This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. For an explanation of our Advertising Disclosure, visit this page.

Among the numerous Amex credit cards that have undergone enhancements in recent months, The Platinum Card® from American Express continues to stand out as one of the best cards. With benefits valued at over $1,400, the Amex Platinum card also boasts an attractive welcome bonus offer. But is the Amex Platinum hard to get? We’ll break down the approval factors below.

New Welcome Offer: You might possibly qualify for a huge 100,000 or 125,000-point welcome bonus with the Platinum Card® from American Express. See if you qualify for the Amex Platinum 100,000 or 125,000 offer (no hard credit pull): CardMatch™

Plus, there is a great public welcome bonus to consider too. Earn 80,000 Membership Rewards® Points after you spend $8,000 on purchases on The Platinum Card® from American Express in your first 6 months of Card Membership.

Standard 80,000 Offer: The Platinum Card® from American Express

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

How Hard Is It To Get The American Express Platinum Card?

Use this guide to jump to specific approval factors and benefits:

- Credit Score Needed for American Express Platinum

- How hard is it to get the Amex Platinum

- Do You Need to Be 21 for the American Express Platinum?

- Required Salary

- Annual Fee

- Little-Known Benefits of the Platinum Card

- Summary

With its generous welcome bonus, tiered purchase rewards, annual travel credits, and fringe benefits that will make any frequent flier drool (as exemplified in our comprehensive American Express Platinum review), the Amex Platinum metal credit card is highly sought after.

But, the Amex Platinum has a high annual fee of $695 (See Rates & Fees).

While many travelers have their eyes on it, how hard is it to get The Platinum Card® from American Express? Let’s find out what the Amex Platinum requirements are.

Related: Are Credit Cards Worth Their Annual Fees? Things To Consider

Is Amex Platinum Hard To Get?

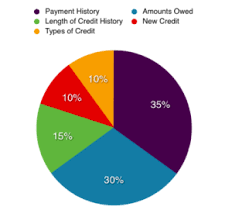

The credit score needed for the American Express Platinum is generally above 700. According to Credit Karma, the average score is 715, so it’s not incredibly hard to get the Amex Platinum card. However, several applicants with credit scores in the 600s have also been approved, even as low as 643.

If your credit score is borderline 700, you might wait until your score crosses that threshold. That way, you can be considered to have good or above-average credit. A few ways to quickly boost your credit score include paying any current credit card debt, paying off a financial loan, and not trying for any new credit accounts. This includes not trying for any additional credit card accounts, as each inquiry will drop your score a few points.

80,000 Points Offer: The Platinum Card® from American Express

If your credit score is in the 600s, you can still get approved for The Platinum Card® from American Express, but it depends on your credit quality. Your approval chances will be highest if you have a low debt-to-income ratio and have not applied for many new credit accounts recently. This tells American Express that while you might have a low score, you can responsibly manage your credit.

Too Many Accounts

Having too many new accounts can jeopardize your approval chances because the reviewer might think you are going on a spending spree and will not afford the monthly payment. While American Express doesn’t have the rigorous 5/24 rule like Chase, where your application is declined if you have five new credit cards within the most recent 24 months, too many recent applications can still raise a red flag.

You can only receive a welcome bonus on American Express cards once per lifetime. This is very important concerning the American Express Platinum requirements.

Consider Getting Another Amex Credit Card First

If you are concerned about your credit score, you might consider getting another American Express credit card first. If you don’t own a credit card already, this can be a wise move. Your approval odds increase if you can responsibly manage a credit card.

The Amex Platinum is one of the most prestigious travel credit cards you can own.

Trying for an American Express credit card lets you establish a relationship with Amex. Plus, it can make it easier to add the Amex Platinum Card to your wallet in the near future. Several of the best no-annual-fee travel credit cards are offered by American Express.

Other Options

You might consider the American Express® Gold Card as it also offers travel and dining benefits and is cheaper than the Platinum Card (the annual fee for the Gold Card is $250; See Rates & Fees). But, it doesn’t come with all the additional travel benefits nor earn purchase rewards as quickly on travel purchases.

You may also want to check out some of the other best credit cards for travel miles options that come with lower annual fees.

Some experts recommend waiting two years to try for the Amex Platinum after you get your first credit card. It largely depends on your credit history. If you have a credit score in the 700s or upper 600s, you might be able to try for one in as little as six months, provided you have never missed a payment.

Do You Need to Be 21 for the American Express Platinum Card?

Your approval chances are much better if you’re 21 years old or older when you try for The Platinum Card® from American Express. To be an authorized user, you must be 18 years old. As most teenagers do not have the credit score or income to pay the annual fee, this restriction won’t disqualify too many applicants.

