This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. For an explanation of our Advertising Disclosure, visit this page.

The United℠ Explorer Card can be one of the best options if you are a loyal United traveler but don’t travel too often or don’t want a high annual fee. You can earn bonus United miles, get 25% back on United® inflight purchases, check bags for free, and have priority boarding access. Keep reading to learn more about the Chase United Explorer card perks.

New United℠ Explorer Card cardholders can earn 50,000 bonus miles after spending $3,000 on purchases in the first 3 months of account opening.

Plus, there’s a $0 introductory annual fee for the first year, then $95.

Perks of the Chase United Explorer Card

The $95 annual fee is waived the first year the account is open for the United℠ Explorer Card, one of the best United credit cards. However, there are some great benefits that justify having to pay the fee annually, especially if you fly United regularly.

Personally, I keep United Explorer open and pay the annual fee for the benefits. You get:

- two free lounge passes annually

- free first checked bag for you and a companion on the same reservation

- priority boarding

- no foreign transaction fees & chip technology

- Primary CDW car rental insurance

- Fee credit of up to $100 for TSA PreCheck or Global Entry

Cardholders also earn 2x miles per $1 spent on United tickets purchased directly with United, hotel purchases, and dining including eligible delivery services. All other purchases earn 1x mile per $1 spent.

Eligibility for the Chase United Explorer Card

The United Explorer card falls under Chase’s 5/24 rule, so you will most likely not be approved if you’ve applied for 5+ credit cards in the last 24 months.

From the Chase United Explorer terms & conditions: “This new cardmember bonus offer is not available to either (i) current cardmembers of this consumer credit card, or (ii) previous cardmembers of this consumer credit card who received a new cardmember bonus for this consumer credit card within the last 24 months.”

So, this offer isn’t for you if you currently hold a United card, have received a bonus in the last 24 months on the United card, or have applied for 5+ credit cards from any bank in the last 24 months.

Perks of the United Business Card

There are a number of similarities between the consumer Explorer card and the United℠ Business Card. Cardholders also get priority boarding, their first checked bag free for them and a companion traveling on the same reservation, two United Club passes, and no foreign transaction fees.

Additional business benefits include:

- Employee cards at no additional cost

- Earn 2x miles per $1 spent on United® purchases, dining (including eligible food delivery services), at gas stations, local transit and commuting, and office supply stores

- A 5,000-mile “better together” bonus each anniversary when they have both the United℠ Business Card and a personal Chase United® credit card.

United℠ Business Card cardholders earn 1x mile per $1 spent on all other purchases.

Additionally, get a $100 United® travel credit after 7 United flight purchases of $100 or more each anniversary year.

Cardholders will have primary auto rental collision insurance as well. This can be one of the airline credit cards, thanks to all of the perks.

New United℠ Business Card cardholders can earn 75,000 bonus miles after spending $5,000 on purchases in the first 3 months of account opening. Plus, enjoy a $0 introductory annual fee for the first year, then $99.

With perks like a free first checked bag (a savings of up to $140 per roundtrip—terms apply), 2 United Club one-time passes per year, and priority boarding privileges, the United Business Card has plenty to offer.

What Can You Do with United Airline Miles

One-way award flights start at 12,500 miles within the continental U.S. and Canada. You could easily have enough points for a domestic roundtrip flight with your points earned from your sign-up bonus.

Final Thoughts

The United℠ Explorer Card works well with Ultimate Rewards points earning cards (my favorite points to earn). Like the Chase Sapphire Preferred® Card, it’s valuable since Ultimate Rewards points can be transferred to United at a 1:1 ratio instantly.

Having either the United℠ Explorer Card can be a welcome addition to your wallet. The priority boarding, free checked baggage, and lounge passes are great for travelers who fly United Airlines fairly often.

However, if United is your primary airline, you’ll want to check out our guide to the best United credit cards and more.

Learn more: United℠ Explorer Card

My United Explorer Card Helped Me Save 7,500 United Airlines Miles

Frequent flyer miles are great and earning them through credit card spending is an excellent way to rack up miles, especially with a good sign-up bonus. But did you know the United Explorer Card can do much more than earn miles? It can save them, too. Here’s how I saved by having one of the best United credit cards.

How I Saved 7,500 United Miles as a United Explorer Card Cardholder

With most airlines, when it comes to booking with miles, award availability is pretty consistent across the board. You have to be enrolled in their frequent traveler program, of course, but beyond that, most travelers see the same availability for award bookings. Some Delta American Express Skymiles cards offer cardholders the option to pay for part of their flight in miles and the rest in cash, but the United credit card is different.

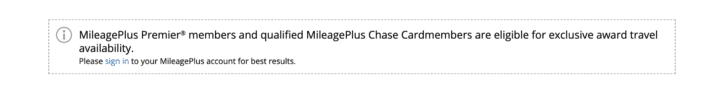

As a United Explorer Card cardholder, I automatically have access to more award seats than non-United Airlines cardholders, especially in the economy Saver and Everyday Awards category. Without the United credit card, far fewer award seats will show as available through the United booking portal. If there is a seat available, cardholders like me have unrestricted access to book an Everyday Award, even if it’s the last seat on the plane.

