This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. For an explanation of our Advertising Disclosure, visit this page.

Let’s compare two top premium travel cards available: the Chase Sapphire Reserve® and The Platinum Card® from American Express. I’ve used points earned from the Platinum and Sapphire Reserve to fly around the world. Hopefully, this review can help you too.

While both the Sapphire Reserve and Amex Platinum let you redeem points for award travel, transfer points to major travel partners, and enjoy swanky benefits like complimentary airport lounge access (enrollment may be required), there is so much more to enjoy.

These two premium cards are not only great for travel, but they are also useful for everyday spending. Oh, and both come with worthwhile bonuses.

60,000 bonus points (worth $900 in award travel): Chase Sapphire Reserve®

80,000 bonus points: The Platinum Card® from American Express

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Which is Better: Chase Sapphire Reserve vs. American Express Platinum?

Even though the Chase Sapphire Reserve vs. American Express Platinum cards seem very similar on the surface, they differ quite a bit. One offers Chase Ultimate Rewards® points, while the other offers Membership Rewards® points, which matters if you want to use your card for travel.

Both of these cards are not only some of the best for getting rewards, but they also require excellent credit. They both are on the higher end when it comes to card categories, but they are still appealing to some travelers.

So who wins between the Chase Sapphire Reserve vs American Express Platinum?

Platinum & Sapphire Reserve Sign-up Bonus/Welcome Offers

Chase Sapphire Reserve: New Chase Sapphire Reserve® cardholders can earn 60,000 bonus points after spending $4,000 on purchases in the first 3 months from account opening. That’s $900 toward travel when redeemed through Chase Travel℠.

Amex Platinum: New The Platinum Card® from American Express cardmembers can earn 80,000 Membership Rewards® points after spending $8,000 on purchases on their new Card in the first 6 months of Card Membership.

The Chase Sapphire Reserve

The Chase Sapphire Reserve has a valuable signup bonus when redeemed through Chase Travel℠.

But you can almost always find a better deal by transferring your points directly to your frequent flyer or hotel loyalty program.

The Platinum Card from American Express

Depending on which award flights you book, the Amex Membership Rewards points can be worth more.

There’s one more thing to keep in mind with the Amex Platinum bonus offer. You can only the Amex Platinum bonus “once in a lifetime.” If you earned it in the past, Amex will not offer you the welcome bonus for the Platinum Card again.

Assuming you are still undecided at this point in the comparison, if you qualify for one bonus and not the other, strongly consider that card if you can reach the spending requirement.

Here’s how the Chase Sapphire Preferred® Card vs. Amex Platinum compares if you want to compare the Reserve’s sister card.

Winner: The Platinum Card® from American Express

Amex Platinum & Sapphire Reserve Annual Travel Credit

Chase Sapphire Reserve: $300 annual travel credit as reimbursement for travel purchases charged to your card each account anniversary year

Amex Platinum: Up to $200 annual air travel credit (in the form of a statement credit; enrollment required); up to $200 annual statement credit for hotel perks

The Chase Sapphire Reserve® has a flexible $300 credit that will reimburse you for the first $300 in travel purchases, including the price of airfare, lodging, rental cars, etc. This flexibility is very rare for annual travel credit.

Cardholders can get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings with American Express Travel when they pay with their Platinum Card®. The Hotel Collection requires a minimum two-night stay. Also, select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Card.

The better option comes down to your travel preferences. Because of its sheer flexibility, the Chase Sapphire Reserve® is better because it can be applied to any travel purchase. But if you max out airline travel credits, the Amex Platinum is better.

Winner: Tie

Chase Sapphire Reserve vs. American Express Platinum: Purchase Rewards

This Chase Sapphire Reserve vs. American Express Platinum review continues to look at some of the most exciting aspects of a card—the purchase rewards.

Platinum Card

The Platinum Card® from American Express is the most rewarding credit card for airfare purchases made directly from the airline or with American Express Travel. If you fly frequently, the Amex Platinum can earn Membership Rewards points at twice the pace of almost any other rewards credit card.

Cardholders earn 5x Membership Rewards® Points for flights booked directly with airlines or with American Express Travel, up to $500,000 on these purchases per calendar year.

Cardholders can also earn 5x Membership Rewards® points on prepaid hotels booked with American Express Travel.

Chase Sapphire Reserve

The Chase Sapphire Reserve can be the better option to earn bonus points from travel purchases, not just flights and hotels.