Basically, American Express wants to know if their applicants have shown they can honor their commitments by being steadily employed or graduating college in the four years between when they graduate high school at age 18 and usually get their first “real” job at age 21.

You can still submit an application if you are under the age of 21. But, you might have to submit additional documentation to verify your income for this metal credit card.

Is Amex Platinum’s $695 Annual Fee Worth It?

Unlike other credit cards that waive the annual fee for the first year, the $695 annual fee will be charged on your first monthly billing cycle. If you don’t have $695 to pay the annual fee, don’t try for the card.

If you want to add an authorized user, you will also need to pay $195 upfront for each additional card.

The benefits below are proof that some travel credit cards are worth it:

Benefits

Cardholders earn 5x Membership Rewards® Points for flights booked directly with airlines or with American Express Travel, up to $500,000 on these purchases per calendar year, and earn 5x Membership Rewards® points on prepaid hotels booked with American Express Travel.

Cardholders can get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings with American Express Travel when they pay with the Platinum Card®. The Hotel Collection requires a minimum two-night stay.

Also, select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Card.

Plus, American Express has expanded The Centurion® Network to include 40+ Centurion Lounge and Studio locations worldwide. Now there are even more places where your Platinum Card® from American Express can get you complimentary entry and exclusive perks.

The Platinum Card from American Express Benefits

There’s also a digital entertainment credit, making this card one of the best for streaming services. Cardholders can get up to $20 in statement credits each month when they pay for eligible purchases with the Platinum Card®. Enrollment required.

In addition to enjoying TSA PreCheck or Global Entry access, cardholders can also enjoy CLEAR perks. Breeze through security with CLEAR Plus at 100+ airports, stadiums, and entertainment venues nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Platinum Card®.

Another exciting benefit is the ability for cardholders to get up to $300 back each year in the form of statement credits on an Equinox+ subscription or any Equinox club membership when they pay with their Platinum Card. Enrollment required.

Plus, get a $155 Walmart+ credit, which covers the cost of a $12.95 monthly Walmart+ membership with a statement credit after you pay for Walmart+ each month with your Platinum Card. The cost includes $12.95 plus applicable local sales tax.

Get the full details and learn more in our in-depth The Platinum Card from American Express review.

Salary Needed for Amex Platinum Credit Card

There are no published salary requirements in order to qualify for The Platinum Card® from American Express. But the more you earn, the better. If you make nearly $100,000 a year and have good credit, you should have no issue getting approved. However, applicants with annual incomes as low as $40,000 have also been approved if they have a low debt-to-income ratio and pay their other credit cards in full every month.

Having a lower income means you will most likely get a lower credit limit. But it still means you get the Platinum Card and can enjoy all the benefits. You just might have to make other purchases on your secondary cards to keep your monthly balance below 30% of your Platinum Card’s credit limit.

This will help maximize your credit score.

Related: Best Places To Get A Free Credit Score

Going for the Amex Platinum Card

The last step is to try for The Platinum Card® from American Express. The easiest way is online as you enter all your personal information and your salary to receive an instant decision. If American Express has a few questions about your credit history, they might hold your application for additional review and give you a decision within a few business days.

You will also need the full name and social security number of all people you wish to add as an additional cardholder.

HOT: Targeted 100K+ Amex Platinum offer.

Related: How Much Are 60k Miles Worth? Here Are Some Examples

How Hard Is It to Get the American Express Platinum?

Getting approved for the American Express Platinum is like any new credit card application. You have better chances with a credit score above 700, a clean credit history, and a low debt-to-income ratio. If you think you might have to work on these factors, take the time to improve your credit to enjoy the benefits.

80,000 Offer: The Platinum Card® from American Express

Little Known Benefits of the American Express Platinum Card

The Platinum Card® from American Express is one of my favorite premium credit cards. There are many well-known benefits, such as the ability to earn 5X Membership Rewards® points per dollar spent on purchases made directly with airlines or at amextravel.com, up to $500,000 on these purchases per calendar year.

There are also some great hotel perks, helping it land some of the best hotel card offers list. Terms apply, and enrollment may be required.

But there are a ton of other great benefits jam-packed into this card that you might not know about.

10 Little-Known Benefits of the Amex Platinum Card

Here are ten little-known American Express benefits of The Platinum Card. Note that enrollment may be required for the benefits below. Terms may apply.

Related: The Best Premium Credit Cards To Use For Rewards

1. Emerald Club Executive Membership with National

This is one of the benefits of the Platinum card that you’ll love if you do a lot of driving. You can enroll in the National’s Emerald Club program and automatically be upgraded to their Executive status level. When you’re Executive, you can select from a special aisle of cars at participating locations, usually including many great rental options!