Not so if you don’t have a United Explorer card linked to your MileagePlus account.

Examples

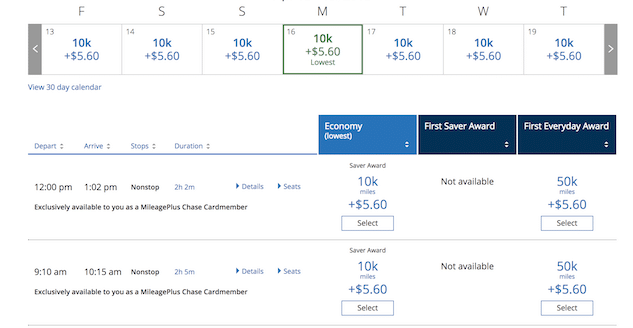

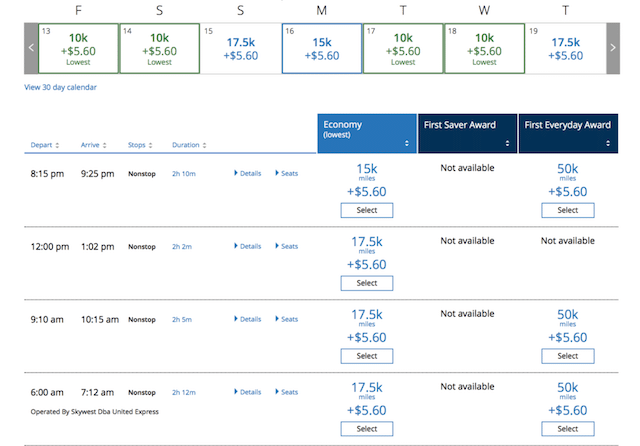

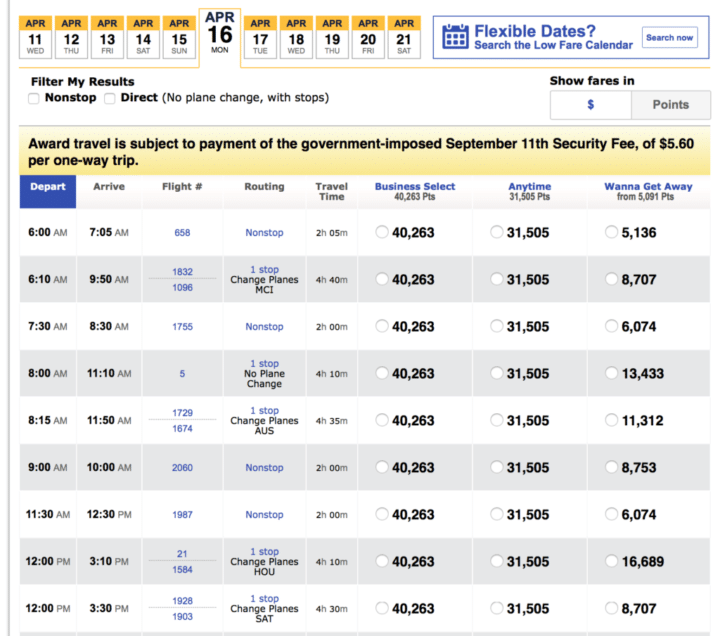

For example, when a UnitedPlus member without the Explorer card searches for award flights, one or two might show up that require 10,000 miles for flights that are under 700 miles from point A to point B. Most will be 15,000-35,000 miles for longer domestic flights. The magic number seems to be 17,500, which is what most seats were going for.

However, when I log in to search as a member with the Explorer card, a couple of lower-priced award flights are available.

Compared to when I search signed out of my MileagePlus account:

As you can see, there are two award flights that show up for me as cheaper. Just having the card saved me 7,500 miles per one-way flight.

Non-cardholders can expect to shell out more United miles simply because award seats don’t show up in search results. Without the United Explorer card, you can still find award flights for 10,000-12,500 miles (the former for flights under 700 miles), there just won’t be as many of them, especially on popular routes. And in reality, if you didn’t have the Explorer card, you wouldn’t even know those discounts were available.

Flying farther than across state lines? I have the potential to save even more on international flights with the Explorer card.

Just watch out for the close-in booking fee. It’ll get you every time. If you try to book an award flight within 21 days of departure you’ll be charged an additional $75 on top of the usual taxes and fees, which are typically $5.60 per one-way ticket.

The United Explorer Card Perks

New United℠ Explorer Card cardholders can earn 50,000 bonus miles after spending $3,000 on purchases in the first 3 months of account opening.

Plus, there’s a $0 introductory annual fee for the first year, then $95.

The United credit card falls under Chase’s 5/24 rule.

On top of that, every time you book a flight and pay with the United Explorer card you will get priority boarding, 25% back on United® inflight purchases, and a free checked bag, too. And every year that you renew the United card, you will also receive two passes to a United Club. Those alone are worth more than $100. And of course, there are no foreign transaction fees.

