

The Global Lounge Collection includes complimentary access to The Centurion Network, Priority Pass Select, Escape, Plaza Premium, and Delta Sky Clubs (entry policies vary by network).

Its other air travel benefits include:

- Up to $200 airline fee credit annually

- Global Entry or TSA PreCheck fee credit (up to $100 every 5 years)

- Up to $189 in CLEAR credits per year

- International Airline Program discounts

- Trip Cancellation and Trip Delay coverage

The travel benefits don’t stop once you step off the tarmac at your destination. It’s possible to receive up to $200 in annual statement credits and complimentary amenities at Fine Hotels + Resorts and The Hotel Collection through American Express Travel (requires a minimum two-night stay).

Up to $200 in annual Uber Cash plus premium car rental perks are available too. Several lifestyle perks for retail and fitness for non-travel perks.

Its numerous benefits and valuable welcome offer make it one of the best American Express credit cards for travel.

The annual fee is $695 (See Rates & Fees) making this card ideal for frequent travel.

Capital One Venture X Rewards Credit Card

The Capital One Venture X Rewards Credit Card is one of the most affordable premium travel credit cards as its annual fee is only $395 (which is easily offset by the perks). You can also request up to four free additional cards.

Frequent flyers stand to gain the most from these core benefits:

- Priority Pass Select lounge access

- Capital One Lounge membership

- Global Entry or TSA PreCheck application fee credit

To maximize the Venture X Rewards benefits value, you receive an annual $300 credit for Capital One Travel purchases. The booking portal offers flights, hotels, and car rentals along with price protection benefits.

On each card anniversary, you receive 10,000 bonus Capital One miles, which is worth $100 in travel statement credits or booking upcoming travel. You can also transfer them to participating airlines and hotels, usually at a 1:1 ratio.

This card is best for traveling because of its flexible mile redemption options. In addition to earning up to 10 miles per $1 on travel purchases, you can redeem your miles as a travel statement credit with no redemption minimum.

Related: Capital One Venture X Rewards review

Chase Sapphire Preferred Card

When we get asked, “What is the best card to use while traveling?” this card is always mentioned. The Chase Sapphire Preferred® Card offers extensive travel insurance benefits. It also has a budget-friendly $95 annual fee and free additional cards.

Its travel coverage benefits include:

- Trip cancellation and interruption coverage of up to $10,000 per person/$20,000 per trip

- Trip delay reimbursement of up to $500 per ticket

- Primary auto rental collision damage waiver (up to the cash value of the vehicle)

- Baggage delay insurance of up to $100 per day for 5 days

You can also earn up to 5x Chase Ultimate Rewards® points per $1 on travel purchases and 3x points on dining. Your points are worth 25% more when redeeming them for award travel through Chase Ultimate Rewards. There are several valuable 1:1 point transfer partners including Southwest Airlines, United Airlines, and World of Hyatt.

Related: Chase Sapphire Preferred review

American Express Gold Card

The American Express® Gold Card excels at dining rewards. First, you receive up to a $10 monthly credit in Uber Cash for rides and eats. Add your Gold Card to your Uber account and each month automatically get $10 in Uber Cash for Uber Eats orders or Uber rides in the U.S., totaling up to $120 per year.

Second, earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at these establishments:

- Grubhub

- Shake Shack (participating locations only)

- The Cheesecake Factory

- Goldbelly

- Wine.com

- Milk Bar

Enrollment required.

Our American Express Gold Card review provides more details.

You may also like this card as it earns up to 4x Membership Rewards on purchases. Dining worldwide and U.S. supermarket purchases (the first $25,000 per year) earn 4x Membership Rewards. Flight reservations can earn 3x points.

The American Express Gold Card carries a $250 annual fee (See Rates and Fees).

Chase Freedom Unlimited

The Chase Freedom Unlimited® earns some of the highest rewards for a credit card with no annual fee. It also includes several trip protection benefits to protect against cancellations, delays, and rental car accidents. You can also combine your rewards with a Chase Sapphire product, another best card to use while traveling option.

First, your purchases can earn up to 5% back:

- 5% back on travel purchases through Chase Travel

- 3% on dining, takeout, and eligible delivery services

- 3% back on drugstore purchases

- 1.5% back on all remaining purchases

You can redeem your purchase rewards for cash back, upcoming award travel, and gift cards.