This benefit of the Platinum card has made National my favorite car rental company. Recently, I’ve been able to upgrade to a VW Bug convertible, a Jeep Wrangler, and a Cadillac XTS, even though I paid for the cheapest economy car possible!

The Amex Platinum is also one of the best credit cards for car rental insurance.

2. American Express Concierge

If you want to be known as the person who scores seats for the sold-out events, you’ll love the benefits of the Platinum card. Do you need help with a tough-to-nail restaurant reservation or event tickets? Need assistance with your Christmas shopping?

The American Express Concierge can help. Simply call (800-525-3355) or email with your request and they’ll do what they can to meet your needs.

3. Presale Tickets Access

Similar to the above, this is one of the benefits of the Platinum card that will help you score those impossible seats. Cardholders have access to presale tickets to concerts and events from Ticketmaster. This is a great benefit if there’s a show you’ve had your eye on.

American Express also regularly offers early or exclusive access to other events, such as the theater production of Hamilton.

4. Reserved Seating

Another concert benefit – get preferred seating when you reserve your tickets with Ticketmaster using the offer code on the back of your card. This is one of my favorite benefits of the Platinum card. You can sit in front and center and enjoy the show.

5. By Invitation Only Events

If small, intimate events are your thing, this benefit is going to come in handy. American Express books events for cardholders with celebrity chefs and other celebrities. They tend to be expensive but are small, intimate, and incredibly unique.

More conventional but still highly desirable events, like the ball dropping in Times Square for New Year, are also available.

Learn more: The Platinum Card® from American Express

6. Cruise Privileges

You’ll get up to $100-$300 in onboard credit for each stateroom you book when you book a cruise through Amex Cruises. You’ll also be eligible for additional amenities that vary by the cruise line. This is definitely one of the better benefits of the Platinum card if you like to vary your travel between air, land, and sea.

There’s a reason why the Platinum Card from American Express is one of the best rewards credit cards!

7. Global Dining Collection

Certain restaurants reserve a table specifically for American Express card members. You may book these tables through the Amex Platinum Concierge.

Additionally, cardholders have access to special events and experiences at some restaurants, such as kitchen tours.

8. InCircle Loyalty Program

After enrolling in InCircle, you’ll get up to a $100 InCircle Point Card for every $10,000 you spend at Neiman Marcus, Bergdorf Goodman, Last Call, Horchow, and Cusp. Points are not earned on sales tax, shipping, alterations, gift packaging, and several other things. This is one of those great little additional benefits of the Platinum card if you shop at these stores anyway.

9. Premium Private Jet Program

If there’s ever a time you need to hire a private jet, you can book it directly through American Express Travel. While not a benefit that most people will need regularly, it’s a nice option to have in your back pocket.

10. Global Boingo Wi-Fi Membership

This is probably one of the most useful and widely used benefits of the Platinum card. While it’s usually not too difficult to find free WiFi, your American Express Platinum card gives you access to a Boingo WiFi membership. Boingo has over one million hotspots available worldwide.

This could be the difference between WiFi and no WiFi or lightning-fast speeds and slower connections. However, you must register to access these hotspots.

Summary of How Hard Is It To Get Amex Platinum Card

As you can see, The Platinum Card® from American Express has a ton of benefits packed in. It’s likely that you don’t know about these benefits because they don’t get as much attention.

Personally, I really love that I have access to the Executive Aisle cars when I rent from National. I also occasionally use the Boingo membership that comes with my card. Which of these benefits of the Platinum card from American Express is your favorite?

HOT: Targeted 100K+ Amex Platinum offer.

Related Posts:

- Chase Sapphire Preferred vs. Amex Platinum Review

- American Express Platinum Review

- Amex Business Platinum Card Review

- How Hard is it to get the Amex Business Platinum Card?

Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

For rates and fees of The Platinum Card® from American Express, please click here.

For rates and fees of The American Express® Gold Card, please click here.

I was 22 years old and making only $10,00 USD per year when I got the Platinum AmEx Card. My credit score was around 750 and I had very little debt. I got the card in January of 2011.

Got mine with 722 FICO score and only 10 months credit history. But was denied 3 times before. And in one night they approved me for four cards

Got the black card last week. My credit score is 645 and my annual salary is only 16,000

Seriously? You have to pay 7500.00 immediately to get that card and you have to spend (and pay for) at least $350K in charges annually. I don’t thin that you are being truthful here.

Really bro no way you can get the black card. I have the platinum and I spend around $3k every month member since 1998 and as today I never received invitation from AE to get the black card.