Chase Sapphire Reserve® purchases earn up to 10x Ultimate Rewards. Cardholders can earn unlimited:

- 10x total points on hotels and car rental purchases through Chase Travel℠ (after the first $300 is spent on travel purchases annually)

- 10x total points on Chase Dining purchases with Chase Travel℠

- 5x total points on flights when you purchase travel through Chase Travel℠ (after the first $300 is spent on travel purchases annually)

- 3x points on other travel worldwide (after the first $300 is spent on travel purchases annually)

- 3x points on other dining at restaurants, including eligible delivery services, takeout, and dining out

- 1x points for all remaining purchases

You will not receive rewards points on your first $300 in annual travel purchases as the annual travel statement credit reimburses these purchases.

Winner: Chase Sapphire Reserve®

Redeeming Ultimate Rewards & Membership Rewards

Chase Sapphire Reserve: Points are worth 1.5 cents each for all award travel or can be transferred to a 1:1 travel partner

Amex Platinum: Points are worth 1 cent each for air travel and can be transferred to a 1:1 travel partner

The Chase Sapphire Reserve and American Express Platinum travel cards offer flexible redemption options. Overall, the Chase Ultimate Rewards Points are more valuable because they are always worth at least one cent each (10,000 points=$100) and 1.5 cents each (10,000 points=$150) when you redeem them for travel in the Chase travel portal.

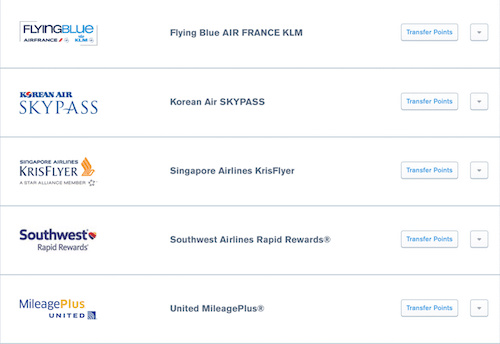

Leading Chase partners include Southwest Airlines, United, IHG, Marriott, and Hyatt.

The Amex Membership Rewards points are only worth 1 cent each at most for award air travel and gift cards. If you redeem them for any other type of award travel through Amex Travel, they might only be worth 0.7 cents each or less.

The best perk of either card is the ability to transfer points to a 1:1 travel partner, where your points can easily be worth 2.0 cents each. While there’s some overlap between airline partners like British Airways, Air France Flying Blue, and Singapore Airlines, both Amex and Chase have exclusive partnerships.

Exclusive Amex travel partners include Delta, Emirates, Etihad, JetBlue, and Choice Privileges.

Even if you can’t transfer directly to your favorite frequent flyer programs, you can usually transfer your points to a travel partner and book a partner flight.

Winner: Chase Sapphire Reserve®

Additional Sapphire Reserve and American Express Platinum Benefits

After the purchase rewards and 1:1 travel partners, your tie-breaking vote will most likely hinge on the additional card benefits. Let’s take a look at which benefits are most valuable for you:

Chase Sapphire Reserve Benefits

- $100 Global Entry or TSA PreCheck application fee credit

- Priority Pass Select airport lounge access

- Primary rental car collision damage and waiver coverage

- Special rental car privileges at National, Avis, and Silvercar

Learn more about what Chase Sapphire Reserve credit score you will need for approval.

The Platinum Card from American Express Benefits

- Up to $100 Global Entry or TSA PreCheck application fee credit (plus CLEAR benefits; enrollment required)

- Complimentary lounge access to The Centurion, International American Express, Delta SkyClub, and Priority Pass Select (enrollment required)

- Elevated Hilton Honors loyalty status (enrollment required)

- Upgraded rental car upgrades and discounts

- Secondary rental car collision damage waiver protection

I really like that the Amex Platinum gives complimentary access to their Centurion lounges. Although they can be very crowded, they are my favorite lounges to frequent in the States. American Express has expanded The Centurion® Network to include 40+ Centurion Lounge and Studio locations worldwide. Now there are even more places your Platinum Card® can get you complimentary entry and exclusive perks.

Additional Benefits

There’s also a digital entertainment credit, making this one of the best for streaming services. Cardholders can get up to $20 in statement credits each month when they pay for eligible purchases with the Platinum Card®. Enrollment required.

In addition to enjoying TSA PreCheck or Global Entry access, cardholders can also enjoy CLEAR perks. Breeze through security with CLEAR® Plus and get up to $189 back per year on your membership (subject to auto-renewal) when you use your Card.