New Chase Freedom Unlimited® cardholders can enjoy an additional 1.5% cash back on everything they buy (on up to $20,000 spent in the first year) – worth up to $300 cash back! So, they’ll earn 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

Switching to trip protection perks, your travel purchase can be eligible for these complimentary benefits:

- Trip cancellation/interruption insurance of up to $1,500 per person and $6,000 per trip

- Secondary auto rental collision damage insurance

- Travel and emergency assistance (third-party fees apply)

Unfortunately, the Freedom Unlimited has a 3% foreign transaction fee. You may consider the Capital One Quicksilver Cash Rewards Credit Card to avoid this fee, have no annual fee, and earn 1.5% back on purchases.

Related: Chase Freedom Unlimited review

Ink Business Unlimited Credit Card

The Ink Business Unlimited® Credit Card from Chase is one of the best business credit cards for airline miles trips since there is no annual fee. However, a 3% foreign transaction fee applies.

Additionally, featured benefits include:

- Earn 1.5% back on purchases

- Redeem rewards for cash back, travel, and gift cards

- Primary auto rental collision damage waiver

- Roadside dispatch (service fees apply)

- Purchase protection of up to $10,000 per claim

- Free employee cards

The primary rental car coverage is unique for a $0 annual fee credit card.

New Ink Business Unlimited® Credit Card cardholders can earn a $750 bonus cash back after spending $6,000 on purchases in the first 3 months from account opening.

Related: Ink Business Unlimited Credit Card Review

Summary of Best International Credit Cards

- Best flexibility: Chase Sapphire Preferred® Card – $750 Award Travel Bonus

- At least 2x Rewards on Everything: Capital One Venture Rewards Credit Card

- The biggest Travel Perks: Chase Sapphire Reserve® – Lounge access, $300 annual travel credit

- Best Premium International Card: The Platinum Card® from American Express

Point transfers, travel redemption bonuses, and annual travel credits. Each of the best credit cards for international travel provides different travel rewards. More importantly, they can all help you have a great trip.

Related Posts:

- Chase Sapphire Preferred or Capital One Venture

- Best Credit Cards for Travel Miles

- Chase Sapphire Reserve vs. Sapphire Preferred

FAQs

What is the best airline credit card for international travel deals?

The Platinum Card® from American Express earns 5 points per $1 spent on flights booked directly through the airline or on AmexTravel.com, up to $500,000 on these purchases annually. You can also redeem points for award flights or transfer them at a 1:1 ratio to domestic and international frequent flyer programs. Select partners include Delta SkyMiles, Emirates Skywards, and British Airways Executive Club.

The Platinum Card also gives you an annual $200 airline fee credit (in the form of a statement credit; enrollment required) and a Global Entry or TSA PreCheck application fee credit. Plus, you get complimentary airport lounge access to some of the best networks including The Centurion, Priority Pass (enrollment required), Delta Sky Club, and Plaza Premium.

What is the best Chase credit card for international travel?

The Chase Sapphire Reserve® is the Chase credit card with the most international travel benefits. Your points are worth 50% more when booking award flights. You can also transfer them at a 1:1 ratio to airlines, including United, Emirates, Air France KLM, and Southwest Airlines.

Other benefits include an annual $300 travel credit, Priority Pass Select airport lounge membership, and a Global Entry or TSA Precheck application fee credit.

How do I inform my credit card provider that I’m traveling internationally?

You must notify your credit card provider before leaving your home country. One option is to call the credit card provider customer service number on the back of your credit card. A second option is logging into your online account. Then create a new travel notification stating your destination(s) and travel dates.

When should I notify my credit card company that I’m traveling internationally?

Most banks let you create a travel notification up to one year in advance. You should set your notification as soon as you finalize your travel plans to avoid forgetting. If you are within 72 hours of starting your trip, you may most likely have to call to create a notification.

For rates and fees of The Hilton Honors American Express Business Card, please click here.

For rates and fees of The Platinum Card® from American Express, please click here.

And for rates and fees of the Marriott Bonvoy Brilliant® American Express® Card, please click here.

Johnny Jet has partnered with CardRatings for our coverage of credit card products. Johnny Jet and CardRatings may receive a commission from card issuers.

Pentagon Federal Credit Union Pathfinder Travel Rewards Visa (previously AmEx).

No AF, no FTF, $100 incidental airline fee credit, $100 Global Entry/TSA PreCheck reimbursement. Up to 4x (about 3.4% return) for all travel charges, 1.5x (about 1.2%) for everything else. Points can be redeemed for various retail gift cards, or by making travel reservations in PenFed’s portal (prices may not be the best).

Temporarily closed to new applications right now, but scheduled to open again soon. It’s easy to join PenFed.

Thank you for telling me about credit cards that should be used for international travel. It helped me . Great work and guidance.

Would it make sense to have an Amex platinum card and a Hilton honors credit card at the same time?

Yes, if you stay frequently at Hilton properites.