BS

Just because the card is black, that doesn’t make it “the black card”.

So you’re going from broke to broker

Going for the platinum card this evening..had an Amex everyday card for over 2years. My FICO scores are745,781,746…..3 years of credit.platinum card members,what’s your thoughts ?

I’ve been approved at 19! before I got this card I had a secured card with Capital One, and an authorized user card with my mom from chase. My score was 695. I think what they check mostly on is if you pay in full every month. Since this is a charged card, you must pay full each month. Gladly I always paid every month. Good Luck!

I more than qualify buy dont understand why it is attractive to pay $550 to a credit card…for the privilege of using said credit card…and paying them back every dime…because its you know…a credit card!

The perks like getting into lounges. But with all of the credits ($200 airline credit, $200 in Uber credits, $100 in Saks Fifth Ave…) they give you the card ends up paying for itself.

It only makes sense to apply for the Amex Platinum if you travel frequently and can take advantage of its many perks. The travel credit alone almost justifies the annual fee by itself. Plus, there’s the sign-up bonus and other perks.

Been a Platinum Card Memeber for about a year now, besides the hefty annual fee which if you take advantage of the perks pays for itself it’s one of my favorites, I think they just introduced a payment method for the card if you qualify so i think if you spend more that $100 on the card you can make payments instead of paying the balance in full at the end of the month? could be wrong I haven’t tried it yet, but I got this card when I was 20, have a 750 score and make around 60k a year, love a metal card I also have a chase sapphire preferred (also highly recommend)

I’m 19 and got approved for the card, as long as your credit score is good (mines at 724) and some decent income you should be fine. I travel fairly often, and being in the military can get you exempt of paying the $550 annual fee, so the card was pretty appealing to me, why not get it if it has so many benefits!

At some point, usually a year after getting the card, they will offer you the “pay over time feature” which is great. You have a minimum payment just like other credit cards and the interest rate is 19 or 20%. The card kinda pays for itself with the benefits but I love the card.

Agree. The Amex Platinum easily pays for itself over time if you maximize its benefits.

My man, is your Black Card the Master Card Black Card? Thats what it sounds like. The Amex Centurion Card, otherwise known as “The Black Card” is the original card with 7500 bucks due on the first billing cycle. The Master Card Black Card has a rewards structure that is relatively poor for the AF costs. Its actually ranked just underneath the Venture card in terms of return. The Venture card is only 95 bucks a year though. Unless youre military and getting your AF waived, Id stay clear of the Master Card Black Card. For its annual fee, it should be crushing a similar 95 buck card, but it doesnt. It doesnt even beat the Chase Freedom Unlimited, if you have the Reserve too….and thats a free card.( no AF) If you like it, enjoy it, but consider that its considered a fake Black Card as well. Just stuff to consider about that card :)

Considering the Platinum. Not a frequent traveler. Once a year trip.

Factors luring me.

100,000 bonus offer. That’s nice. But why keep it for subsequent years?

1. Uber/Uber Eats credit of $ 200 year.

2. Great 90 day return policy, up to $ 300 per purchase, regardless of store policies. Amex pays you.

3. Trip cancellation protection can save you big. Award tickets also covered.

4. $ 200 air credit for baggage, if you check baggage. We do.

5. The lounge benefit may be used, depending on layover. We had the Green Card, and a 6 hour layover made this a good benefit.

6. Phone protection of $ 800 per phone.

7. High dollar value purchase protection.

8. TSA fee savings for 1 person.

9. Factors 2 through 8 are the wildcard. They can save you big, or have no value. If you look at it as paying $ 300 for an insurance policy, I deducted the $ 200 Uber credit from the $ 550 fee, it’s probably worth keeping.

FICO Score 689 with no SSN got mine AE Platinum Card,Only one month credit history…

Thanks for the data point!

The additional card members for Amex Platinum are NOT $175 each. Upto three are included in the $175 anf 4th and on are additional $175 each.

Also, the boingo benefit for discontinued WAY before this article was published.

Do your research carefully before spreading misinformation.

Thank you

About that additional card member: It seems from the available information that the only benefit to being an additional Platinum rather than Gold Card member is that the holder has access to the lounges on par with the primary account holder. Is that the case?

Excellent article on the American Express Platinum Card! It’s clear, informative, and really demystifies the process of applying for this prestigious card. The detailed breakdown of requirements and benefits is super helpful for anyone considering this card.

Wow, this list of hidden Amex Platinum benefits is amazing! I never knew about the National car rental upgrades or the InCircle points at Neiman Marcus. These definitely make the high annual fee a little easier to swallow. Thanks for sharing!