Another exciting benefit is the ability for cardholders to get up to $300 back each year in the form of statement credits on an Equinox+ subscription or any Equinox club membership when they pay with their Platinum Card. Enrollment required.

Plus, get a $155 Walmart+ credit, which covers the cost of a $12.95 monthly Walmart+ membership with a statement credit after you pay for Walmart+ each month with your Platinum Card. The cost includes $12.95 plus applicable local sales tax.

I also love that both the Platinum and Reserve cards can credit the Global Entry and TSA PreCheck application fees. Just another benefit that, if maximized, can justify the annual fee.

Both cards are also made of metal.

So, which card has the better benefits?

Winner: The Platinum Card® from American Express

Annual Fee for the Sapphire Reserve and American Express Platinum

Chase Sapphire Reserve: $550 ($75 per additional user); no foreign transaction fee

Amex Platinum: $695 (The annual fee for Additional Cards is $195); no foreign transaction fee (See Rates & Fees)

If you can max out the annual travel credits, the effective annual fee can be offset for either travel credit card. The annual fee is even more justified if you consider the welcome bonus and use the other card benefits like Global Entry credit, lounge access, etc.

Winner: Varies. While the fees may be steep, the Chase Sapphire Reserve and American Express Platinum are both top-notch travel credit cards. The only way to determine the true winner is to examine how you intend to use the credit card. If you can use the card in several ways and have it offset the costs, that card is worth it.

Every luxury traveler probably has considered two premium credit cards: the Chase Sapphire Reserve and Platinum Card from American Express. While the Amex Platinum is known for being benefits-rich, the Chase Sapphire Reserve benefits might be a better option based on your travel habits. After all, a premium travel rewards card is only as valuable as its benefits, right?

Related: The Best American Express Card? Amex Gold vs. Amex Platinum Review

What Benefits Both Cards Have In Common

Before we look at how the Chase Sapphire Reserve benefits can be different, let’s first look at which travel benefits the Sapphire Reserve and American Express Platinum have in common:

- Global Entry or TSA PreCheck application fee credit

- 1:1 Point Transfers

- Car Rental Privileges

- Travel Rewards

Besides the Global Entry application fee reimbursement, there are some nuances in the other three shared benefits. Each card has its own unique twist that may make you prefer one card to the other. For example, Chase Ultimate Rewards and American Express Membership Rewards have different travel transfer partners.

Also, you get access to Centurion lounges with the Amex Platinum.

Chase Sapphire Reserve Annual Travel Credit

The Chase Sapphire Reserve® has a $300 annual travel credit as reimbursement for travel purchases charged to your card each account anniversary year. It can be used for any travel-related purchase, including plane tickets.

With the Amex Platinum, you receive up to $200 air travel credit (in the form of a statement credit; enrollment is required). And, the Amex air travel credit only covers incidental fees like checked baggage and in-flight purchases for one airline. Cardholders can get $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings, which require a minimum two-night stay, with American Express Travel when paying with their Platinum Card®.

Even though the Sapphire Reserve travel credit is less, the only way to not use the credit is if you don’t travel enough. Chase reimburses you for your first $300 in travel purchases each year, regardless of the purchase. You’ll never have to worry about not maximizing the credit.

Amex Platinum Airport Lounge Access

It’s no secret that the Amex Platinum is extremely friendly to frequent flyers.

You only get complimentary access to the Priority Pass Select lounge network (enrollment required) with the Chase Sapphire Reserve. There are more than 1,000 location locations worldwide so most airports will have a lounge. You’ll also get access to the Chase lounges.

The Amex Platinum gives you access to these three additional lounge networks, as well as Priority Pass Select (enrollment required):

- Delta SkyClub

- The Centurion Lounge Network

- International American Express

The only way to access Delta SkyClub for free is if you’re flying on an active Delta itinerary.

Plus, American Express has expanded The Centurion® Network to include 40+ Centurion Lounge and Studio locations worldwide. Now there are even more places your Platinum Card® can get you complimentary entry and exclusive perks.

Your only option might be a Priority Pass lounge if you don’t fly Delta or pass through an airport with a Centurion or International American Express Lounge. If that’s the case, either card can be a toss-up when it comes to airport lounges.