The annual fee is $95 (waived the first year), but the benefits make it worth it if I’m flying even semi-regularly with United. However, those aren’t the only perks that make the Explorer card worth hanging onto.

How to Earn Miles with the Explorer Card

Everyday spending isn’t the only way you can earn miles with the Explorer card. It also offers the opportunity to earn additional miles through their online shopping portal, cruise partners, and dining out. You can earn with numerous partners ranging from car rental company Hertz to loans with Quicken Loans to auto insurance with Liberty Mutual.

United also offers the MileagePlus X app, which allows you to earn additional miles at local stores and restaurants in addition to online. Just log in to the app and when it’s time to check out, type in the total amount due, and use the barcode provided to complete the purchase at the register.

It’s like purchasing a gift card for the exact amount you’re about to spend. But instead of earning 1 point per dollar, the app shows you which storefronts and restaurants nearby where you can earn up to 5 points per dollar. It’s a no-brainer.

How it Compares to Other Airlines

Compared to other airlines, United’s Explorer is fairly middle-of-the-road. Shorter flights, the ones under 700 miles, don’t require as many miles to redeem as American Airlines. As an AAdvantage member, award flights start at 12,500 miles one-way.

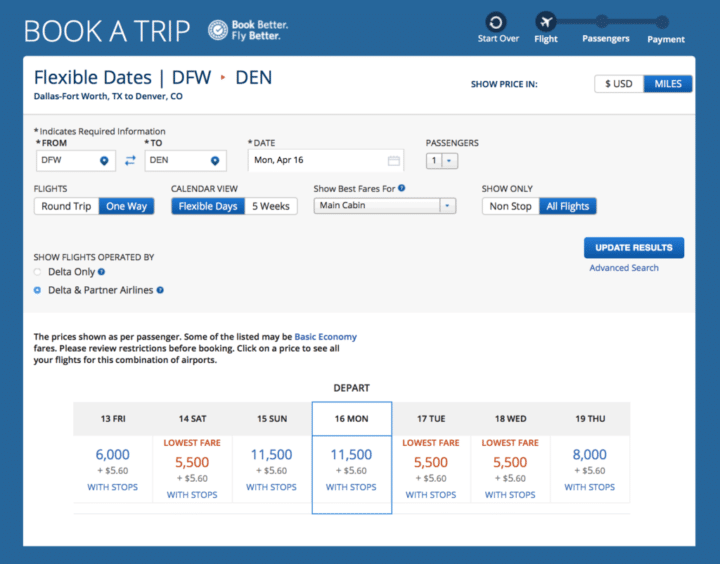

But the same flight on Delta requires as little as 5,500 miles each way. Frontier flights range from 10,000-20,000 miles for flights of most distances.

For longer domestic flights, Delta still comes out on top with award flights as low as 5,500 miles. American Airlines and United flights still start at 12,500. Southwest Airlines has a different pricing structure for miles, requiring any amount from 5,136 to 16,689 points for flights with the same destination on the same day.

None of these airlines seem to offer the increased award availability for cardholders that United does, though. Meaning award availability can fluctuate with the popularity of any given flight.

The Bottom Line

All airline comparisons aside, if you fly with United often, getting the United℠ Explorer Card to pair with your MileagePlus frequent flyer account isn’t a bad idea. Plus, you can top off your United MileagePlus account by transferring Ultimate Rewards points.

Related post:

quick question- does the condition that says the 50,000 miles bonusis not available to “previous cardmembers of this consumer credit card who received a new cardmember bonus for this consumer credit card within the last 24 months” mean that the cardmember has to have closed the account 24months earlier in order to apply and get the bonus now OR does it mean 24 months from when the initial cardmember bonus of whatever thousands of miles the deal was then was awarded as in within 3 months of obtaining the card. I had a United Mileage Explorer card that I obtained in 2014, closed a year later in May or June 2015 so it has certainly been two years since I opened that account and earned the bonus, but will not be 24 months since I closed the account and got my last miles on that card until May or more likely June 2017.

I hope that is not as convoluted as it sounds and that someone has experience with this question. Thanks much.

Read more at: https://johnnyjet.com/new-50000-united-explorer-airlines-card-limited-time-offer/ mean

Read more at: https://johnnyjet.com/new-50000-united-explorer-airlines-card-limited-time-offer/

It’s 24 months from account approval not closure. Hope this helps!

That is a big difference and thanks in advance. I can now apply for another United Mileage Explorer card and start thinking of what to do with those 50,000 or hopefully, 70,000 miles. Thanks much

Rejected for this card with a 698 credit score, United Gold status and $120k yearly income. The reason given when I called into Chase was high student loan debt and a charge off that had JUST fallen off my credit report that apparently Chase could still see. The charge off was from when I was unemployed after being laid off for a year in 2014-2015. Chase rep wasn’t very sympathetic, despite 7 years of clean payments since. Have a non-Chase card with $10k limit for six years, too.