Hotel Benefits

There are very few hotel benefits to speak of with the Sapphire Reserve other than the 1:1 hotel travel partners:

- IHG

- Marriott

- World of Hyatt

Unless you stay at these properties, the Amex Platinum has better hotel perks, including elevated Hilton Honors and Marriott Bonvoy membership status. Cardholders can get $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings, which require a minimum two-night stay, through American Express Travel when paying with their Platinum Card®.

Rental Car Privileges

When it comes to rental cars, the Chase Sapphire Reserve rental car insurance benefits guide has a slight edge for the following reasons:

- Primary Rental Car Collision Damage Waiver Coverage

- Special discounts and upgrades with Avis, National, and Silvercar

American Express only offers secondary rental car CDW coverage and special relationships with Avis, Hertz, and National.

While your rental car will hopefully never be involved in an accident or attempted theft, Chase’s primary coverage will kick in before your personal insurance benefits do, which can save you some money during the claims process.

Travel Protection Benefits

The Chase Sapphire Reserve® benefits also come with several trip protection benefits when your travel plans get changed due to weather, sickness, and other carrier delays:

- Non-refundable travel expenses reimbursed up to $10,000

- Essential purchases for travel delays of 6 hours or more are reimbursed up to $500 per ticket

- Damaged or lost luggage claims reimbursed up to $3,000 per passenger

1:1 Travel Partners

Besides the complimentary travel benefits and credits, 1:1 point transfers are also extremely valuable. Both American Express and Chase have 1:1 travel partners, and your preference will depend on which airlines you fly.

If you fly these airlines on a regular basis or can book partner flights through your frequent flyer account for the non-Chase Ultimate Rewards partners to still booker a cheaper reward flight than booking directly through the airline.

Many Sapphire cardholders transfer their points to a travel partner to make each point more valuable (partly why it’s one of the best Chase credit cards). If you decide to redeem them through Chase, each reward point is worth 1.5 cents each for all award travel. With Amex, rewards points are worth 1 cent each for airfare and less than 1 cent for non-air travel.

Since the Sapphire Reserve earns 10x points on eligible travel (once you’ve earned your $300 travel credit), it can be extremely easy to rack up the points to achieve award travel sooner. The Amex Platinum does give you 5x on airline purchases made directly with the airline, up to $500,000 per year, which is a great benefit.

When The Sapphire Reserve Benefits Are Better

The Chase Sapphire Reserve® benefits are better in the following instances:

- You want a flexible $300 travel credit

- Only visit Priority Pass airport lounges

- Prefer the Chase 1:1 travel partners or 50% point redemption bonus

- Want additional trip protection benefit

- Want a lower annual fee

With the Sapphire Reserve, you receive fewer benefits that are more flexible to use.

When The American Express Platinum Benefits Are Better

The Platinum Card® from American Express is intended for frequent flyers because of the 5x air travel purchase rewards and additional air travel benefits. But purchase rewards aren’t the only reason to apply for the Amex Platinum if you fly regularly:

- Can visit the Delta SkyClub or Centurion Lounge

- Stay at Hilton or FINE Hotels and Resorts

- Check bags or make in-flight purchases to use the $200 air travel credit

- Prefer the Amex Membership Rewards travel partners like Delta, Emirates, and Etihad

- Can use the extra benefits that can help offset fees

The Amex Platinum benefits do a better job of making your flight and layover more comfortable if you already spend money each year to join several lounge networks. The Centurion Lounges are the nicest lounges available domestically. You can also enjoy additional hotel perks if you stay at a Hilton property.

Additionally, cardholders can get up to $100 in statement credits annually for purchases at Saks Fifth Avenue on their Platinum Card®. That’s up to $50 in statement credits semi-annually. However, they must be enrolled for this benefit to apply.

You may also want to check out our post on how hard is to get the American Express Platinum card and what credit score you need for the American Express Platinum.

Summary of Amex Platinum vs. Chase Sapphire Reserve

In conclusion, both the Chase Sapphire Reserve and American Express Platinum are excellent travel rewards cards. You need to look at your travel habits and see if they align better with the Sapphire Reserve or American Express Platinum. Or, you may choose the Sapphire Reserve because of the flexible rewards options.

60,000 bonus points (worth $900 in award travel): Chase Sapphire Reserve®

80,000 bonus points: The Platinum Card® from American Express

For rates and fees of The Platinum Card® from American Express, please click here.

Actually, for the Amex Platinum it’s $175 for first three additional users and $175 every additional user thereafter.

Good catch. The post has been edited. Thanks!